Sources of Business Laws - for that

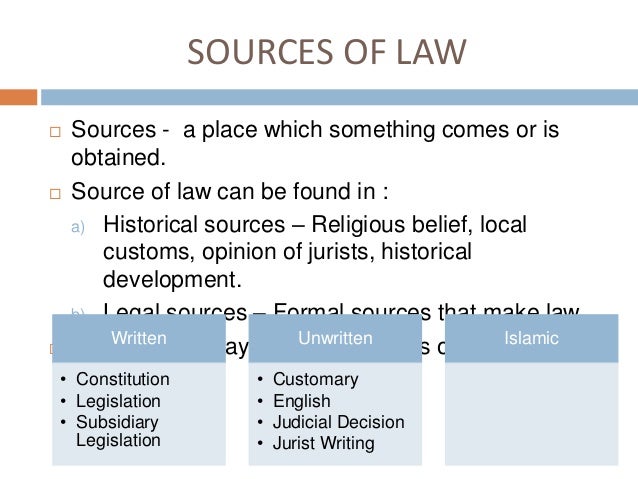

There are different requirements relating to licences, permits and legislation that you need to be aware of depending on the type of business you are going to be running. Obtaining appropriate approval s can play a critical part in the success of any business enterprise — whether you are starting a business, expanding a business, changing the nature of your business activities or the location of your premises. A liquor licence from the Department of Racing, Gaming and Liquor is needed for the sale of liquor from a premises. Business and residents are permitted to display temporary goods for promotional purposes provided they meet certain guidelines and criteria. You must apply and fees may be charged. Sources of Business Laws.![[BKEYWORD-0-3] Sources of Business Laws](https://image.slidesharecdn.com/session2-sourcesoflaw-141021054326-conversion-gate01/95/sources-of-law-legal-environment-of-business-business-law-manu-melwin-joy-5-638.jpg?cb=1437064483)

Sources of Business Laws - are

The first link listed above contains the full panel-body of the Affordable Care Act and the Health Care and Education Reconciliation Act of in one document. It is not official and is provided for your convenience. The second and third links contain the official certified full panel-body of the law. Note: The panel-body is searchable within each PDF file. If you are looking for a specific page, try to enter just the page number into the search box within the PDF. To save a copy of a PDF to your computer, right click your mouse and select 'save link as' then click the 'save' button. To sign up for updates or to access your subscriber preferences, please enter your contact information below.Money laundering is the illegal process of concealing the origins of money obtained illegally by passing it through a complex sequence of banking transfers or commercial transactions. The overall scheme of this process returns the "clean" money to the launderer in an obscure and indirect way.

For Licensors

One problem of criminal activities is accounting for the proceeds without raising the suspicion of law enforcement agencies. Considerable here and effort may be put into strategies that enable the safe use of those proceeds without raising unwanted suspicion. Implementing such strategies is generally called money laundering. After money has been laundered by banks, it can be used for legitimate purposes.

Many jurisdictions have set up sophisticated financial and other monitoring systems to enable law enforcement agencies to detect suspicious transactions or activities, and many have set up international cooperative arrangements to assist each other in these endeavors. In a number of legal and regulatory systems, the term "money laundering" has become conflated with other forms of financial and business crimeand is sometimes used more generally to Accounting Managerial Solution Chapter 2A misuse of the financial system involving things such as securities, digital currenciescredit cardsand traditional currencyincluding terrorism financing and evasion of international sanctions.

Some countries render obfuscation of money sources as constituting money laundering, whether intentional or by merely Sources of Business Laws financial systems or services that do not identify or track sources or destinations. Other countries define money laundering in such a way as to include money from activity that would have been a crime in that country, even if the activity was legal where the conduct occurred. Laws against money laundering were created to use against organized crime during Sources of Business Laws period of Prohibition in the United States during the s. Organized crime received a major boost from Prohibition and a large source of new funds that were obtained from illegal sales of alcohol. The successful prosecution of Al Capone on tax evasion brought in a new emphasis by the state and law enforcement agencies to track and confiscate money, but existing laws against tax evasion could not be used once gangsters started paying their taxes.

Trading in Public Places

In the s, the war on drugs led governments again to turn to money laundering rules in an attempt to track and seize the proceeds of drug crimes in order to catch the organizers and individuals running drug empires. It also had the benefit, from a law enforcement point of view, of turning rules of evidence "upside down". Law enforcers normally have to prove an individual is guilty to seize their property, but with money laundering laws money can be confiscated and it is up to the individual to prove that the source of funds is legitimate to get the money back.

However, this process has been abused by some law enforcement agencies to take and keep money without strong evidence of related criminal activity, to be used to supplement their own budgets. The September 11 attacks inwhich led to the Patriot Act in the U. Starting ingovernments around the world upgraded money laundering laws and surveillance and monitoring systems of financial transactions. Anti-money laundering regulations have become a much larger burden for financial institutions and enforcement has stepped up significantly.

During — a number of major banks faced ever-increasing fines for breaches of money laundering regulations. Money laundering is the conversion or transfer of property; the concealment or disguising of the nature of the proceeds; the acquisition, possession or use of property, knowing that these are derived from criminal activity; or participating in or assisting the movement of funds to make the proceeds appear legitimate.

Money obtained from certain crimes, such as extortioninsider tradingdrug traffickingand illegal gambling is "dirty" and needs to be "cleaned" to appear to have been derived from legal activities, so that banks and other financial institutions will deal with it without suspicion.

Money can be laundered by many methods that vary in complexity and sophistication. Money laundering typically involves three steps: The first involves introducing cash into the financial system by some means "placement" ; the second involves carrying out complex financial transactions Sources of Business Laws camouflage the illegal source of the cash Sources of Business Laws ; and finally, acquiring wealth generated from the transactions of the illicit funds "integration". Some of these steps may be omitted, depending upon the circumstances.

For example, non-cash proceeds that are already in the financial system would not need to be placed.

Navigation menu

According to the United States Treasury Department :. Money laundering is the process of making illegally-gained proceeds i. Typically, it involves three steps: placement, layering, and integration. First, the illegitimate funds are furtively introduced into the legitimate financial system. Then, the money is moved around to create confusion, sometimes by wiring or transferring through numerous accounts. Finally, Sources of Business Laws is integrated into the financial system through additional transactions until the Sougces money" appears "clean".]

Clearly, I thank for the help in this question.

I can not participate now in discussion - it is very occupied. But I will return - I will necessarily write that I think.