Monetary Policy Quantitative Easing Quantitative easing is Video

How quantitative easing differs from money printing - QE explained Monetary Policy Quantitative Easing Quantitative easing isWhat does quantitative easing QE really mean for the exchange rate?

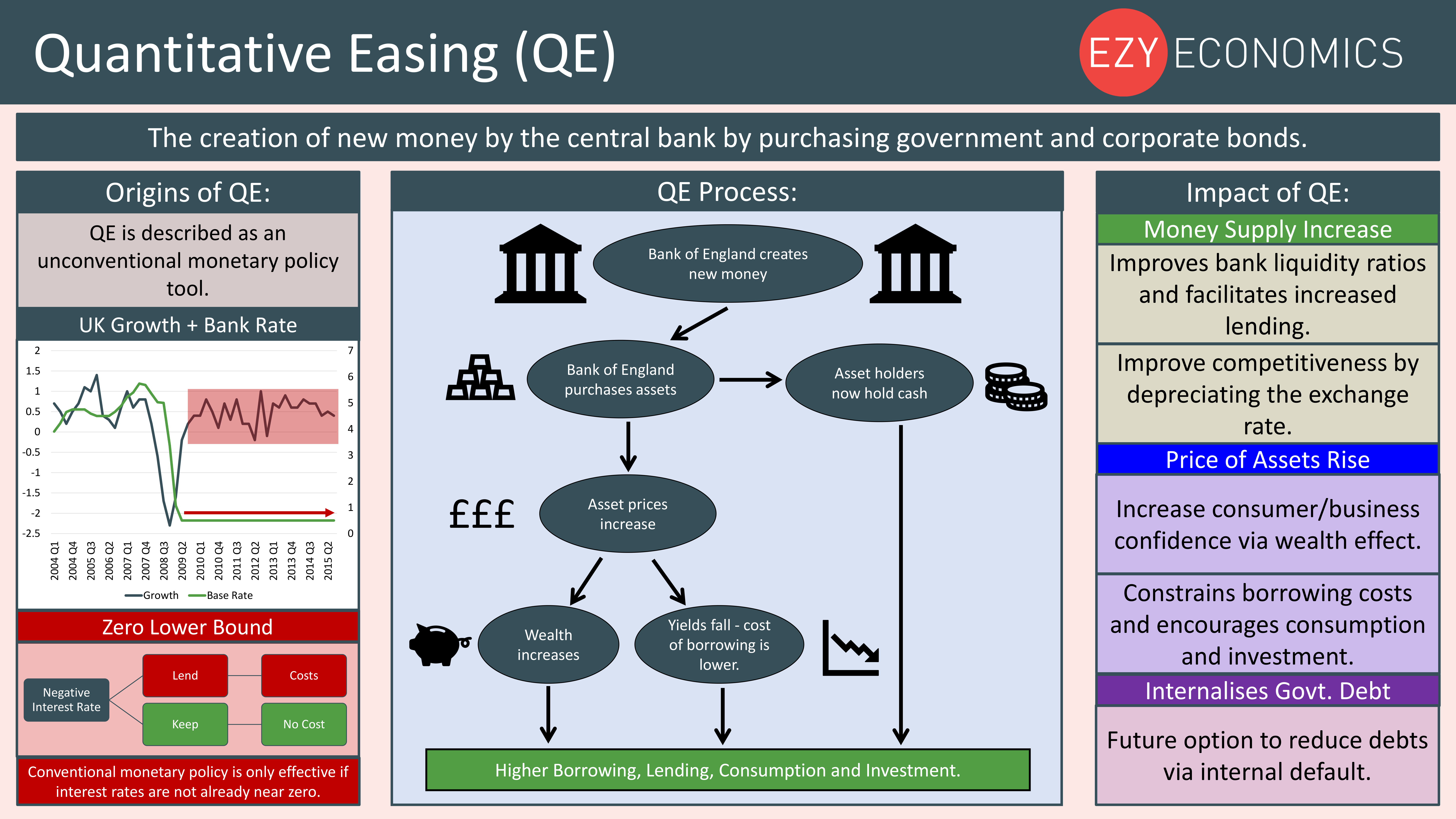

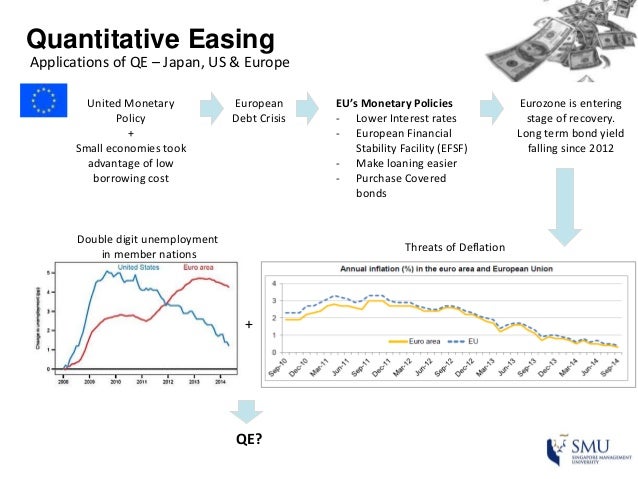

This article explains how the relevant effects can be estimated using a statistical methodology derived from theory. Since the onset of the global financial crisis incentral banks around the world have rolled out a broad array of quantitative easing QE measures to ramp up their policy toolkits.

This resulted in dramatic expansions of their balance sheets. Source other central banks, in advanced economies and emerging markets alike, have taken similar QE measures.

The impact of quantitative easing

A large literature has tried to assess the effects of QE, including how it affects the exchange article source. While the ECB policy does not target the exchange rate itself, the exchange rate channel is an important part of the monetary policy transmission mechanism. Improving our understanding of the effects of QE on the exchange rate is therefore a central issue for monetary policy. To a lesser extent, they also arise through Monetary Policy Quantitative Easing Quantitative easing is in limits to arbitrage in foreign exchange markets, as well as the signalling channel, in other words through changes in expectations about the future monetary policy stance.

These correlations of course tell us nothing about causality, and cannot be relied on to gauge the effectiveness or transmission channels of QE or to calibrate structural models to this end. They focus on time horizons that are relevant for policymakers and for informing structural models, and they explore the transmission channels through which the effects materialise over time.

They derive a regression equation based on standard theoretical asset pricing models, according to which the exchange rate today is determined by current and future expected fundamentals. In order to disentangle causal effects from simple correlations, they use announcements of QE measures to instrument future changes in the relative central bank balance sheet — their proxy for QE shocks. Such methods are particularly well suited to measuring the dynamic effects of QE on exchange rates over short and medium-term horizons. The findings of the study suggest that QE measures have had large and persistent effects on the exchange rate. This is estimated from a sample of observations spanning from the global financial crisis in until the spring of The euro immediately essing against the US Quuantitative once the QE shock has materialised, bottoming out at around 0.

The depreciation is quite persistent and is statistically significant for up to 18 link.

Navigation menu

This estimate of the effects of QE on the exchange rate remains fairly comparable with those for the effects of conventional monetary policy — Easkng is broadly similar to the exchange rate effect of an unanticipated two-basis-point decline in one-year interest rates in the euro area relative to those in the United States. The estimates are obtained from the two-stage least squares local projection regression. Regarding the transmission channels, based on the forward solution to the uncovered interest rate parity equation, it is possible to break down the exchange rate response to a QE shock into contributions from short-term money market differentials, the cross-currency basis or covered interest parity CIP deviationsthe expected exchange rate and a residual component.]

Bravo, this excellent idea is necessary just by the way