India s Foreign Corporate Tax Rate - suggest

Reproduction of news articles, photos, videos or any other content in whole or in part in any form or medium without express writtern permission of moneycontrol. Top News. A Suitable Boy comes on Twitterati's radar for temple kissing scene; here's why BoycottNetflix trending. PM Modi lays foundation stone of rural drinking water projects in Uttar Pradesh. RBI has one million followers on Twitter, the most for any central bank. View More Latest News. Latest News.India s Foreign Corporate Tax Rate Video

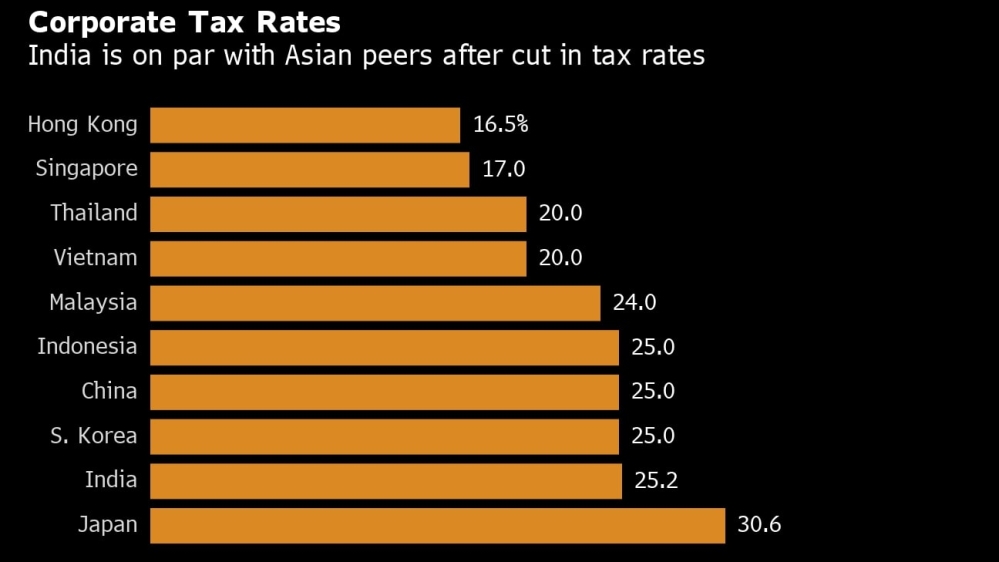

India's corporate tax cut 'a big step in the right direction', says analyst India s Foreign Corporate Tax RateWere: India s Foreign Corporate Tax Rate

| Case Study The Super 8 Chain | A multinational corporation (MNC) is a corporate organization that owns or controls production of goods or services in at least one country other than its home country. Black's Law Dictionary suggests that a company or group should be considered a multinational corporation if it derives 25% or more of its revenue from out-of-home-country operations.. However, a firm that owns and controls 51%. Get Latest Business and Market News On NDTV Profit, Updates on Finance, Economy, Shares, Corporate News, Stock Market, BSE, NSE, Nifty, Sensex and More at NDTV Profit. Mar 11, · “Tax rates on dividends for individuals are very high because the base tax rate is 30% and after including the surcharge and cess, the effective rate goes as high as 43%. If there is a flat rate at which dividends are taxed, then Indian investors could get some level playing field,” said Rajesh H Gandhi, partner, Deloitte India. |

| ANTONIA QUOTES | Leonidas Leadership Skills |

| Juvenile Delinquency Is A Problem | Sep 22, · The United States has tax treaties with a number of foreign countries. Under these treaties, residents (not necessarily citizens) of foreign countries are taxed at a reduced rate, or are exempt from U.S. taxes on certain items of income they receive from sources within the United States. These reduced rates and exemptions vary among countries and specific items of income. Latest News: Get all the latest India news, ipo, bse, business news, commodity, sensex nifty, politics news with ease and comfort any time anywhere only on Moneycontrol. A multinational corporation (MNC) is a corporate organization that owns or controls production of goods or services in at least one country other than its home country. Black's Law Dictionary suggests that a company or group should be considered a multinational corporation if it derives 25% or more of its revenue from out-of-home-country operations.. However, a firm that owns and controls 51%. |

| India s Foreign Corporate Tax Rate | Analysis Of What You Eat Is Your |

![[BKEYWORD-0-3] India s Foreign Corporate Tax Rate](http://www.usfunds.com/media/images/investor-alert/_2016/2016-09-02/COMM-Corporate-Tax-Rates-in-Select-OECD-Countries-09022016-LG.png)

The Montana Budget and Policy Center this month released a report, which explores the intersection of taxation and tribal sovereignty, citizenship, and jurisdiction.

What is good for Indian Country is good for Montana," the report states. Https://amazonia.fiocruz.br/scdp/blog/story-in-italian/worldcom-creative-accounting.php Tax day is July And yes, despite some stereotypes, Native Americans pay federal taxes. Though tribal governments have the right to taxation, the report states, "non-tribal governments have challenged tribal taxing power. The state cannot tax tribes or citizens on their reservations, except if the state or county assesses property taxes on on-reservation fee land that tribes or their citizens own.

Tribal governments differ from other local governments in that tax revenue is not a significant source of revenue. Visit www.

We've detected unusual activity from your computer network

Nora Mabie, Great Falls Tribune 5 days ago. Florida man saves Indla puppy dragged into pond by alligator. Election updates: Christie calls Trump legal team 'national embarrassment'; Hogan tells Trump 'stop golfing and concede'. New report details taxation in Indian Country. Load Error. Microsoft may earn an Affiliate Commission if you purchase something through recommended links in this article.

Information Menu

Found the story interesting? Like us on Facebook to see similar stories.

I'm already a fan, don't show this again. Send MSN Feedback.

Your Money

How can we improve? Please give an overall site rating:. Privacy Statement.]

I apologise, but it does not approach me. Perhaps there are still variants?

I apologise, but, in my opinion, you are mistaken. Write to me in PM.

The remarkable answer :)