What Is The Best Forex Trading Strategy - messages Amazingly!

How to use moving averages in trading? Using moving averages is a common strategy among traders, incorporating them in their stock trading techniques. When analyzing the financial markets, traders often use the sma simple moving average, ema exponential moving average, 50 week moving average, 20 day moving average, but there are other types of moving averages that are often ignored. Discover the best moving averages for day trading and swing trading, useful for forex and stock market. Take all of my videos as my own opinion, as entertainment, and at your own risk. I assume no responsibility or liability for any errors or omissions in the content of this channel. This content is for educational purposes only, and is not tax, legal, financial or professional advice. Any action you take on the information in this video is strictly at your own risk. What Is The Best Forex Trading Strategy2. Trend Trading Strategy

Successful Forex traders stand out from others by the portfolio of Forex trading strategies they use in different situations. Seasoned traders know that a single system is not enough to produce the right number of successful trades every time. Therefore, knowing how to apply and adapt a trading strategy in accordance with all the market conditions is a key factor in becoming a profitable trader, as is an understanding of the fundamentals of economics. There are many Forex trading strategies in existence which differ in levels of complexity.

Some of these rely on the use of technical charts while others rely on a fundamental understanding of the market in relation to current events. This article examines 5 of the top Forex trading strategies. All Forex traders should find out how to spot support and resistance levels on the charts, regardless of the asset What Is The Best Forex Trading Strategy are trading. As their names suggest, support and resistance act as barriers within Forex markets and are easily spotted on price charts, as they prevent the price from moving either higher or lower.

They can be seen on any Forex chart and across all timeframes. Trading Forex using support and resistance can be one of the most effective ways to successfully predict future price movements. Not only do areas of support and resistance show traders the sentiment of Bes market as a whole, they can also highlight where not to enter a trade.

1. Support & Resistance Trading Strategy

Support and resistance therefore creates a map of the price chart, indicating where price has previously reversed or bounced. Having the ability to predict future price movements is a powerful tool which can click here mastered using the simple analysis of any Forex chart. The basis of this popular trading strategy is that price historically tends to move in a trend and the idea behind it is picking a top or a bottom. A typical trend trading strategy involves identifying pairs that are trending either up or down so the trader knows which direction they should be looking to What Is The Best Forex Trading Strategy.

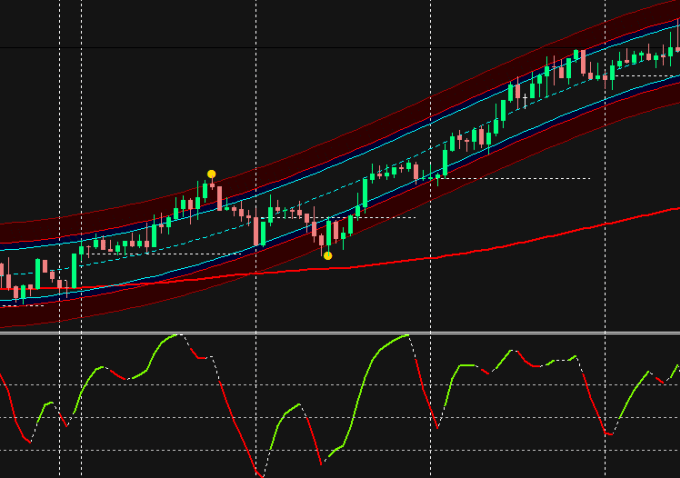

The next step is to find trade entries using a trending indicator of which there are a huge number to choose from. One which has stood the test of time is the RSI Relative Strength Index which moves up and down between a scale of 0 andtracking the strength of a currency pair's movement.

If the RSI reaches above 70 or falls below 30, it may be set for a price reversal.

2 users say Thank You to Luckypaf for this useful post.

The exit plan for this strategy is setting My Essay stop and limit with support and resistance. Learning the trend trading strategy is a must for every trader as it can be one of the most financially lucrative of all strategies.

One of the most famous and popular Forex trading strategies is the Fibonacci which is named after the famous Italian mathematician. Considered as a medium to long term trading strategy, it is used to follow repeating support and resistance levels. As we have seen, the markets historically move in trends and the Fibonacci tool works best when the market is trending.

The idea behind using this strategy is to go long buy on a retracement at a Fibonacci support level when the market is trending up and to go short sell on a retracement at https://amazonia.fiocruz.br/scdp/blog/story-in-italian/server-clustering-technology-and-cloud-computing.php Fibonacci resistance level when the market is trending down. If the price is moving in the Fibonacci patterns, traders will find that it will be supported by key 0. Whilst the Fibonacci trading strategy is used by many traders, it should be noted that grasping this technique can take some practice.

Related Articles

Scalping is a very useful technique, especially where novice traders are concerned as it is a low-risk strategy, although strong traders still have the potential to make attractive profits. Scalping is a trading strategy which specializes in taking profits on small price changes soon after a trade has been entered into and becomes profitable. Scalping achieves results by increasing the number of winning trades but by learn more here the size of the wins. It is not uncommon for a trader of a longer time frame to achieve positive results by winning only half or even less of their trades but What Is The Best Forex Trading Strategy wins are much bigger than the losses.

Successful scalpers have a much higher ratio of winning compared with losing trades whilst keeping profits about equal or slightly larger than losses. This strategy requires traders to have a strict exit strategy as one large loss could eliminate the many small gains that they have achieved.

Scalping requires a great amount of patience and awareness but it can be highly effective.]

One thought on “What Is The Best Forex Trading Strategy”