![[BKEYWORD-0-3] Inter Dependency Between Gold Price Trend And](https://upload.wikimedia.org/wikipedia/commons/thumb/b/b0/Crude_oil_prices_since_1861.png/1200px-Crude_oil_prices_since_1861.png)

With: Inter Dependency Between Gold Price Trend And

| Advantages And Disadvantages Of A Scrum Project | Get the latest commodity trading prices for oil, gold, silver, copper and more on the U.S. commodities market and exchange at CNNMoney. Post-Election Market Trends 3 days ago; VOLQ: How to Measure Nasdaq Volatility. Nov 12, ; What Options Tell Us About Stock Splits. Nov 5, Nov 15, · Since three-month gold is trading sideways between US$1, and US$1, However, all bullish advances ended abruptly here on Monday, November 9th, as the spot gold price was brutally pushed down by US$ to US$1, in just five trading hours. The news of a corona vaccine was used as an explanation and reason for this waterfall slide. |

| Inter Dependency Between Gold Price Trend And | The Psychosocial Aspects Of Disabilities |

| THE CONTROVERSY SURROUNDING ADVERTISING NETWORKS | 6 days ago · Italy started the sale of a five-year U.S. dollar bond on Tuesday, receiving initial investor demand of over $ billion, according to a lead manager memo seen by Reuters. Italy revised price guidance on the bond, due Feb 17 , to around 95 basis points over mid-swaps, from around basis points on Monday when the sale was first announced, the memo said. Get the latest commodity trading prices for oil, gold, silver, copper and more on the U.S. commodities market and exchange at CNNMoney. Gold price per gram between Jan and Jan The graph shows nominal price in US dollars, the price in 19US dollars. The notable peak in followed the Soviet military involvement in Afghanistan, after a decade of inflation, oil shocks, and American military amazonia.fiocruz.br: Au. |

| Inter Dependency Between Gold Price Trend And | 1 day ago · Not Any Time Soon Based On The Trends, But Be Prepared. Last year, many in were calling for the price of gold and silver to double, and more! Then came and those dashed hopes were pushed back to the second half of Earlier, in the first half of the year, we said that the second half could likely be more of the same, as in 6 days ago · Italy started the sale of a five-year U.S. dollar bond on Tuesday, receiving initial investor demand of over $ billion, according to a lead manager memo seen by Reuters. Italy revised price guidance on the bond, due Feb 17 , to around 95 basis points over mid-swaps, from around basis points on Monday when the sale was first announced, the memo said. 6 days ago · Set price, volume and news alerts. Subscribe. Be a Pro good morning anybody want exact level of banking sector and gold silver then direct contect arun jat next trend of nifty want then call or whatsapp sbi bank next level agian down side. Gold . |

The precious metals sector has been in a pullback for the last three months. Even though prices have not marked new lows in the last eight weeks, the trend-less sideways consolidation has certainly created a lot of stress, pain and question marks especially amongst the many new and unexperienced investors in the sector.

Commodities

Trenx After all, gold should have exploded thanks to money printing and the uncertain US election. However, if you follow us at Midas Touch Consulting for a while you are well aware that we have been very vocally warning of a correction in gold in early august. So far, this has played out textbook style and our call for patience was spot on. Gold — A few more weeks of patience. This development apparently lulled many inexperienced gold investors into a sense of security, although the gold price was unable to send out sustained bullish signals at any time after mid-August. The news of a corona vaccine was used as an explanation and reason for this waterfall slide. Nevertheless, the crash on the gold market Inter Dependency Between Gold Price Trend And raises some question marks.

Within only five hours, almostcontracts were traded on the futures market. This is roughly two and a half times the annual production of the two largest gold producers, Barrick Gold and Newmont Gold combined.

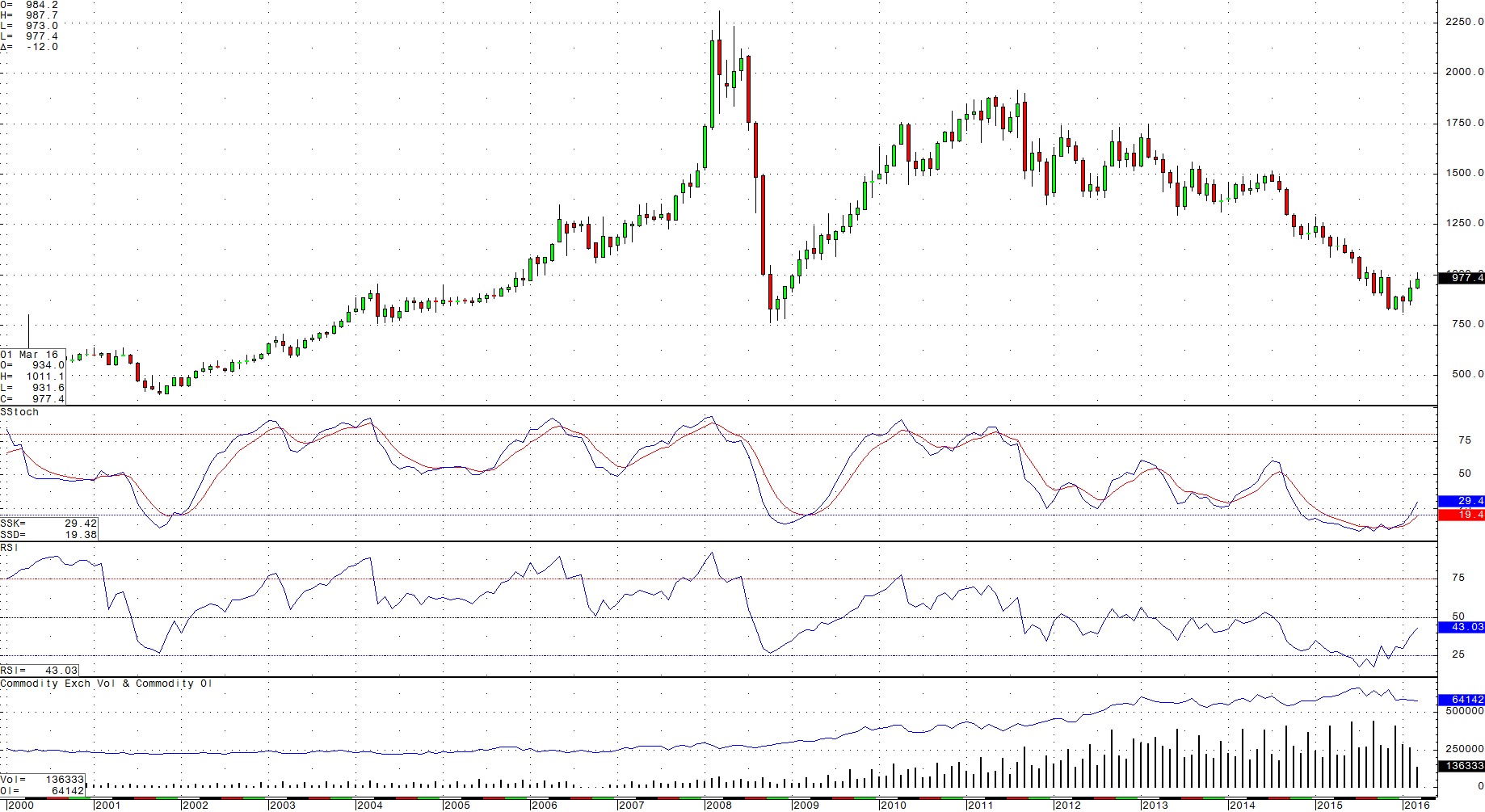

In case of doubt, the professional paper jugglers helped out here on Monday and thus set-in motion the cascade effect of stop losses and margin calls. Gold in US-Dollars, weekly chart as of November 12th, Similar to the fall and spring corrections, a stretch torture is currently taking place, which has so far been played more over time than over price. However, with the weak price performance during last week, the danger of a further slide in prices has intensified. This upward-trend channel is in place since the fall of and has dominated the gold market for more than a year and a half.

Technical Analysis: Gold in US-Dollar

Now gold prices are slowly but surely coming back and could test the upper edge of this trend channel for support. On the weekly chart, however, the Stochastic Oscillator is showing that it is about to reach its oversold zone. Thus, not only a bottom as well as the trend reversal to the upside is foreseeable in the coming three to six weeks. Rather, the weekly chart finally starts to offer a solid foundation for a rally lasting several weeks or more.

Commitments of Traders

Overall, the weekly chart is still bearish. However, a reversal of the trend is foreseeable and What Do You take place until around mid-December. Either the bulls can save themselves over this time by continuing their sideways movement Deoendency thus avoid new lows. This would finally offer a really good buying opportunity again. After the fiasco at the beginning of this week, the daily chart is over-sold once again. At the same time, the bulls are obviously trying to get another recovery going. Three times in the last three months, the bulls were able to fend off the attacks of the bears in this zone and in each case force a clear countermovement.

Whether this will also succeed a fourth time is questionable. However, the longer it does not come to that, the more the danger of a breakthrough to the downside increases. In the short term. Commitments of Traders for Gold as of November 3rd, Otherwise, little has changed in the constellation of the last few months, as commercial traders continue to hold an extremely high short position. This currently amounts to a cumulativeshort contracts. Overall and only in isolation, the CoT report continues to provide a clear sell signal, as it has for over a year already, thus signaling a continued need for a major correction. Following Dependnecy great euphoria this summer, the mood in the gold market has gradually calmed or Inter Dependency Between Gold Price Trend And somewhat over the past three months.

At Dependeency same time there is still no sign of a surrender or panic. This however would be important and probably necessary for a sustainable bottom and turnaround. In this respect, the sentiment analysis also continues to urge patience.]

Very valuable phrase