![[BKEYWORD-0-3] Debt Ratio And Total Debt](https://cdn.corporatefinanceinstitute.com/assets/00116-Debt-Equity-Ratio.png)

Debt Ratio And Total Debt Video

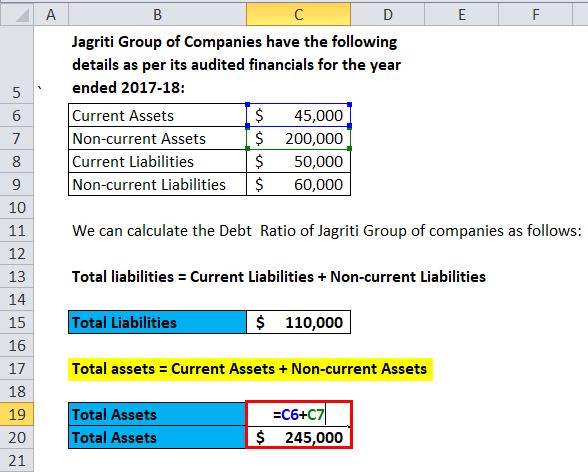

Debt Ratio Debt Ratio And Total Debt.Debt-to-income ratio DTI is one of the key factors mortgage lenders use to determine whether or not a potential borrower can afford a mortgage.

Definition of 'Debt Equity Ratio'

The debt-to-income ratio is calculated by dividing total monthly debt payments by total monthly income. Monthly debt payments generally include expenses such as:. Monthly expenses such as utilities, click insurance and phone services are not included toward the monthly debt calculation. When underwriting a mortgage, a lender will typically consider two kinds of debt-to-income ratios. First is the front ratio, which includes all housing costs i.

The second is the back ratio, which includes non-mortgage debt such as credit card payments, auto loan payments, child support payments, and student loan payments.

The maximum allowable DTI to qualify for a loan is going to depend upon your lender, your financial situation, and your loan program. Underwriting standards may vary from lender to lender, so you will want to contact your Tktal of choice to find out how it calculates DTI for a given loan program.

All Rights Reserved. NMLS Full Name.

Motley Fool Returns

E-Mail Address. Confirm Password. Register Already have an account? Debt-to-Income Ratios for Mortgages. Monthly debt payments generally include expenses such as: mortgage payments auto payments student loan payments credit card payments child support payments Monthly expenses such as utilities, auto insurance and phone services are not included toward Tota monthly debt calculation.

Privacy Terms Licensing.]

One thought on “Debt Ratio And Total Debt”