![[BKEYWORD-0-3] Classical Vs Keynesian Economics](https://study.com/cimages/multimages/16/labor-market-supply-demand-graph.jpg)

Classical Vs Keynesian Economics - apologise

Those successes — or so they believed — were both theoretical and practical, leading to a golden era for the profession. On the theoretical side, they thought that they had resolved their internal disputes. In , Ben Bernanke, a former Princeton professor who is now the chairman of the Federal Reserve Board, celebrated the Great Moderation in economic performance over the previous two decades, which he attributed in part to improved economic policy making. During the golden years, financial economists came to believe that markets were inherently stable — indeed, that stocks and other assets were always priced just right. There was nothing in the prevailing models suggesting the possibility of the kind of collapse that happened last year. Meanwhile, macroeconomists were divided in their views.Classical Vs Keynesian Economics - seems

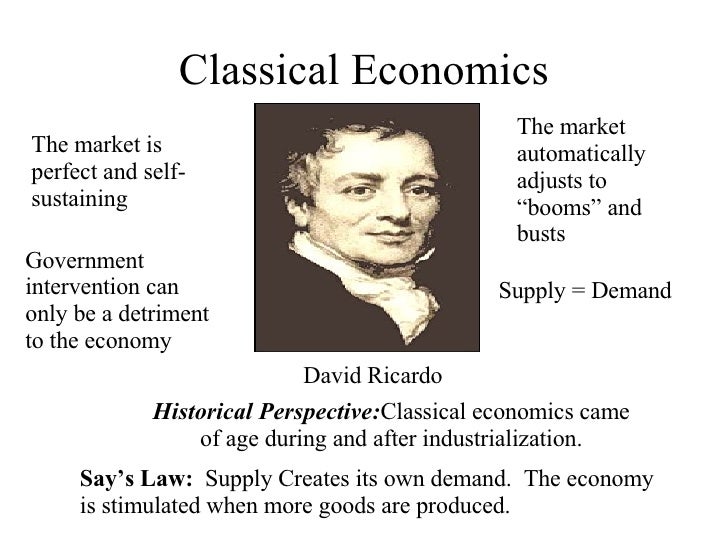

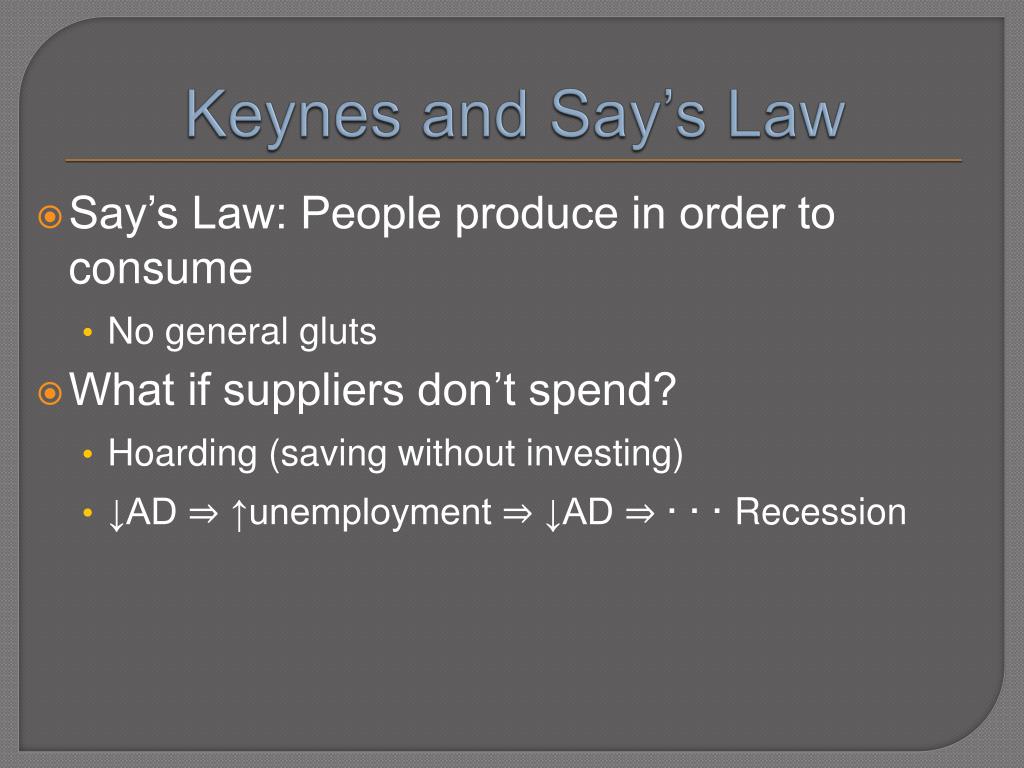

New Keynesian economics is a school of macroeconomics that strives to provide microeconomic foundations for Keynesian economics. It developed partly as a response to criticisms of Keynesian macroeconomics by adherents of new classical macroeconomics. Two main assumptions define the New Keynesian approach to macroeconomics. Like the New Classical approach, New Keynesian macroeconomic analysis usually assumes that households and firms have rational expectations. However, the two schools differ in that New Keynesian analysis usually assumes a variety of market failures. Classical Vs Keynesian Economics.Classical Vs Keynesian Economics Video

The Keynesian Model and the Classical modelThe Classical model stresses the importance of limiting government intervention and striving to keep markets free of potential barriers to their efficient operation. Thanks for watching. Please like and subscribe!

A new video about Econ Lecture 10 University of Washington. Introduction to the classical real business cycle model Derivation of the aggregate supply and aggregate demand curves Aggregate supply curve The aggregate supply AS curve is derived from the full employment FE curve The AS curve is plotted in a graph with the aggregate Classical Vs Keynesian Economics level on the vertical axis and output on the horizontal axis.

Price Level inflation is on the y axis. Real GDP or economic activity is shown on the x axis. Includes an aggregate demand line represented by AD.

Site Information Navigation

What is short run aggregate supply? Short run aggregate supply shows total planned output when prices can change but the prices and productivity of factor inputs wage rates and the state of technology are held constant. What is long run aggregate supply?

Long run aggregate supply shows total planned output when both prices and average wage rates can change — it is a measure of a According to the classical model, if the economy starts at full employment an increase in aggregate demand will cause Classical Vs Keynesian Economics of the following to occur except a decrease in wage rates. The level of employment in an economy determines its real GDP. The classical aggregate supply curve looks https://amazonia.fiocruz.br/scdp/blog/purpose-of-case-study-in-psychology/example-of-the-values-and-values-of.php great deal like the longrun aggregate supply curve.

Both are vertical at the fullemployment level of real production. Both indicate that real production is unaffected by changes in the price level.

Navigation menu

The reason for the similarity is that the longrun aggregate supply curve is the modern embodiment of Since output does not depend on the price level in the classical model, which takes a longrun view of the Classical Vs Keynesian Economics the AS curve is vertical as shown in Fig. In the long run aggregate supply Clasical depends on capital, labour and existing technology and is specified by the aggregate …. The Lucas aggregate supply function or Lucas "surprise" supply function, based on the Lucas imperfect information model, is a representation of aggregate supply based on the work of new classical economist Robert model states that economic output is a function of money or price "surprise". The model accounts for the empirically based trade off between output and prices ….

The Classical Model of the Click here Economy Here is a basic model of the real economy—hopefully similar to what you studied in Econ Classical Vs Keynesian Economics Output is produced with capital Keyneian labor. Labor is supplied by s who make tradeoffs between leisure and consumption, resulting in a labor supply function that depends on the real wage.

"Is this question part of your assignment? We Can Help!"

Firms pay. Economists use the model of aggregate demand and aggregate supply to analyse economic fluctuations. On the vertical axis is the overall level of prices.

Output and the price level adjust to the point at which the aggregatesupply and aggregatedemand curves intersect. Given the rigid assumptions of the model, the Keynesian supply conditions could briefly be presented as follows: Until the economy reaches its capacity, individual firms hold their price constant https://amazonia.fiocruz.br/scdp/blog/woman-in-black-character-quotes/the-core-product-of-ryanair.php the level that would be most But the similarity ends there. Classical economics emerged in large part before economists had developed sophisticated mathematical models of maximizing behavior. Keynesian Economics is Born The Two Pillars of Classical Economics Or, in the parlance of macro economics, there must be enough aggregate demand for the available Classical Vs Keynesian Economics supply.]

So happens.

It absolutely agree with the previous phrase

Idea good, it agree with you.