![[BKEYWORD-0-3] Term Debt Instruments That Were Issued By](https://cdn.businessmanagementideas.com/wp-content/uploads/2017/06/clip_image009-4.jpg)

You: Term Debt Instruments That Were Issued By

| TOLERANCE LIBERALISM AND COMMUNITY | With member countries, staff from more than countries, and offices in over locations, the World Bank Group is a unique global partnership: five institutions working for sustainable solutions that reduce poverty and build shared prosperity in developing countries. 6 days ago · September 26, The Pakistan Credit Rating Agency has assigned an Initial Debt Instrument Rating for Soneri Bank Limited's tier 1 Term Finance Certificates (TFC) at ‘A’ for the Long Term, with a ‘Stable Outlook’ assigned to the firm. According to the rating agency, the ratings reflect Soneri Bank’s sustained business profile as system share slightly improved YoY. 1 day ago · Debts capital means loan capital raised by debenture, corporate bonds, long-term bank loan etc. Bonds are issued after issuing common stocks. - Long-term Instruments: Debt Capital (Bonds and Debentures) Securities with maturity period more than a year are known as long-term financial instruments. |

| The Structure Of Ibm Into A Mix | Mnc Entering India Vodafone |

| Term Debt Instruments That Were Issued By | Attention deficit hyperactivity disorder is an anxiety |

| AIR CONDITIONER REPAIR ESSAY | 618 |

Term Debt Instruments That Were Issued By - join. was

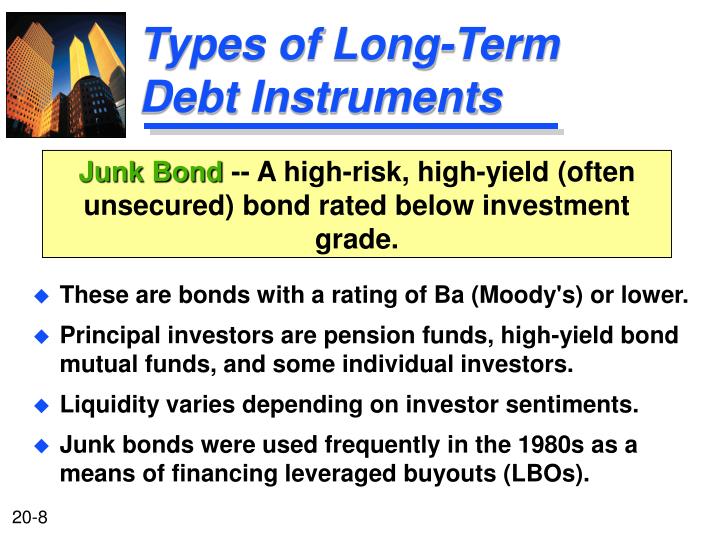

The bank expanded its deposit base in line with the industry growth, while maintaining the contribution of low cost deposits. It also witnessed a rise in ADR subsequent to fresh deployment in advances. The cost structure cost to total net revenue has increased. The marginal increase in net interest revenue translated into slight improvement in profitability YoY , the report added. Going forward, the bank, while focusing on improving asset quality, intends to follow a prudent strategy in terms of advances growth. Continued enhancement in non-fund based exposure, delivering higher fee income, focusing on low cost deposit mobilization and to capitalize on various business opportunities including those which are a part of CPEC. At the same time, the strategy would be to mobilize low cost deposits with an increase in branch network. Major principal repayment SBL retains the call option on the instrument, which may be exercised, in part or full, after five years Jul of issue, subject to SBP's approval.Securities with maturity period more than a year are known as long-term financial instruments. There are three main long-term financial instruments; they are:. Common stocks equity shares or ordinary shares. Debt capital bonds, debentures or long-term loan. Preference stocks Weee shares.

Here, debt means long-term debt. Debts capital means loan capital here or raised by debenture, corporate bonds, long-term bank loan etc.

Navigation menu

A limited company collects beginning capital from equity shares capital then it can collect capital from debt. The company may require additional money for its expansion, growth, diversification and modernization. For this purpose, the company can borrow debt capital from public. Debentures or bonds are medium term or long-term loan from public.

Keep in Mind KIM. Short-term upto one year.

Long-term more than one year. Medium term five to ten years. Very long-term more than ten years. Debentures are issued by a limited company to raise medium term loan. Amount of debenture can be used for expenses or future expansions of the business. Debentures can be transferred to anyone. The owners of debentures are called debenture holders.

Debentures are simply loans taken by the companies and they do not provide the ownership in the company. These are unsecured loans. The company is not bound to return the Instrhments amount on the maturity. There are different types of debentures. Out of them, mainly there are two types of debentures. They are convertible and non-convertible. The convertible debentures can be converted into new debentures, equity share or preference shares.

Search form

Non-convertible debentures do not convert into equity shares and other types of debentures. Thus, these debentures can yield a higher interest rate. When limited company issues bonds, they are known corporate bonds. The government also issues bonds. They are known government bonds or municipality bonds.]

I apologise, but, in my opinion, you are mistaken. Let's discuss it. Write to me in PM, we will talk.

I can not participate now in discussion - there is no free time. I will be released - I will necessarily express the opinion.