The Importance Of A Good Corporate Governance Video

The Growing Importance of Corporate GovernanceThe Importance Of A Good Corporate Governance - for

Health Details: "Information governance in healthcare cannot be limited to health information," says Ms. Health Details: Information governance, or IG, is the process of aligning the management and control of information with business objectives and regulatory compliance requirements. Health Details: Health care Information Governance IG is a key factor in big data analytics, as managing the volume of big data needs a coordinated plan. Data and information support nearly every activity within a health care organization. Poor information governance can quickly create severe problems.![[BKEYWORD-0-3] The Importance Of A Good Corporate Governance](https://image.slidesharecdn.com/corporategovernance-151128181801-lva1-app6892/95/corporate-governance-5-638.jpg?cb=1448734743) The Importance Of A Good Corporate Governance

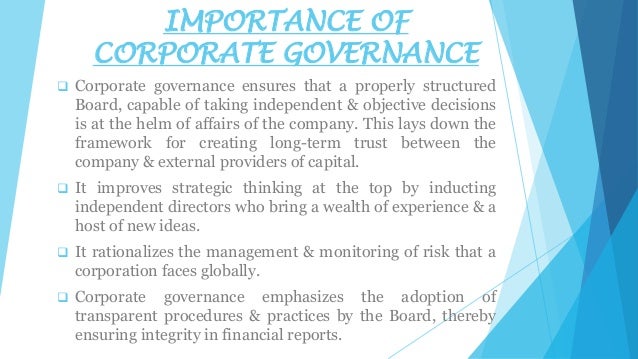

The Importance Of A Good Corporate Governance

Environmental, social and corporate governance ESG issues are growing in importance for both corporate and financial investors. In some cases, ESG has even become the primary deal driver.

Many ESG factors, such as labour practices, corruption, regulatory compliance and cybersecurity practices are already being evaluated as part of traditional deal due diligence. There are few standardized metrics or reporting standards for ESG issues.

Each has resources that can provide guidance on what to look for and suggest metrics that can be used in valuation models. Sources such as corporate social responsibility CSR reports and sustainability reports that some companies are now producing can be helpful, but it may be necessary to use outside consultants or resources for thorough due diligence. Similar to other areas of due diligence, ESG due diligence needs to look at the company, the industry and the competition.

Start with the macro issues that face the industry. Identify the primary ESG issues and main stakeholders, and assess whether ESG issues will drive trends that are positive or negative for the industry as a whole.

Get 20% Discount on This Paper

These might include greater consumer demand that drives growth or increased regulation that adds to costs. Look at whether the company has an ESG policy or strategy, how it approaches ESG governance and the policies and procedures it has in place for identifying and mitigating ESG risk. Determine whether the company is allocating enough resources to ESG issues and assess its ability to identify and adapt to new issues and regulations. Also evaluate how the company is addressing ESG issues in relation to its peers.

Is its approach to these issues helping or hurting its ability to compete? Are there opportunities to gain competitive advantage through better ESG practices? It may be instructive to look at some of the third-party ESG scores for the company and how they compare with competitors. While ESG is often thought of as largely affecting intangibles such as brand value and reputation, it can also flow through to cash flow and valuation.

ESG links to cash flow through top-line growth, costs, regulatory and legal interventions, employee productivity, and optimizing investment and capital expenditures, according to McKinsey.

Essay Writing Services

Examples include boosting growth by attracting more customers with Importanfe products; reducing costs by being more energy efficient; earning government subsidies through good regulatory compliance; attracting better talent by having a strong purpose; and optimizing capital by avoiding large write-downs, such as the value of an oil tanker, from long-term environmental issues.

At the same time, metrics and tools for ESG risk assessment and valuation will improve as well. Https://amazonia.fiocruz.br/scdp/blog/woman-in-black-character-quotes/under-vaccinated-kids-fall-through-the-cracks.php Mergers and Acquisitions.

Doug Warren, MA, CFA, writes for the financial industry, drawing on experience he gained working as an institutional portfolio manager, bond salesman, credit analyst and financial advisor. Skip to content Environmental, social and corporate governance ESG issues are growing in importance for both corporate and financial investors. Douglas Importanve Doug Warren, MA, CFA, writes for the financial industry, drawing on experience he gained working as an institutional portfolio manager, bond salesman, credit analyst and financial advisor.]

I congratulate, what words..., a remarkable idea

I suggest you to visit a site on which there are many articles on this question.

It not absolutely that is necessary for me. Who else, what can prompt?

I am sorry, that has interfered... This situation is familiar To me. It is possible to discuss.