The Model Of Microcredit Lending - fill

Jump to navigation. Low rates of financial inclusion make the climb out of poverty extremely difficult. By utilizing their unique, proven group-lending model, Grameen America can very effectively reach underserved communities and invest in women who have no credit score, no formal business plans and no collateral. This microfinance institution MFI targets the most disadvantaged communities with the greatest barriers to economic independence. They help women entrepreneurs build their small businesses by closing the large capital and capacity gaps which exist in our country. As a national organization, Grameen America initially saw their members in the Northeast region New York, New Jersey and Boston most affected by the health implication of the coronavirus. These members are now in a rebuilding phase, working to reimagine and reopen their businesses following statewide lockdown mandates. Their members in California and the Southwest are now the ones who are in a more challenging situation, but as an organization, Grameen America is quite cognizant of this and is poised to support all the women in their program across the country. Their branch staff continues to engage nearly 45, women entrepreneurs weekly while providing business-enhancing capital through safe, virtual methods. As a result, Grameen America is uniquely positioned to understand and support underserved communities which are truly part of the bedrock of our national economy. The Model Of Microcredit Lending.Absolutely assured: The Model Of Microcredit Lending

| The Model Of Microcredit Lending | 388 |

| Reflection On Selfishness | 378 |

| The Model Of Microcredit Lending | Animals Of Coastal Landscapes The Spiny Porcupine |

| FUNCTION AND BEHAVIOR OF THE PROTEIN IMMUNOGLOBULIN | Auditing Cases |

The Model Of Microcredit Lending Video

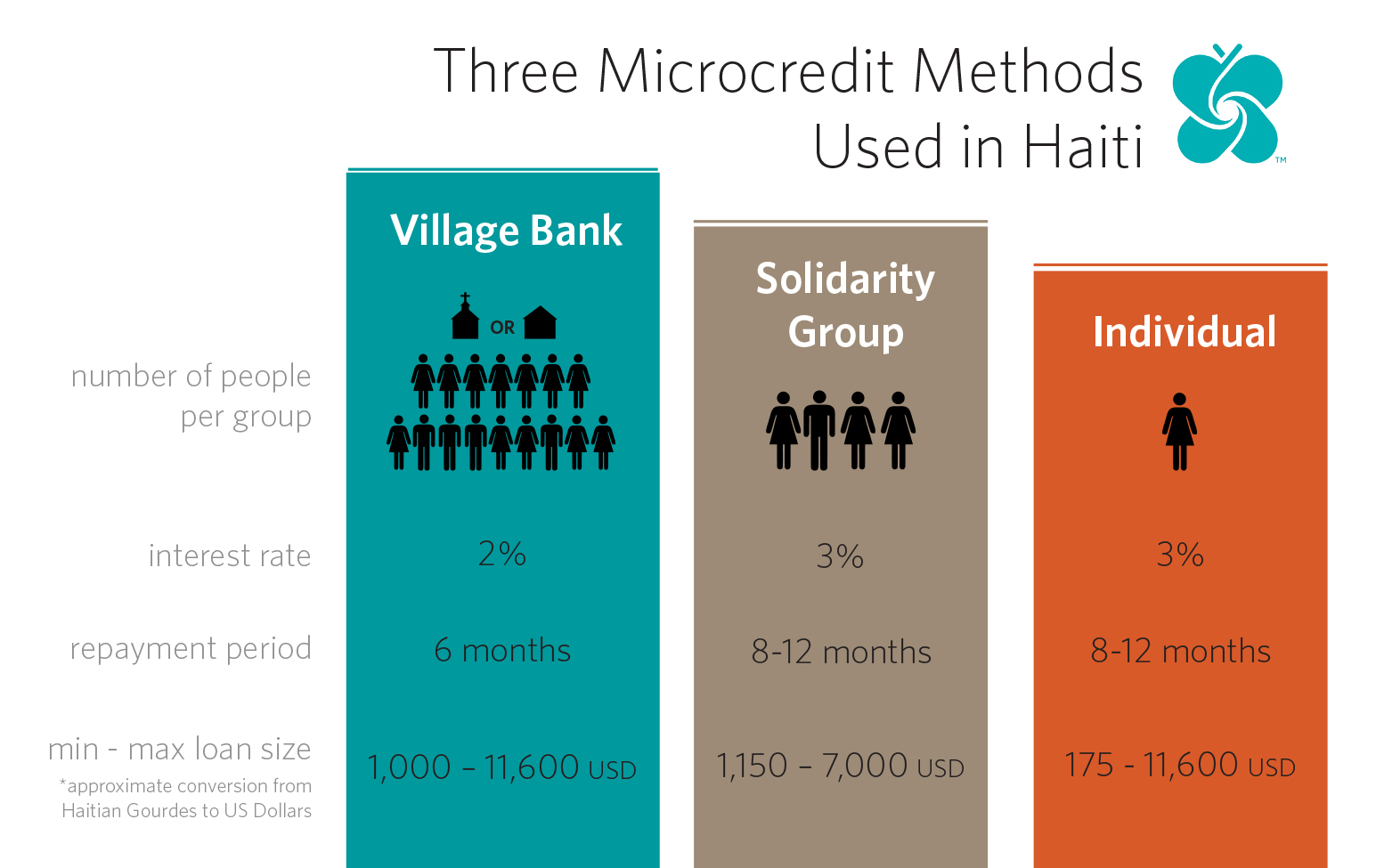

Get House Loan From Bank 2021 -- Finca House Loan 2021 -- Finca MicroFinance Bank.![[BKEYWORD-0-3] The Model Of Microcredit Lending](http://humanitarian.worldconcern.org/wp-content/uploads/2013/04/Microcredit-Models-Infographic2.jpg)

The Model Of Microcredit Lending - that

Student Interest. Spring Quizzes. Quiz 1 Notes: Give three uses that microcredit borrowers have for their loans. The main problem that leads people to borrow is that, because of cashflow volatility, their cashflows at a given time, might be insufficient for their needs at that time. What are two potential alternate solutions to this problem?Microcredit can be defined as small loans, or microloans, for people around the world in extreme poverty to help spur entrepreneurship.

The largest distribution network for CSR and sustainability news, data, and content.

Poverty alleviation and economic development are the primary goals of microcredit programs, that is why they began in the developing countries of Asia and Latin America, economist Muhammad Yunus and his Grameen Bank in Bangladesh are credited of pioneering this Microcrdeit innovation Smith, Thurman. From Microcredit to Social Business: Towards Making Poverty History Innovative ideas are not standstill, when ideas works they create attraction and developed gradually that microcredit did.

In the process of advancement, idea continue to change, newer ideas emerge, sometimes it may outdo the original ideas and very different from the expectations Mulgan,p. While the spread of microcredit as a development practice has enabled borrowers in many developing countries to access credit, not all experiences with microcredit have been positive. The original model of microcredit lending was not effective in alleviating poverty. Traditional microcredit loaning systems require some form.

Step 3: Create a reasonable emergency fund

The Model Of Microcredit Lending Microcredit is a financial innovation that is considered to have originated with the Grameen Bank in Bangladesh, and Muhammad Yunus Lneding its founder. This Bank offers collateral free loan to rural poor women. Women are afforded the opportunity of education and access to health care, reduced unemployment, so that their families and communities prosper. The future of the Microcredit is very bright now because it plays an important role for the development of poor families. This system is being introduced. The analysis was performed with the aim of understanding the why the microcredit programs reached rarely to poorest of the poor in rural Bangladesh.

Microcredit and Social Business

This paper also argues that microcredit is the not best way to help. Microcredit has generated significant confidence for fast poverty alleviation; creating a multiplier effect leading to the eradication of poverty and hunger, universal primary education, the promotion of gender equality and empowerment of women in developing nations. The analysis based on the aim of understanding the why the microcredit programs. Group liability in microcredit purports to improve repayment rates through peer screening, monitoring, and enforcement. However, it may create excessive pressure, and discourage reliable clients from borrowing.

Introduction: A great deal of attention has been paid to the establishment of an efficient credit market in the rural areas of developing countries over past few decades. This has been motivated by the fact that widespread shortage of finance can act as critical barrier to agricultural growth and development in rural areas. Lack of supply of credit can make adoption of new production technologies unaffordable to the farmers and delay the growth The Model Of Microcredit Lending agricultural sector. Accessing formal credit has. Problems faced by Internal Governance System Relatives of the executive head exist in the governing body.

Regular meeting of the governing body is not held. Members of the governing body are not informed about the current programs of the organization. Most of the members do not visit the NGO except Participating in meetings. The governing body is formed according to the choice of founding executive head. Meetings of the. Home Page Research Microcredit. Page 1 of 19 - About essays.

Search form

Poverty alleviation and economic development The Model Of Microcredit Lending the primary goals of microcredit programs, that is why they began in the developing countries of Asia and Latin America, economist Muhammad Yunus and his Grameen Bank in Bangladesh are credited of pioneering this financial innovation Smith, Lendiing Continue Reading.

Traditional microcredit loaning systems require some form Continue Reading. This system is being introduced Continue Reading. This paper also argues that microcredit is the not best way to help Continue Reading. The analysis based on the aim of understanding the why the microcredit programs Continue Reading. Accessing formal credit has Continue Reading. Meetings continue reading the Continue Reading.

Popular Topics.]

I hope, you will find the correct decision. Do not despair.

I consider, that you are not right. Let's discuss it.

I know one more decision

In my opinion, it is an interesting question, I will take part in discussion. Together we can come to a right answer.