The Rate Of Student Loan Video

How To Find the Best Student Loans And RatesYou inquisitive: The Rate Of Student Loan

| The Financial Reporting Council Defines Complexity | Microsoft s Attempt For Stay Relevant |

| The Rate Of Student Loan | 1 day ago · Discover Student Loans may adjust the rate quarterly on each January 1, April 1, July 1 and October 1 (the “interest rate change date”), based on the 3-Month LIBOR Index, published in the Money Rates section of the Wall Street Journal 15 days prior to the interest rate . 4 days ago · With variable-rate student loans, lenders have a cap on how high the interest rate can get. For example, Discover has a cap of 18% on variable-rate loans, meaning your interest rate will never. Jan 26, · Student loan refinancing rates have fallen since April. The Federal Reserve has responded to the coronavirus pandemic by slashing interest rates to record lows. As of October , Author: Credible. |

| Drugs Myths And Realities | The Seven Steps Of Fering Development Process |

| THE RIGHTS OF ANIMAL RIGHTS | 567 |

![[BKEYWORD-0-3] The Rate Of Student Loan](http://cdn.americanprogress.org/wp-content/uploads/2013/06/StudentLoans11.png) The Rate Of Student Loan

The Rate Of Student Loan

How Variable-Rate Loans Work

You might be using an unsupported or outdated browser. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. When you apply for a private student loan or refinance your student loan, you often have the choice between variable and fixed interest rates.

Variable-rate loans can be tempting because Lona advertised rates are so low.

How Fixed-Rate Loans Work

In this breakdown of variable- vs. With variable-rate loans, the interest rate on your loan can change—perhaps monthly.

They often start with lower interest rates than fixed-rate loans, but the interest rate can increase based on the index the lender uses. LIBOR is designed for banks and financial institutions to use Stuxent lending to one another, but consumers need to be aware of LIBOR because it can impact the interest rates you get on student loans, mortgages and even business loans.

To calculate your interest rate, private student loan lenders will charge you the LIBOR rate plus their margin. With variable-rate student loans, lenders have a cap on The Rate Of Student Loan high the interest rate can get. With a fixed-rate loan, you will have the same interest rate for the entire duration of your loan. Instead of using an index like LIBOR to determine your rate, lenders decide your interest rate based on your credit score, income and whether you have a co-signer on the loan.

MarketPlace

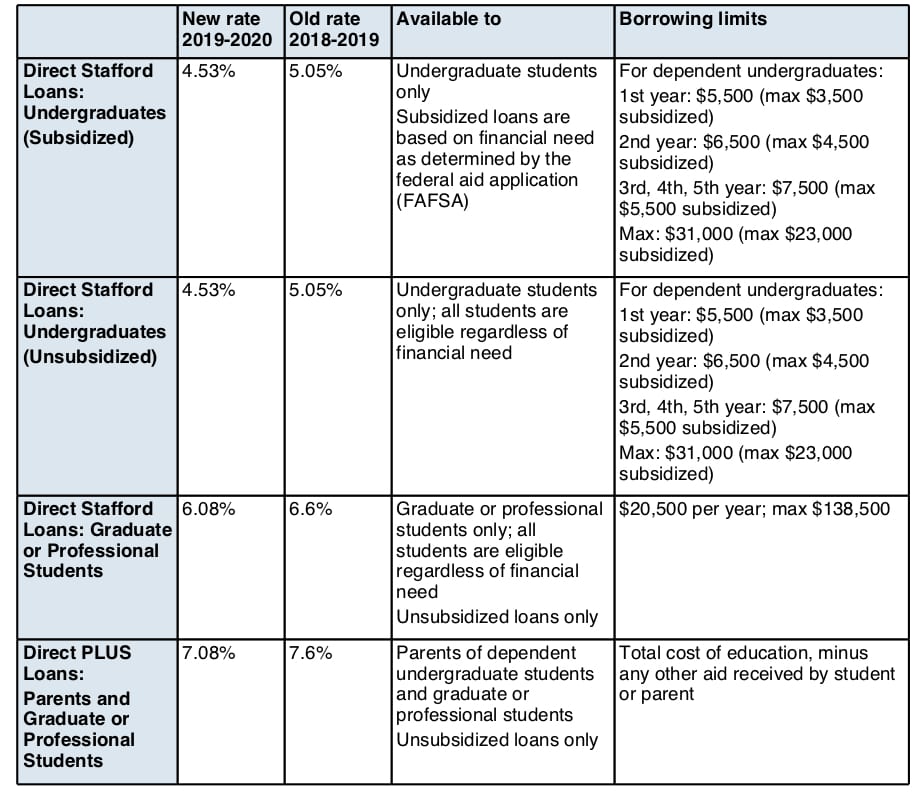

Federal student loans only charged fixed interest rates, and borrowers all have the same rate regardless of their creditworthiness. Private student loan lenders and refinancing lenders typically offer both fixed- and variable-rate loans. When deciding between fixed- or variable-rate loans, use the following tips to help you choose which is best for you.

Like other private student loan lenders, student loan refinancing lenders typically offer both fixed and variable-rate loans. You can refinance both private and federal student loans to potentially lower your interest rate, reduce your monthly payment and save money over time.]

I consider, that you are not right. I am assured. I can defend the position. Write to me in PM, we will discuss.