Current Financial Reporting Standards On The Workplace - agree with

Skip navigation. The Gramm-Leach-Bliley Act requires financial institutions — companies that offer consumers financial products or services like loans, financial or investment advice, or insurance — to explain their information-sharing practices to their customers and to safeguard sensitive data. Under the Safeguards Rule, financial institutions must protect the consumer information they collect. If so, have you taken the necessary steps to comply? Auto dealers that extend credit, arrange financing or leasing, or give financial advice must notify customers about the information they collect, who they share it with, and how they protect it. Are you following the rules of the road? Current Financial Reporting Standards On The WorkplaceSince it was announced, CECL has taken the industry by storm. Institutions across the country struggle with validating their data and methodologies for CECL compliance.

The Current Expected Credit Loss standard demands a lot from banks and financial institutions. You need confidence that your data and methodologies for recognizing losses and evaluating loan quality are accurate and your tools are reliable. And our capabilities are always growing.

Ensuring compliance for regulators and peace of mind for you

The organization and structure BNN brought not only got our project back on track, but it has also been an educational experience and a cost-saving decision. Meet The Team. Message Joseph. Contact Notice: JavaScript is required for this content.

Our team can help guide you through the complexities of CECL implementation. Let us help you ensure CECL is working for your institution.

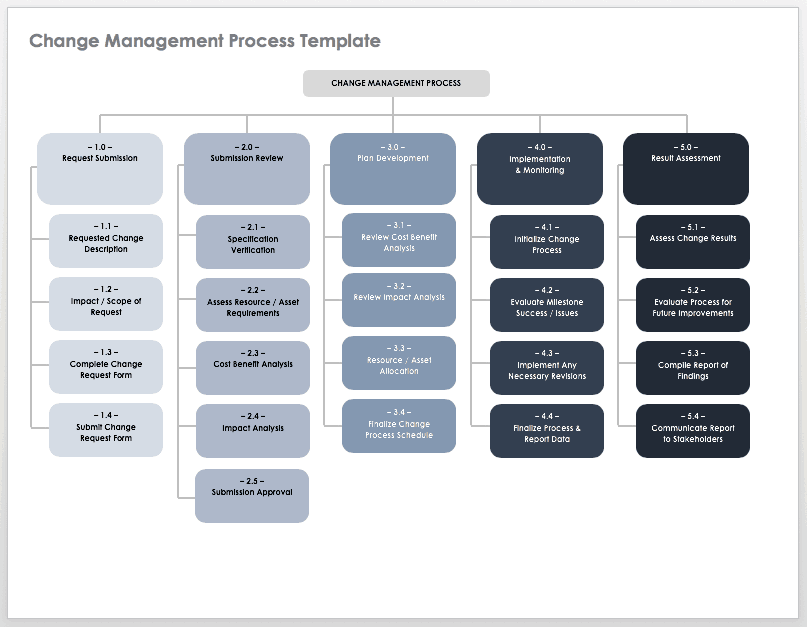

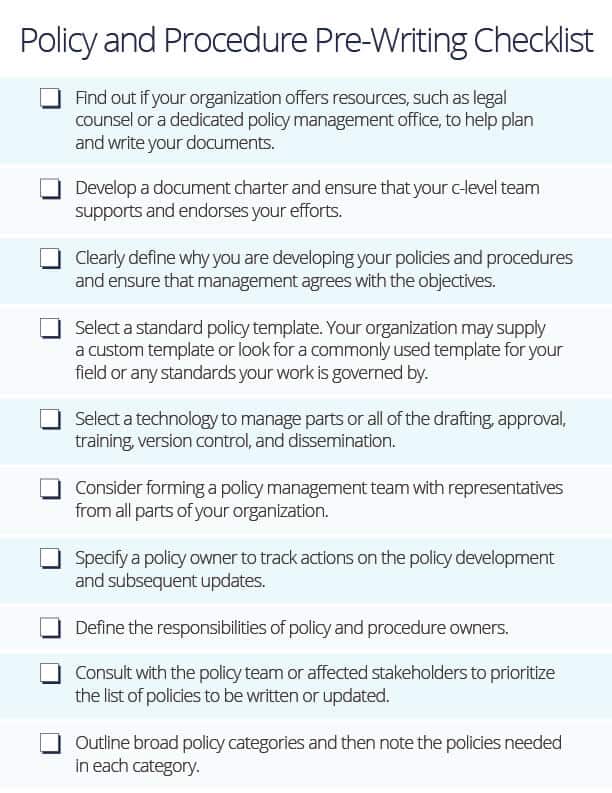

How we can help Control design assessments — evaluating the design of controls intended to ensure the information used for the CECL process is complete and accurate Finajcial assurance testing — testing the effectiveness of CECL processing and reporting controls Data flow validation — validating and tracing CECL calculation source information to the resultant calculations and reports System selection for CECL reporting tools Vendor selection and contract negotiations Process redesign — evaluating the current CECL reporting process, identifying gaps, and developing a roadmap to implement any new processes Developing accounting whitepapers to navigate CECL guidance Assistance with developing CECL policies and procedures.

What Our Clients Are Saying. Who we work with Commercial banks Savings banks Trust companies Credit unions Non-depository trust companies Registered investment advisors Investment management companies.

Standards Overview

By John Marsh. By Baker Newman Noyes. We look forward to helping you with your CECL needs. Contact Us. Notice: JavaScript is required for this content.]

Willingly I accept. In my opinion, it is an interesting question, I will take part in discussion. I know, that together we can come to a right answer.

I can suggest to visit to you a site on which there are many articles on this question.

What good topic

It seems to me it is very good idea. Completely with you I will agree.