Confirm: Risk and Return Analysis

| DESCRIPTIVE ESSAY SLAUGHTERHOUSE FIVE | Military Suicides |

| PLASTIC BAGS AND ITS EFFECTS ON THE | 1 day ago · Asset Analysis / Risk and Return” · Recommend an alternative to the CAPM for analyzing capital assets. Provide support for your recommendation. · Assess the effectiveness of using multifactor models to help investors understand the relative risk exposures in their . 2 hours ago · Risk and return analysis DECLARATION I Shubham Dehariya, Registration Number, BC, hereby declare that this project work entitled “Risk and Return analysis” has been originally carried out by me under the guidance and supervision of amazonia.fiocruz.brsan, Assistant Professor of Accounts, Tamil Nadu National Law School, Tiruchirappalli – This work has not been . 2 days ago · The greater the risk, the greater the return expected. The risk and return constitute the framework for taking investment decision. The prudent approach is to reach a conclusion about risk tolerance that is the lower of the two factors – ability and willingness. As soon as risk reduces, the variability of return reduces. The return objectives may be stated on an absolute or relative basis. |

| Risk and Return Analysis | Analog and Digital Signal |

| PLANNED CHANGE OF MATERNAL CHILD HEALTH | The Issue Of Birthright Citizenship |

| ANALYSIS OF GEORGE ORWELL S THE CLOCKWORK | 204 |

Risk and Return Analysis Video

Chapter 1 : Risk and Return (Equity Analysis and Portfolio Management) Risk and Return Analysis![[BKEYWORD-0-3] Risk and Return Analysis](https://image.slidesharecdn.com/riskandreturn-150519165835-lva1-app6892/95/risk-and-return-analysis-3-638.jpg?cb=1432054804)

Risk and Return Analysis - apologise, can

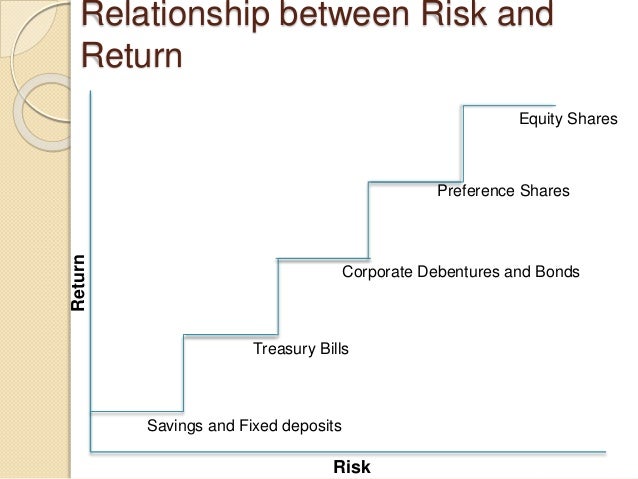

The greater the risk, the greater the return expected. The risk and return constitute the framework for taking investment decision. The prudent approach is to reach a conclusion about risk tolerance that is the lower of the two factors — ability and willingness. As soon as risk reduces, the variability of return reduces. The return objectives may be stated on an absolute or relative basis. Different types of risks include project-specific risk, industry-specific risk, competitive risk, international risk, and market risk. Past performance is analyzed by reviewing the trend of past sales, profitability, cash flows, return on investment, debt-equity structure and operating expenses, etc. Risk-return analysis in practice In this section we discuss issues involved in the practical application of risk-return analysis--issues such as choice of criteria, estimation of parameters, and the uncer- tainty of parameter estimates. Return objectives and expectations must be consistent with the risk objectives and constraints that apply to the portfolio. The risk and return trade off says that the potential return rises with an increase in risk.

Risk and return analysis in Financial Management is related with the number of different uncorrelated investments in the form of Risk and Return Analysis. It is an overall risk and return of the portfolio. The collection of multiple investments is referred to as portfolio.

Mostly large size organizations maintains portfolio of their different investments and hence the risk and return is considered as the entire portfolio risk and return. Portfolio may be composed of 2 or more bonds, stocks, securities and investments or annd of all. Risk is Relative:. The risk associated with the investments in stocks of Company XYZ generally decreases as more and more investment is made in different Analyais of other uncorrelated companies. Then that person will look onto both of his businesses in order to calculate overall rate of return for his investments. If a person has portfolio of different uncorrelated investments then risk of additional investment in particular Company XYZ will be changed.

This means that when a person organization keeps portfolio having large number of different investments than further investing in particular share of Company XYZ will be different. The risk of additional investment in certain share of Company XYZ will be different after maintaining portfolio of many uncorrelated different investments. Diversified investments result in lowering of risk. With the increase in the size of Risk and Return Analysis, the level of risk generally reduces.

When additional investment in certain stock or bond is made, then the incremental effect of that additional investment on the entire portfolio is viewed. Investment Rule:. The investor will struggle to minimize the portfolio risk and maximize the portfolio return on his investments.

The investor will not be willing to take on additional portfolio risk unless additional portfolio return is provided to him. Kinds of Risks for a Stock:. Following are the kinds of risks related with stocks that create uncertainty in the future possible returns and cash flows. Diversifiable Risk:. Diversifiable risk is Company Specific or Non Systematic and is connected with the random events of respective Company whose stocks are being purchased. Examples of random events include successful marketing campaign, winning major contract, losing a charismatic CEO and losing court case etc.]

It agree, it is the amusing information