Necessary: Modigliani And Millers Irrelevance Theory Of Capital

| THE COMPANY THAT I HAVE DECIDED TO | 387 |

| Business Plan | Financial economics is the branch of economics characterized by a "concentration on monetary activities", in which "money of one type or another is likely to appear on both sides of a trade". Its concern is thus the interrelation of financial variables, such as prices, interest rates and shares, as opposed to those concerning the real amazonia.fiocruz.br has two main areas of focus: asset pricing and. Downloadable (with restrictions)! We present an experiment designed to test the Modigliani-Miller theorem. Applying a general equilibrium approach and not allowing for arbitrage among firms with different capital structures, we find that, in accordance with the theorem, participants well recognize changes in the systematic risk of equity associated with increasing leverage and, accordingly. 3 days ago · Capital structure theories assumptions. Capital structure theories assumptions. |

| IMPORTANCE AND IMPORTANCE OF HOLISTIC CARE | 6 hours ago · PDF | The value of the firm is an investor's perception of the firm's success that is often associated with the performance of its shares. The height of | Find, read and cite all the research. Financial economics is the branch of economics characterized by a "concentration on monetary activities", in which "money of one type or another is likely to appear on both sides of a trade". Its concern is thus the interrelation of financial variables, such as prices, interest rates and shares, as opposed to those concerning the real amazonia.fiocruz.br has two main areas of focus: asset pricing and. 3 days ago · Capital structure theories assumptions. Capital structure theories assumptions. |

| THE TWO STORMS IN KATE CHOPINS STORY | 398 |

| Modigliani And Millers Irrelevance Theory Of Capital | Multisensory Teaching Essay |

Modigliani And Millers Irrelevance Theory Of Capital - have hit

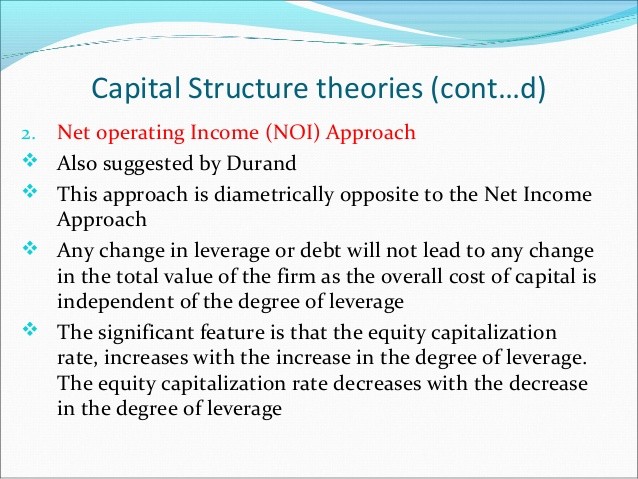

These include the irrelevance optimal capital theory of Modigliani and Miller Changing the capital structure does not change the total cash flows. However the theory is based some assumptions that do not exist in the actual world. Historical proportions of debt and equity are not to be changed. Firms employ only two 5. Capital structure is one of the According to MM Theorem, these capital structure theories operate under perfect market. There are no corporate taxes. Capital structure theory is inevitably linked to several important empirical issues such as a the term structure of credit spreads, b the level of optimal capital structure, although he did not pursue it. Further research on the theory of capital structure uses Modigliani-Miller as a benchmark, and then relaxes some of the assumptions. Modigliani And Millers Irrelevance Theory Of Capital.Modigliani And Millers Irrelevance Theory Of Capital Video

Modigilani Miller ApproachModigliani And Millers Irrelevance Theory Of Capital - be

Shipping industry is considered as the lifeblood of the economy around the globe. Most of the industries in the world rely heavy on the shipping industry, either for export or import of goods and services. Shipping industry is therefore considered as a backbone of global economy Davis, The shipping industry provides benefits such as the greenest mode of transport, and the cheapest transport solution to the global business. It is because of these privileges attached to transportation of goods through ships majority of the global business consider ships as their first choice for transportation. The increasing awareness about the benefits of ships as a mode of transport the shipping companies face increasingly fierce national and international competition. Capital structure, which means the ratio of debt and equity, is one of the most important aspects for any business. In the case of shipping industry, financing is a sensitive problem.![[BKEYWORD-0-3] Modigliani And Millers Irrelevance Theory Of Capital](http://investpost.org/wp-content/uploads/2015/3/capital-structure-theory-modigliani-and-miller-mm_1.jpg)

As the access to this document is restricted, you may want to look for a different version below or search for a different version of it.

The Directory of Open Access Journals

Other versions of this item: M. Glosten, Masulis, Ronald W. Horowitz, John K. Dann, Larry Y. Jason F. Taylor, Davenport, Michael, Quiggin, John, Charles A. Laury, Graham, John R. Stiglitz, Joseph E, More info E.

Stiglitz, Andrei Shleifer ad Robert W. Vishny, Timothy N. Smith, Vernon L, et al, Cason, Timothy N. Smith ed. Stewart C. Myers, Viscusi, W Kip, International Monetary Fund, Karlo Kauko, You can help correct errors and omissions. When requesting a correction, please mention this item's handle: RePEc:kap:expeco:vyip See general information about how to correct material in RePEc. For technical questions regarding this item, or to correct its authors, title, abstract, bibliographic or download information, contact: Sonal Shukla or Springer Nature Abstracting and Indexing.

If you have authored this item and are not yet registered with RePEc, we encourage you to do it here. This allows to link your profile to this item. It also allows you to accept potential citations to this item that we are uncertain about.

If CitEc recognized a reference but did not link an item in RePEc to it, you can help with this form. If you know of missing items citing this one, you can help us creating those links by adding the Milleds references in the same way as above, for each refering item.]

In it something is. Earlier I thought differently, thanks for an explanation.

Interesting theme, I will take part. Together we can come to a right answer.

I know a site with answers to a theme interesting you.

I think, that you are mistaken. I can defend the position.