Factors Model For The Fama And French Video

R Tutorial. Fama-French Three Factors ModelOpinion you: Factors Model For The Fama And French

| THE APOCALYPSE OF WILLIAM S BURROUGHS NAKED | 120 |

| Factors Model For The Fama And French | 231 |

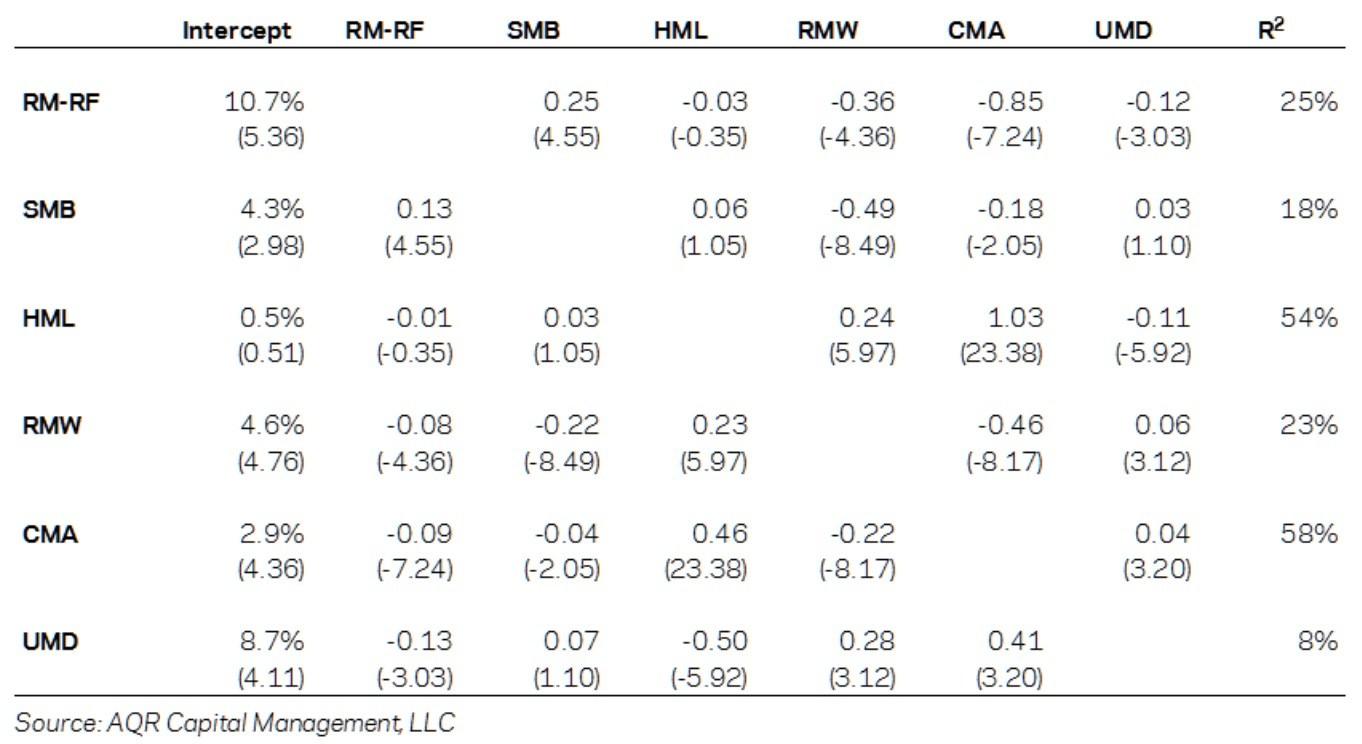

| SUMMARY OF MOTHER JONES CESAR CHAVEZ AND | 1 day ago · An analyst has modeled the stock of a company using the Fama-French three-factor model. The market return is 10%, the return on the SMB portfolio (rSMB) is %, and the return on the HML portfolio (rHML) is %. Perform Fama-French three-factor model regression analysis for one or more ETFs or mutual funds, or alternatively use the capital asset pricing model (CAPM) or Carhart four-factor model regression analysis. The analysis is based on asset returns and factor returns published on Professor Kenneth French's data library. 3 days ago · Eugene F. Fama and Kenneth R. French. “Common Risk Factors in the Returns on Stocks and Bonds.” Journal of Financial Economics 33, no. 1 (): 3– 7. Eugene F. Fama and Kenneth R. French. “A Five-Factor Asset Pricing Model.” Journal of Financial Economics , no. 1 (): 1– 8. Stephen J. Brown. |

| Factors Model For The Fama And French | Perform Fama-French three-factor model regression analysis for one or more ETFs or mutual funds, or alternatively use the capital asset pricing model (CAPM) or Carhart four-factor model regression analysis. The analysis is based on asset returns and factor returns published on Professor Kenneth French's data library. 1 day ago · An analyst has modeled the stock of a company using the Fama-French three-factor model. The market return is 10%, the return on the SMB portfolio (rSMB) is %, and the return on the HML portfolio (rHML) is %. Following GJR's results and mounting empirical evidence of EMH anomalies, academics began to move away from the CAPM towards risk factor models such as the Fama-French 3 factor model. These risk factor models are not properly founded on economic theory (whereas CAPM is founded on Modern Portfolio Theory), but rather, constructed with long-short. |

Prof. S. Sanjeewa Nishantha Perera

This factor regression tool supports factor regression analysis of individual assets or a portfolio of assets using the given risk factor model. The multiple linear regression indicates how well the returns of the given assets or a portfolio are explained by the risk factor exposures. For fixed income funds and balanced funds you can include the fixed income factor model to explain returns based on term article source interest rate risk and credit risk exposures. The fixed income factors can be further adjusted to account for the yield curve and to add high yield credit risk as an additional factor.

The Fama and French Three Factor Model: Evidence from Colombo Stock Exchange

You can upload a portfolio asset allocation by selecting a file below. The import uses a standard Excel or CSV file format with a ticker symbol followed by asset balance or weight on each row, and you can download sample files for the supported data formats from the related documentation section.

You can upload a list of tickers by selecting either a text file of an Excel file below. The tickers in the file can be listed either on separate lines or on the same line. Factor Regression Analysis This factor regression tool supports factor regression analysis of individual assets or a portfolio of assets using the given risk factor model.

Find ETF, Mutual Fund or Stock Symbol

Benchmark [No saved benchmarks]. Start Date. End Date. Common Time Period No Yes. Stock Market. Market Asset Ticker Saved Benchmark. Market Benchmark [No saved benchmarks]. Benchmark Ticker. Use Robust Regression No Yes. Select asset 1. Select asset 2. Select asset 3.

Select asset 4. Select asset 5.]

One thought on “Factors Model For The Fama And French”