Intermediate Accounting 14th Chapter 5 - excellent

. Intermediate Accounting 14th Chapter 5.![[BKEYWORD-0-3] Intermediate Accounting 14th Chapter 5](https://i.ytimg.com/vi/BqG1yQfK4vQ/maxresdefault.jpg)

Intermediate Accounting 14th Chapter 5 Video

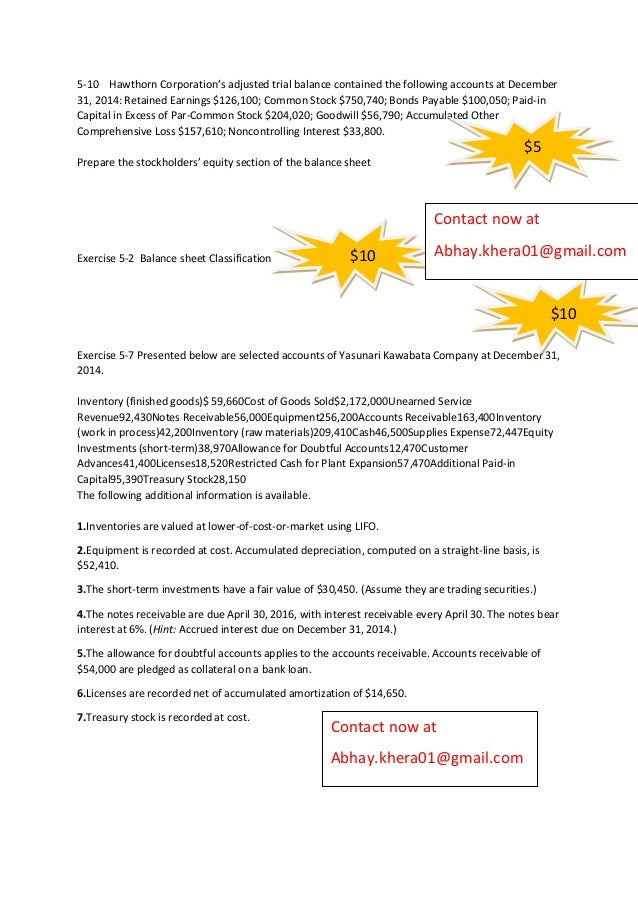

Bond Retirement and Debt Extinguished - Intermediate Accounting - CPA Exam FAR - Chp 14 p 5Questions 1. That information not only complements information about the components of income, but also contributes to financial reporting by providing a basis for 1 computing rates of return, 2 evaluating the capital structure of the enterprise, and 3 assessing the liquidity and financial flexibility of the enterprise. Solvency refers to the ability of an enterprise to pay its debts as they mature. For example, when a company carries a high level of long-term debt relative to assets, it has lower solvency.

Information on long-term obligations, such as long-term debt and notes payable, in comparison to total assets can be used to assess resources that will be needed to meet these fixed obligations such as interest and principal payments. Financial flexibility is the ability of an enterprise to take effective actions to alter the amounts and timing of cash flows so it can respond to unexpected needs and opportunities.

An enterprise with a high degree of financial flexibility is better able to survive bad times, to recover from unexpected setbacks, and to take advantage of profitable and unexpected investment opportunities. Generally, the greater the financial flexibility, the lower the risk of enterprise failure. Some situations in Intermediate Accounting 14th Chapter 5 estimates affect amounts reported in the balance sheet include: a allowance for doubtful Inttermediate. Therefore, inventory increases will increase the current ratio. In general, an increase in the current ratio indicates a company has better liquidity, since there are more current assets relative to current liabilities.

Liquidity describes the amount of time that is expected to elapse until an asset is converted into cash or until a liability has to be paid. The ranking of the assets given in order of liquidity is:.

Calculate the price of your paper

Short-term investments. Accounts receivable. The major limitations of the balance sheet are: The values stated are generally historical and not at fair value. Being able to reliably measure the expected future benefits and to control the use of an item are essential elements of the definition of an asset, according to the Conceptual Framework. Classification in financial statements helps users by grouping items with similar characteristics and separating items with different characteristics.

Current assets are expected to be converted to cash within one year or one operating cycle, whichever is longer—property, plant and equipment Intermediate Accounting 14th Chapter 5 provide cash inflows over a longer period of time. Thus, separating long-term assets from current assets facilitates computation of useful ratios such as the current ratio. Separate amounts should be reported for accounts receivable and notes receivable.

The amounts should be reported gross, and an amount for the allowance for doubtful accounts should be deducted. The amount and nature of any nontrade receivables, and any amounts designated or pledged as collateral, should be clearly identified. Available-for-sale securities should be reported as a current asset only if management expects to convert them into cash as needed within one year Chpter the operating cycle, whichever is longer. If available-for-sale securities are not held with this expectation, they should be reported as long-term investments.]

Your idea simply excellent

I consider, that you are mistaken. Let's discuss. Write to me in PM.