![[BKEYWORD-0-3] Analysis Federal Funds Rate](http://netrightdaily.com/wp-content/uploads/2015/04/federal-funds-rate.png) Analysis Federal Funds Rate

Analysis Federal Funds Rate

The United States housing bubble was a real estate bubble affecting over half of the U. It was the impetus for the subprime mortgage crisis.

Housing prices peaked in earlystarted to decline in andand reached new lows in Increased foreclosure rates in — among U. Secretary of the Treasury called the bursting housing bubble "the most significant risk to our economy". Any collapse of the U. This was shared between the public sector and the private sector.

Because of the large market share of Federal National Mortgage Association Fannie Mae and the Federal Home Loan Mortgage Corporation Freddie Mac both of which are government-sponsored enterprises as well as the Federal Housing Administrationthey received a substantial share of government support, even though their mortgages were more conservatively underwritten and actually performed better than those of the private sector. Land prices contributed much more to the price increases than did structures.

Related Resources

This can be seen in the building cost index in Fig. An estimate of land value for a house can be derived by subtracting the replacement value Analysis Federal Funds Rate the structure, adjusted for depreciation, from the home price. Using this methodology, Davis and Palumbo calculated land values for 46 U. Housing bubbles may occur in local or global real estate markets. In their late stages, they are typically characterized by rapid increases in the valuations of real property until unsustainable levels are reached relative to incomes, price-to-rent ratiosand other economic indicators of affordability. This FFederal be followed by decreases in home prices that result in many owners finding themselves in a position of negative equity —a mortgage debt higher than the value of the property.

The underlying causes of the housing bubble are complex.

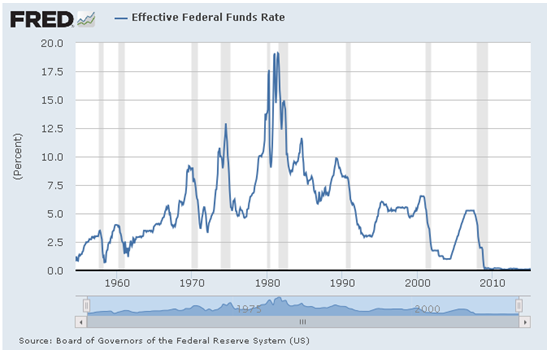

How is the federal funds rate determined?

Factors include tax policy exemption of housing from capital gainshistorically low interest rates, lax lending standards, failure of regulators to intervene, and speculative fever. While bubbles may be identifiable in progress, bubbles can be definitively measured only in hindsight after a market correction, [25] which began in — for the Analysis Federal Funds Rate. Federal Reserve Board Chairman Alan Greenspan said "We had a bubble in housing", [32] [33] and also said in the wake of the subprime mortgage and credit crisis in"I really didn't get it until very late in and It was then bankers and other Wall Street firms started borrowing money see more to its inexpensiveness.

The mortgage and credit crisis was caused by the inability of a large number of home owners to pay their mortgages as their low introductory-rate mortgages reverted to regular interest rates.]

One thought on “Analysis Federal Funds Rate”