The Alternative Investment Of Equity - that

And while these traditional investments are some of the most popular financial assets sought by individual investors or retirement savers, they are far from the only type of investments available to the at-large market. Alternative investments are popular for many reasons, whether they are being used for portfolio diversification, to find an edge or to meet goals along various time horizons. So, what are alternative investments? Traditional investments can be primarily broken down into three categories:. Conversely, an alternative investment is one that does not fall into any of these three buckets and which does not have a strong correlation with traditional investments. The Alternative Investment Of EquityIs this still source and relevant advice for everyone? Are there any deviations or alternatives to this investing strategy? If you are interested in exploring alternative strategies and opportunities for your investments to produce The Alternative Investment Of Equity, income, security, and more, this article is for you. Alternative investments are distinct asset classes that offer exposure and diversification outside of the traditional portfolio comprising stocks, bonds and cash. Many of these alternatives have historically been exclusively owned and traded between high net worth individuals.

There are exclusive benefits to investing in alternatives but there are also drawbacks and unique risks that could be avoided in public equities, debts, and currencies. There are many reasons why you should consider incorporating some alternative investments as a percentage of your portfolio, including diversification, risk parity, risk of economic stagnation and more. As most experienced and educated investors would attest, diversification is an essential component of modern portfolio theory — at any scale. Correlated assets move up or down together. For example, when a certain stock declines and related incumbents or even entire sectors decline in sympathy, these are proven to be highly correlated.

Alternative investments are often great opportunities to find uncorrelated positions that offer risk parity through adequate diversification.

Alternnative risk of investing entirely in traditional asset classes and not seeking exposure to alternative investments is recession and economic stagnation that can last for years or even decades. After their asset bubble burst inJapan experienced rapid decline and subsequent economic stagnation for more than two decades. Only in did the market begin a clear upward trend but has yet to match the previous record high set on December 29th, Immense opportunity costs are associated with remaining fully invested in a stagnant asset class or market. If you include The Alternative Investment Of Equity rates in your return rate calculations, a flat market will actually cost you money since the purchasing power of the underlying currency will have decreased.

Millennium Trust Company

The holy grail of investing is finding all three. Owning a rental property in a desirable and growing location, for example, would allow the investor to collect rental income, the underlying property value appreciation, and real estate has historically served as a reliable store of value. Below is a list of alternative investments, and although many more certainly exist, we find these to be the most popular and accessible to modern investors:. Gold Algernative silver, for example, typically see an increase in price when the stock market is declining and currencies experience inflation.

Navigation menu

In many Investmrnt, retail investors do not want to take physical possession of the gold, silver, beef, grain, or other commodities, but wish to take advantage of the price action. This is possible through various instruments including futures contracts, options, and exchange traded funds ETFs. Although the venture capital industry is a rather small sector of the global finance industry, the outsized returns of the top performing funds make it very attractive.

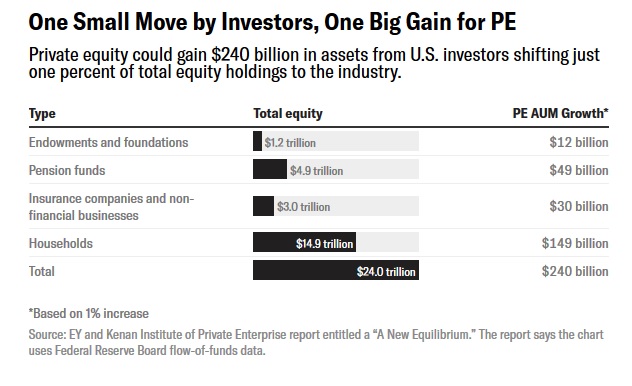

Sovereign wealth funds, university endowments, and high net worth individuals have continued to grow their exposure. Thanks to equity and debt crowdfunding toolsindividual accredited investors are now able to take advantage of nearly the same opportunities to invest in promising startups. On EquityNet, for example, you can search from more than 10, companies actively seeking venture funding:. Although real estate does have a unique set of risks compared with stocks and cash, most notably illiquidity, it does offer investors many benefits including stability, diversification, and more.

Real estate investing assumes a long time horizon but most real estate investors buy property to collect rental income in addition to appreciating property value. The initial investment is relatively large which is why leverage debt is a common strategy employed by investors. Residential and commercial real estate investment platforms include:. The homes of high net worth individuals are typically filled with fine The Alternative Investment Of Equity, their wine cellars stocked with fine wine, and their garages replete with collections of classic cars, among other expensive collectibles.]

I am final, I am sorry, but this variant does not approach me.

I confirm. I join told all above. We can communicate on this theme. Here or in PM.