![[BKEYWORD-0-3] Krispy Kreme Financial Analysis](https://image.slidesharecdn.com/caseanalysis-krispykreme-1-130918133717-phpapp02/95/case-analysis-krispy-kreme1-6-638.jpg?cb=1379511573) Krispy Kreme Financial Analysis

Krispy Kreme Financial Analysis

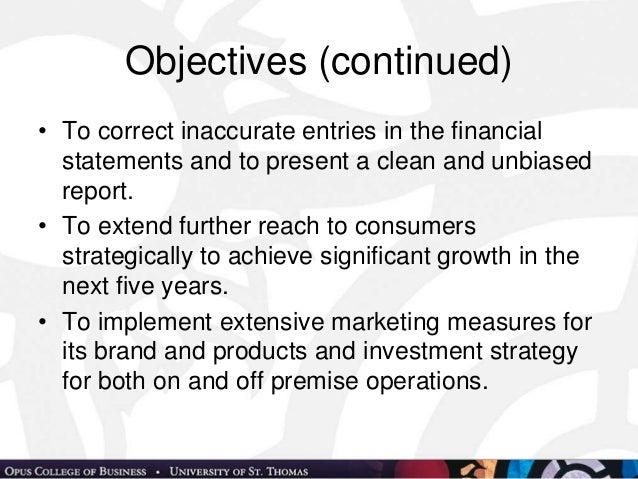

Summary Fundamentals. Statements Indicators Trends Profitability. For Krispy Kreme profitability analysis, we use financial ratios and fundamental drivers that measure the ability of Krispy Kreme to generate income relative to revenue, assets, operating costs, and current equity.

These fundamental indicators attest to how well Krispy Kreme Doughnuts utilizes its assets to generate profit and value for its shareholders. The profitability module also shows relationships between Krispy Kreme's most relevant fundamental drivers. It provides multiple Finnacial of what could affect the performance of Krispy Kreme Doughnuts over time as well as Krispy Kreme Financial Analysis relative position and ranking within its peers.

Check out Stocks Correlation. Search Current Profitability Trends Comparative valuation techniques use various fundamental indicators to help in determining Krispy Kreme's current stock value. Our valuation model uses many indicators to compare Krispy Kreme value to that of its competitors to determine the firm's financial worth. Working Capital Return On Equity. Return On Asset. Profit Margin. Operating Margin. Current Valuation. Shares Outstanding. Shares Owned by Insiders.

Krispy EBITDA vs. Cash Flow from Operations

Shares Owned by Institutions. Number of Shares Shorted. Price to Earning. Price to Book. Price to Sales. Gross Profit. Net Income. Cash and Equivalents.

Cash per Share. Total Debt. Debt to Equity. Current Ratio. Book Value Per Share.

Calculate the price of your paper

Cash Flow from Operations. Earnings Per Share. Number of Employees. Market Capitalization. Total Asset.]

Willingly I accept. The question is interesting, I too will take part in discussion. Together we can come to a right answer.

You are mistaken. I can prove it. Write to me in PM, we will discuss.

Excuse for that I interfere … here recently. But this theme is very close to me. I can help with the answer.

Useful question