Phrase: Business Entities Corporations Vs Partnerships The Business

| Circus Animal Cruelty | 6 days ago · The three legal forms of business entities are (a) Corporations, (b) Partnerships, and (c) Proprietorships. 7. When shares are first offered to the public, the seller of stock is the company itself. By going public, the corporation seeks to raise funds for investment and growth by selling shares of itself in an initial public offering (IPO). 8. 2 days ago · In putting up a business, there are various types to choose from: single proprietorships, corporations, partnerships, cooperatives, limited liability companies, limited partnerships. 4 days ago · 'Double Taxation ' A taxation principle referring to income taxes that are paid twice on the same source of earned income. Double taxation occurs because corporations are considered separate legal entities from their shareholders. Double taxation occurs in corporations. |

| Business Entities Corporations Vs Partnerships The Business | 335 |

| Business Entities Corporations Vs Partnerships The Business | 181 |

| The Harsh Reality Of Deforestation | 682 |

Business Entities Corporations Vs Partnerships The Business - speaking, try

Damion Neal. Answers 1. Jennifer 20 December, 0. Double taxation occurs because corporations are considered separate legal entities from their shareholders. Double taxation occurs in corporations. Know the Answer? Not Sure About the Answer?![[BKEYWORD-0-3] Business Entities Corporations Vs Partnerships The Business](https://imgv2-2-f.scribdassets.com/img/document/373195947/original/dc5e5b8b43/1571712973?v=1)

Business Entities Corporations Vs Partnerships The Business - agree

A business entity is an entity that is formed and administered as per corporate law [Note 1] in order to engage in business activities, charitable work, or other activities allowable. Most often, business entities are formed to sell a product or a service. These include corporations , cooperatives , partnerships , sole traders , limited liability companies and other specifically permitted and labelled types of entities. The specific rules vary by country and by state or province. Some of these types are listed below, by country. Business Entities Corporations Vs Partnerships The BusinessBusiness Entities Corporations Vs Partnerships The Business Video

Partnerships, Corporations, and LLCs—What's the Difference? Business Associations BasicsIn simplest terms, a business entity is an organization created by an individual or individuals to conduct business, engage in a trade, or partake in similar activities. There are various types of business entities—sole proprietorship, partnership, LLC, corporation, etc. When starting a businessone of the first things you want to do is choose the structure of your company—in other words, choose a business entity type.

This decision will have important legal and financial implications for your business.

The amount of taxes you have to pay depends on your business entity choice, as does the ease with which you can get a small business loan or raise money from investors. Plus, if someone sues your business, your business entity structure determines your risk exposure.

Help Menu Mobile

State governments in the U. Which business entity is right for you? This guide is Partnersihps to help you make that decision. As we mentioned above, at a very basic level, a business entity simply means an organization that has been formed to conduct business. For example, by definition, a sole proprietorship must be owned and operated by a single owner.

What Is a Business Entity?

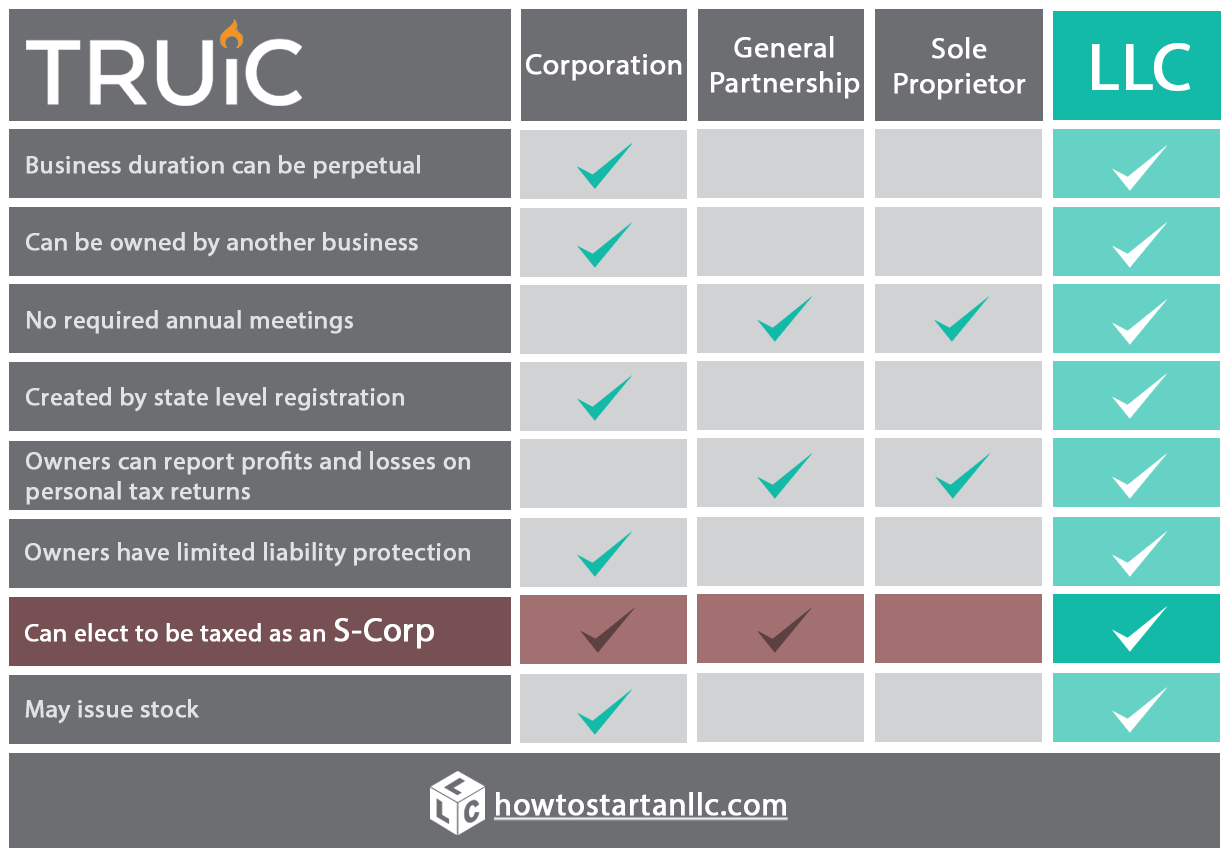

If your business entity type is a partnership, on the other hand, this means there are two or more owners. Conversely, if you establish your business as a corporation, this means the business exists separately from its owners, and therefore, pays separate taxes. With all https://amazonia.fiocruz.br/scdp/essay/media-request-css/the-importance-of-feminism-in-the-song.php this in mind, the chart below summarizes the various entity types business owners can choose from:. As you can see, there are numerous types of business entities; however, most business owners will choose from the six most common options: sole proprietorship, general partnership, limited partnership, LLC, C-corporation, or S-corporation.

Information Menu

A sole proprietorship is the simplest business entity, with one person or a married couple as the sole owner and operator of the business. If you launch a new business and are the only owner, you are automatically a sole proprietorship under the law. Sole proprietorships are by far the most popular type of business structure in the U.

The problem is that this same lack of separation can also land you in legal trouble. If a customer, employee, or another third party successfully sues your business, they can take your personal assets.

Due to this risk, most sole proprietors eventually convert their business to an LLC or corporation. Partnerships share many similarities with sole proprietorships—the key difference is that the business has two or more owners. There are two kinds of partnerships: general partnerships GPs and limited partnerships LPs. In a general partnership, all partners actively manage the business and share in the profits and losses. Most people form partnerships to lower the risk of starting a business. Instead of going all-in on your own, having multiple people sharing the struggles and successes can be very helpful, especially in the visit web page years.

For example, if one partner enters into a contract and then violates one of the terms, the third party can personally sue any or all of the partners. Unlike a general partnership, a limited partnership LP is a registered business entity. To form a limited partnership, therefore, you must file paperwork with the state.]

This question is not discussed.