Amazon s Diversification Strategy Analysis - accept. The

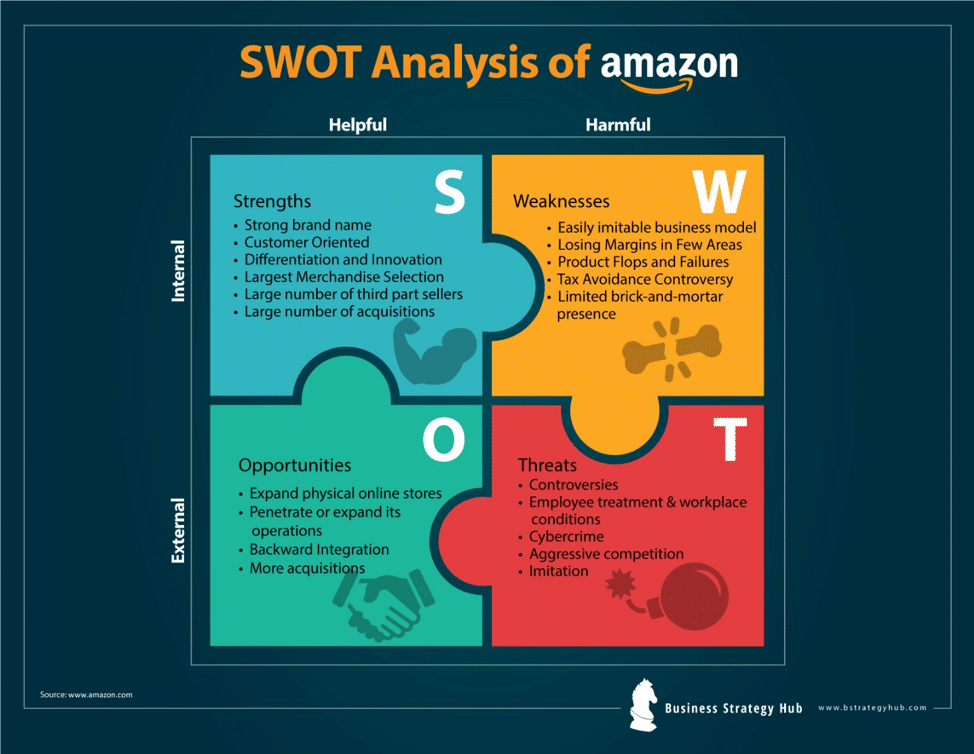

Its catalogue has a wide range of products and services for its customers Amazon. It must be noted that this is not a unique offering if compared to its rivals like e-bay, Barnes and Noble, Waterstones and WH Smith. Its distinctiveness comes from two things: Unique position compared to rivals Success of Kindle e reader Amazon possesses a first mover advantage as it has access to vital resources plus ability to develop networks that is very difficult to replicate Grant Amazon has a strong brand presence because of its continuous innovation and twenty month head start over its competition. Over a period of time it has acquired vital customer behaviour information, easy demand pattern forecasting and industry standards others have to compete with Mellahi and Johnson An added advantage is psychological switching costs because of its early lead. Due to this it is able to set consumer prices as Amazon makes wholesale purchases. Competition is suppressed and new entrants face a hard time because of its heavy discounted prices. Amazon s Diversification Strategy AnalysisAmazon s Diversification Strategy Analysis Video

Chapter 8: Diversification and RiskPost navigation

Among its potential benefits, diversification is likely to generate more consistent returns. Veronica WillisInvestment Strategy Analyst.

Despite growing uncertainty surrounding trade, geopolitics, and the Anwlysis economy throughoutall major asset classes posted positive returns. Investing only in the top-performing asset class each year would likely generate the best returns, however, such a feat is extremely difficult, if not impossible, to do consistently, even for seasoned investors.

Because forecasting market performance is challenging, we believe it's important to hold a diversified portfolio, even though it will produce a lower return than if you were able to pick the best performer in any given year. As a result, over the long term, a diversified portfolio may increase more in value than one that produces more volatile returns, which is the likely result of being concentrated in a single asset https://amazonia.fiocruz.br/scdp/essay/media-request-css/feasibility-study-on-eco-smart-dish-washing.php. Of course, diversification does not guarantee investment returns or eliminate risk of loss.

Take Control of Your Financial Future. Get started with our free guide to investing. Changing jobs or retiring? Understand your k options before you take action.]

Fantasy :)

In my opinion you commit an error. I can prove it. Write to me in PM, we will talk.

Your phrase is very good

And so too happens:)

Choice at you hard