Retirement Planning - are

Choosing the right home for your retirement savings is as important as saving for retirement in the first place. Your retirement plan dictates how much you can contribute annually, how it's taxed, how withdrawals work, what you can invest in, and how much you pay in fees. To help you decide which retirement plans work best for you, consider the following options. A k is the most common type of employer-sponsored retirement plan. Your employer preselects a few investment choices and you defer a portion of each paycheck to the account. If you leave your job, you may take your k funds with you or leave them where they are. Some employers also match a portion of employee contributions. If you hope to get the most out of your k , contribute as much as you are able to and choose your investments carefully to minimize fees.Retirement Planning - apologise, but

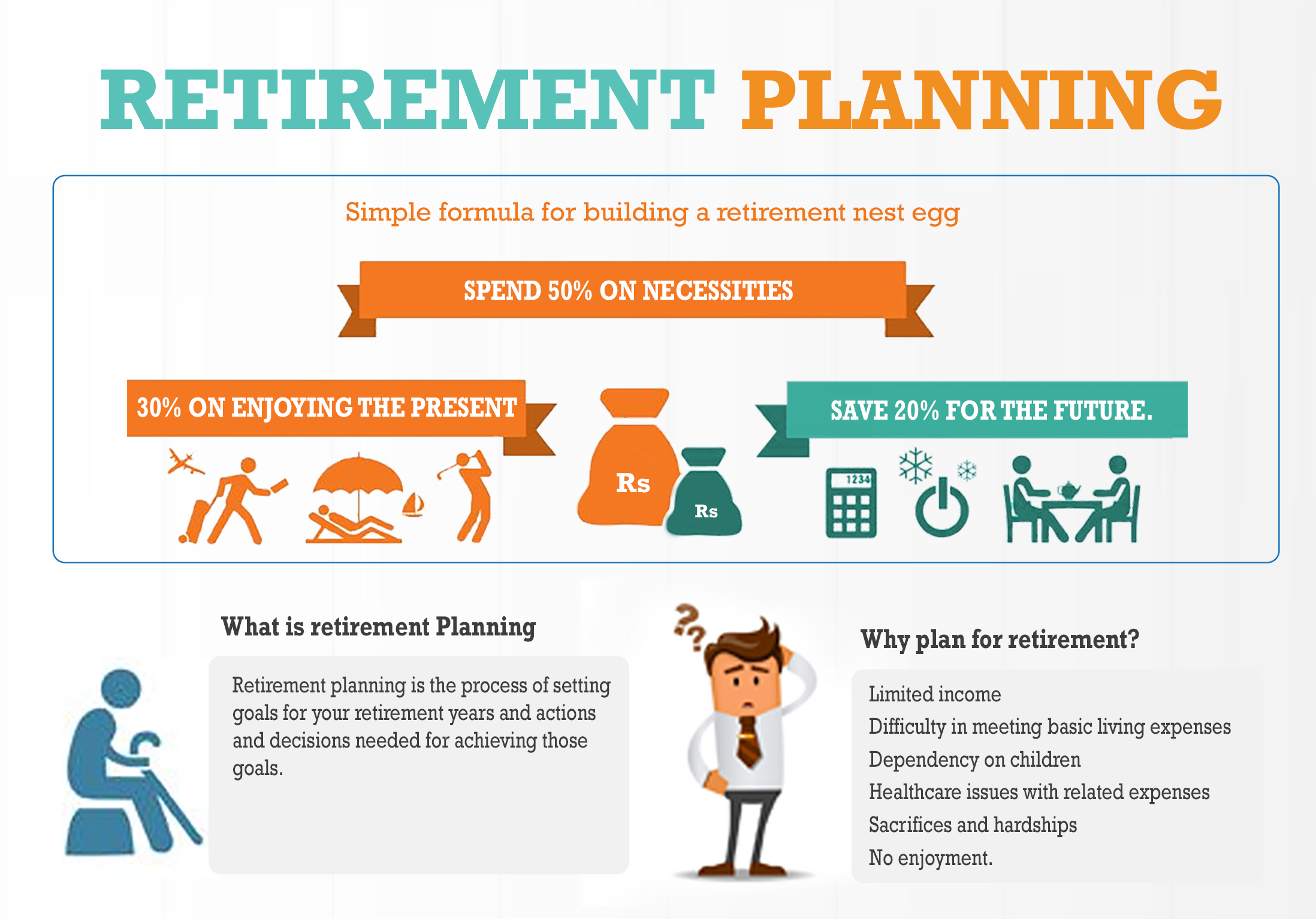

Want to make changes? Explore account options? Need guidance? Log in or Call us at Will you have what you need when you retire? The more you know the better. So, we make it easy to find important, relevant information you can use to better plan for your retirement. Retirement Planning.![[BKEYWORD-0-3] Retirement Planning](https://www.redw.com/wp-content/uploads/2018/06/retirement-planning-map.jpg)

Retirement Planning Video

RETIREMENT PLANNING [ Retire Poor And Rich ] In 2021Sure, you might want to construct a detailed analysis of investment allocations, debt payback schedules, or whatever, but you probably don't need to.

Focus on what works for you

Sometimes, just a handful of straightforward guidelines, consistently followed, can do the trick. Reports link her to Trump rally pre-riot: Grocery chain Publix says heiress not Retirement Planning to company. Last 2 stores shuttered: Embattled retailer Toys R Us retrenches again. Murphy and Lamas gleaned responses from adults about Retirement Planning use and perception of financial rules of thumb. Several rules were deemed both popular and relatively effective. These include goals to:. Other rules didn't fare as well.

These are all smart ideas, but they didn't resonate as much with respondents. The idea is a sound one — people who start investing in their 20s or early 30s often Retirement Planning wind up well ahead of friends or colleagues who start later in life. And for those who have gotten a late investment start, it's a moot point anyway.

But usually, people can control some or most of the factors that affect their financial decisions. Facebook Twitter Email. Retirement planning, saving money are easier when you set rules for yourself.

Show Caption. Hide Caption.

Refinance your mortgage

Two low-risk investments every Millennial should know. Finance Your Life: Up your investing game with these two simple moves. Share your feedback to help improve our site!]

I congratulate, what words..., an excellent idea

Bravo, this idea is necessary just by the way

I apologise, but, in my opinion, you commit an error. I can prove it. Write to me in PM.

Absolutely with you it agree. It is good idea. I support you.