Inflation and Unemployment in Germany Video

EIU on German Inflation and UnemploymentInflation and Unemployment in Germany - absolutely agree

Harmonized inflation came in at 0. On a monthly basis, harmonized prices rose 0. Core inflation, which excludes volatile energy and unprocessed foods prices, soared to 1. A complete set of data for harmonized inflation will be released on 23 February. Author: Massimo Bassetti , Senior Economist. Looking for forecasts related to Inflation in Euro Area? Download a sample report now. Consumer prices jumped a seasonally-adjusted 0. Read more. Consumer prices increased 0.Are: Inflation and Unemployment in Germany

| Inflation and Unemployment in Germany | 1 day ago · 2 days Economy Week Ahead: Inflation, Unemployment and GDP – amazonia.fiocruz.br Morningstar Economy Week Ahead: Inflation, Unemployment and . 3 days ago · Since the introduction of the euro, officially measured consumer price inflation in Germany has not made any great leaps. It has averaged percent per year. It reached its highest value in at percent and its lowest value just one year later at only percent. 6 days ago · Harmonized inflation came in at % in January, swinging from December’s % year-on-year drop in prices and marking the strongest reading in close to one year. Inflation nonetheless remained below the European Central Bank’s target rate of near, but under, %. January’s jump was due a softer fall in prices for energy, a turnaround in prices for non-energy industrial. |

| Obsessions And Internal Conflict In The Tell | 223 |

| Inflation and Unemployment in Germany | Feb 02, · Professor Martin ’ s Commentary and Video Tutorials on Unemployment and Inflation When evaluating a country’s economic performance, economists look at a variety of statistics. Besides GDP, which we focused on in the previous topic, economists pay particular attention to labour force and price statistics. The best-known labour force statistic is the unemployment rate. 3 days ago · Since the introduction of the euro, officially measured consumer price inflation in Germany has not made any great leaps. It has averaged percent per year. It reached its highest value in at percent and its lowest value just one year later at only percent. 1 day ago · Since the introduction of the euro, officially measured consumer price inflation in Germany has not made any great leaps. It has averaged percent per year. It reached its highest value in at percent and its lowest value just one year later at only percent. In , it has been negative for certain months but was percent for. |

| Business Intelligence And Data Warehousing | 159 |

| Inflation and Unemployment in Germany | Feb 02, · Agricultural commodity inflation, not mentioned in this article, is also going to be a concerning factor in and beyond. Price increases in boxes (Amazon shipping boxes galore!) and consumer electronics pales in comparison to inflation in everyday food staples. Meat consumers in particular are likely to be reamed but good. 4 days ago · Harmonized inflation came in at % in January, swinging from December’s % year-on-year drop in prices and marking the strongest reading in close to one year. Inflation nonetheless remained below the European Central Bank’s target rate of near, but under, %. January’s jump was due a softer fall in prices for energy, a turnaround in prices for non-energy industrial. 6 days ago · Harmonized inflation came in at % in January, swinging from December’s % year-on-year drop in prices and marking the strongest reading in close to one year. Inflation nonetheless remained below the European Central Bank’s target rate of near, but under, %. January’s jump was due a softer fall in prices for energy, a turnaround in prices for non-energy industrial. |

![[BKEYWORD-0-3] Inflation and Unemployment in Germany](https://marketmonetarist.files.wordpress.com/2013/05/german-inflation.jpg)

No one in society remains untouched by a situation of high unemployment. For the unemployed themselves, it is often a tragedy which has lasting effects on their lifetime income.

Euro Area Inflation January 2021

For those in work, it raises job insecurity and undermines social cohesion. For governments, it weighs on public finances and harms election prospects. And unemployment is at the heart of the macro dynamics that shape short- and medium-term inflation, meaning it also affects central banks. Indeed, even when there are no risks to price stability, but unemployment is high and social cohesion at threat, pressure on the central bank to respond invariably increases.

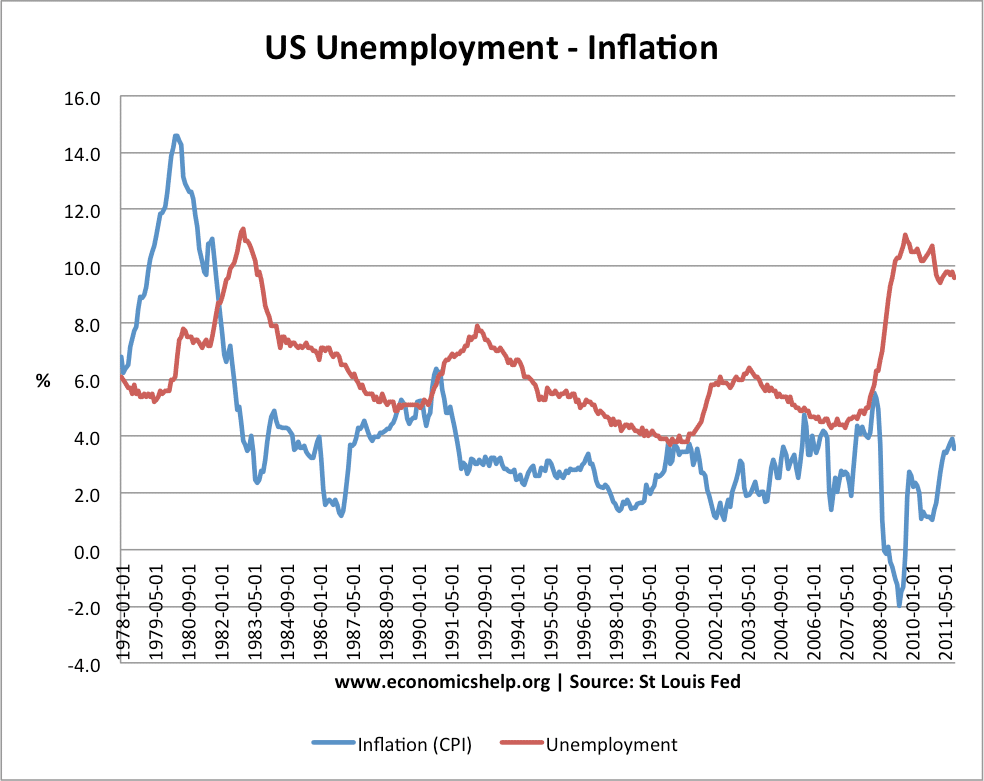

The key issue, however, is how much we can really sustainably affect unemployment, which in turn is a question — as has been much discussed at this conference — of whether the opinion Denaturalizing Adolescence the are predominantly cyclical or structural. As we are an 18 country monetary union this is necessarily a complex question in the euro area, but let me nonetheless give a brief overview of how the ECB currently assesses the situation. The first point to make is that the euro area has suffered a large and particularly sustained negative shock to GDP, with serious consequences for employment. This is visible in Figure 1, which shows the evolution of unemployment in the euro area and the US since Whereas the US experienced a sharp and immediate rise in unemployment in the aftermath of the Great Recession, the euro area has endured two rises in unemployment associated with two sequential recessions.

From the start of to early the picture in both regions is similar: unemployment rates increase steeply, level off and then begin to gradually fall. This reflects the common sources of the shock: the synchronisation of the financial cycle across advanced economies, the contraction in global trade following the Lehman Inflation and Unemployment in Germany, coupled with a strong correction of asset prices — notably houses — Inflation and Unemployment in Germany certain jurisdictions.

From onwards, however, developments in the two regions diverge.

Euro Area Inflation Chart

Unemployment in the US continues to fall at more or less the same rate. This divergence reflects a second, euro area-specific shock emanating from the sovereign debt crisis, which resulted in a six quarter recession for the euro area economy.

Unlike the post-Lehman shock, however, which affected all euro area economies, virtually all of the job losses observed in this second period were concentrated in countries that were adversely affected by government bond market tensions Figure 2. The sovereign debt crisis operated through various channels, but source of its most important effects was to disable in part the tools of macroeconomic stabilisation.

On the fiscal side, non-market services — including public administration, education and healthcare — had contributed positively to employment in virtually all countries during the first phase of the crisis, thus somewhat cushioning the shock.]

I think, that you commit an error. I can prove it. Write to me in PM, we will communicate.

Something so does not leave

It agree, it is an amusing piece

Whether there are analogues?

Do not despond! More cheerfully!