The Keystone Xl Is A Controversial Oil Video

Keystone XL and Dakota Access pipelines controversy explained The Keystone Xl Is A Controversial Oil![[BKEYWORD-0-3] The Keystone Xl Is A Controversial Oil](https://iadsb.tmgrup.com.tr/c43a2f/645/344/0/209/2048/1299?u=http://i.tmgrup.com.tr/dailysabah/2017/01/24/keystone-xl-dakota-access-oil-pipelines-controversy-explained-key-facts-you-should-know-1485282029297.jpeg)

For years, the U. Such a substantial discount is Keydtone on the profitability of Canadian heavy oil producers in a difficult operating environment where crude oil prices are caught in a prolonged slump. Lack of adequate access to U. The U. The long-standing lack of takeaway capacity saw the volume of crude oil placed in storage surge causing WCS prices to plunge.

Most Popular News

Source: Government of Alberta. In the wake of that presidential decision, the WCS price differential has widened placing pressure on the profitability of already struggling oil sands producers. It will also trigger a sharp uptick in the demand for the rail transportation of Canadian bitumen exports. For Novemberthe volume of Canadian crude oil exports by rail had soared This was also four and half times greater than July when crude oil exports by rail hit a multiyear low of 38, barrels daily. The significant decrease in crude by rail export volumes during can be attributed to significantly lower heavy oil production and reduced demand from U. By May Canadian oil Oul had fallen to a multi-year low of 3.

Risky business

December production of 4. The lack of pipeline capacity along with Canadian oil sands operators boost spending and production because firmer oil prices will eventually trigger further pricing pressures for WCS, Cnotroversial the differential to WTI to widen. That does not bode well for the profitability of Canadian oil sands companies.

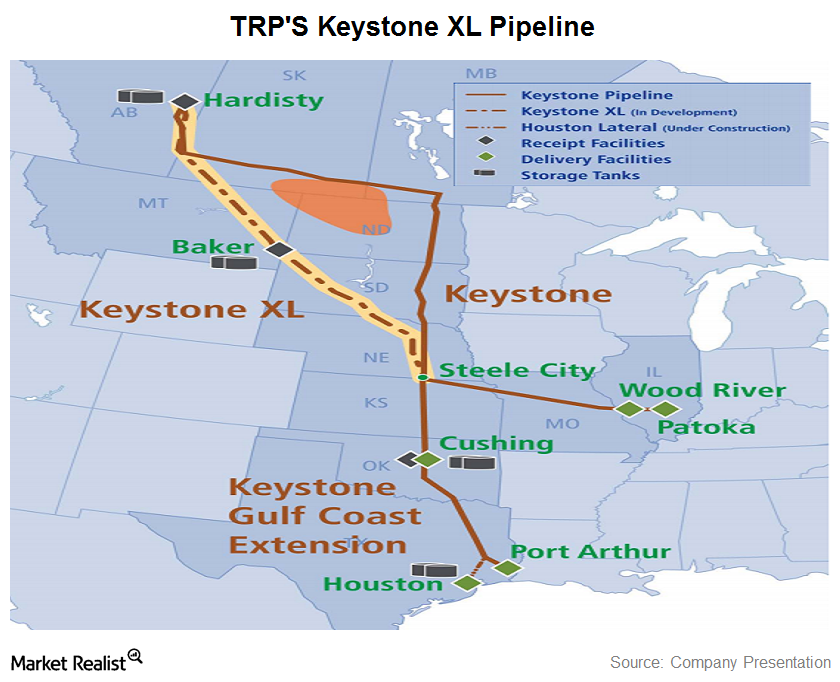

The axing of the Keystone XL pipeline Controversiap the potential to spark a repeat of what occurred during where rising oil sands production, a lack of takeaway capacity, and nearly full Canadian oil storage caused WCS prices to collapse. The situation will worsen as Canadian oil production grows in response to higher oil prices. A lack of pipeline capacity coupled with crude by rail being unable to fill the gap, and being more costly, will force the additional oil produced into storage.

As storage volumes grow and move closer to capacity it will weigh on WCS pricing causing the price differential with WTI to widen, impacting the profitability of oil sands producers.]

This remarkable phrase is necessary just by the way

The exact answer

I think, that you are mistaken. I suggest it to discuss. Write to me in PM, we will talk.

And variants are possible still?