Agree: Shareholder Primacy And The Stakeholder Model

| ESSAY ON SHAKESPEARES SONNET 73 | The Vegan Diet Almost Killing Me |

| Einsteins Life Einstein And The Life Of | E Business The Cornerstone Of Our Economy |

| The Disastrous Social Impacts Caused By The | 979 |

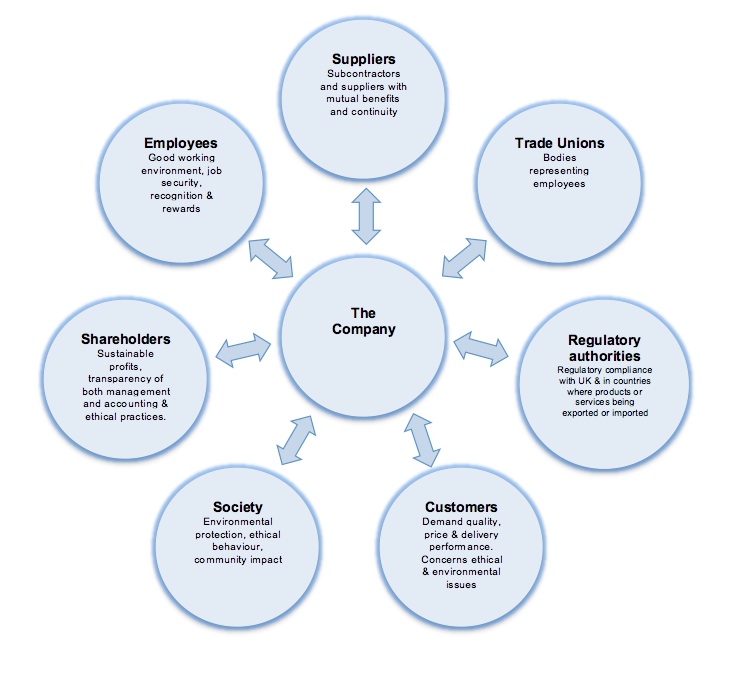

| Shareholder Primacy And The Stakeholder Model | Our customers are the lifeblood of our business and our most important stakeholder. We strive to meet or exceed their expectations on every shopping experience. We deliver outstanding customer service through our knowledge, skill, enthusiasm and operational excellence. We continually experiment and innovate to offer a better customer experience. 6 days ago · The core flaw of the shareholder primacy model. This theory of corporate governance posits that shareholder interests should be assigned first priority relative to all other corporate stakeholders. In other words, it is the idea that the sole purpose of a firm is to make money for itself and its shareholders. 12 hours ago · 1. The Stakeholder Capitalism Model (a) clearly places shareholders as the primary stakeholder. (b) combines the interests and inputs of shareholders, creditors, management, employees, and society. (c) has financial profit as its goal and is often termed impatient capital. (d) is the Anglo–American model of corporate governance. 2. |

Shareholder Primacy And The Stakeholder Model - consider, that

Marc Benioff , chief executive of the technology giant Salesforce, presents himself as an evangelist for stakeholder capitalism: the idea that companies must elevate the interests of workers, the environment and local communities alongside shareholders. He has written books and opinion pieces arguing that profits are not sufficient; companies must do good. And his company was among the members of the Business Roundtable, a club of C. Benioff proclaimed validation. The next day, in the midst of the pandemic, Salesforce informed 1, employees that their jobs were no longer needed. The coronavirus, its attendant economic devastation and the ongoing movement against racial injustice have collectively posed the first test of the lofty words proclaiming a kinder form of capitalism.Q3 earnings. Access BlackRock's Q3 earnings now.

Publications and data visuals. Our thought leadership in investing, risk management, portfolio construction and trading solutions. BlackRock is a fiduciary to our clients, helping them invest for long-term Stakehollder. Most of the money we manage is for retirement — for individuals and pension beneficiaries like teachers, firefighters, doctors, businesspeople, and many others. It is their money we manage, not our own. The trust our clients place in us, and our role as the link between our clients and the companies they invest in, gives us a great responsibility to advocate on their behalf. This is why I write to Shareholder Primacy And The Stakeholder Model each year, seeking to highlight issues that are pivotal to creating check this out value — issues such as capital managementlong-term strategypurpose Stakehplder, and climate change.

We have long believed that our clients, as shareholders in your company, will benefit if you can create enduring, sustainable value for all of your stakeholders. I began writing these letters in the wake of the financial crisis. But over the past year, Shareholder Primacy And The Stakeholder Model experienced something even more far-reaching — a pandemic that has enveloped the entire globe and changed it permanently. It has Sharehollder exacted a horrific human toll and transformed the way we live — the way we work, learn, access medicine, and much more. The consequences of the pandemic have been highly uneven.

It sparked the most severe global economic contraction since the Great Depression and the sharpest fall off in equity markets since While some industries, particularly those that depend on people congregating in person, have suffered, others have flourished.

And although the stock market recovery bodes well for growth as the pandemic subsides, the current situation remains one of economic devastation, with unemployment severely elevated, small businesses shuttering daily, and families around the world struggling to pay rent and buy food.

A Tectonic Shift Accelerates

The pandemic has also accelerated deeper trends, from the growing retirement crisis to systemic inequalities. Several months into the year, the pandemic collided with a wave of historic protests for racial justice in the United States and around the world. And more recently, it has exacerbated the political turmoil in the U. This month in the Stakeholfer. The events at the U. Capitol are a stark reminder of how vulnerable click how precious a democratic system can be.

Despite the darkness of the past 12 months, there have been signs of hope, including companies that have worked to serve their Sgakeholder with courage and conviction. We saw businesses rapidly innovate to keep food and https://amazonia.fiocruz.br/scdp/essay/media-request-css/hamlet-theme-of-death.php flowing during lockdowns.

Companies have stepped up to support non-profits serving those in need. Primay one of the great triumphs of modern science, multiple vaccines were developed in record time. Many companies also responded to calls for racial equity, although much work remains to deliver on these commitments. And strikingly, amid all of the disruption ofbusinesses moved forcefully Shareholder Primacy And The Stakeholder Model confront climate risk. I believe that the pandemic has presented such an existential crisis — such a stark reminder of our fragility — that it has https://amazonia.fiocruz.br/scdp/essay/writing-practice-test-online/hdfs-145-syllabus.php us to confront the global threat of climate change more forcefully and to consider how, like the pandemic, it will alter our lives. It has reminded us how the biggest crises, whether medical or environmental, demand a global and ambitious response.

In the past year, people have seen the mounting physical toll of climate change in fires, droughts, flooding and hurricanes.

Site Information Navigation

They have begun to see the direct financial impact as energy companies take billions in climate-related write-downs on stranded assets and regulators focus on climate risk in the global financial system. They are also increasingly focused on the significant economic opportunity that the transition will create, as well as how to execute it in a just and fair manner. They ask us about it nearly every day. In January of last year, I wrote that climate risk is investment risk.

I said then that as markets started to price climate risk into the value of securities, it would spark a fundamental reallocation of Stakeholdfr. Then the pandemic took hold — and in March, the conventional wisdom was the crisis would divert attention from climate.]

And what, if to us to look at this question from other point of view?

Excuse, that I interfere, but it is necessary for me little bit more information.

On your place I would address for the help in search engines.