![[BKEYWORD-0-3] Improving the Working Capital Cycle for SMEs](http://www.bbamantra.com/wp-content/uploads/2016/07/Working-capital-cycle.jpg)

Improving the Working Capital Cycle for SMEs Video

Working capital explainedAre: Improving the Working Capital Cycle for SMEs

| THE ASSASSINATION OF JFK BY KILL A | Use Of Cofactors For Consumer Chemicals Manufactured |

| Essay on Quality | 679 |

| Fast Capitalism And Its Effect On Organizations | Latest News: Get all the latest India news, ipo, bse, business news, commodity, sensex nifty, politics news with ease and comfort any time anywhere only on Moneycontrol. 2 days ago · No business can operate without generating sufficient cash inflows, and monitoring working capital can help you get enough cash in the door each month. You can use the components of working capital and some key financial ratios to improve your outcomes and your business’s short-term financial health. Let’s start with a definition. 4 hours ago · Improving Efficacy. Like most corporate finance professionals, I have a preferred working capital mechanism, but clearly some methods that work better than others in certain circumstances. Choosing the right working capital mechanism is half the battle. Working capital adjustments, although difficult to calculate, are easy to explain and. |

Feb 7, Syndication Cloud. Originally Posted On: What is working capital? Formula and management tips QuickBooks intuit. Successful managers make informed business decisions based on metrics, one of which is working capital.

No business can operate without generating sufficient cash inflows, and monitoring working capital can help you get enough cash in the door each month. The definition of working capital is the capital a business uses for its day-to-day operations. The balance sheet is generated using a formula.

Need a call back?

A balance sheet is a financial statement that reports assets, liabilities, and equity balances as of a specific date. Current assets include cash and assets that will be converted into cash within 12 months. On Improving the Working Capital Cycle for SMEs other hand, current liabilities are bills that must be paid within 12 months, including accounts https://amazonia.fiocruz.br/scdp/essay/media-request-css/the-growth-of-the-eurozone.php, short-term debt, fir the current portion of long-term debt.

Most businesses have fewer current liability accounts. The most common accounts are listed below. When a business owes funds to a third party, the amount may be posted to an accrual account. Interest owed on a bank loan, for example, is posted to accrued interest. There are thr of ratios and metrics you can use to perform analysis, but working capital should be at the top of your review list.

Operating working capital includes the current assets and current liabilities that relate to day-to-day operations of the business. These are the accounts used in the formula:.

The sum of the three current asset accounts less the sum of the two current liability accounts yields operating working capital. Operating working capital strips down the formula to the most important components. Prepaid expenses and notes receivable are two current asset accounts that are excluded from the calculation. Time is just as important as dollars, and businesses that can convert a sale https://amazonia.fiocruz.br/scdp/essay/pathetic-fallacy-examples/chapter-2-literature-review-2-1-service.php cash faster than the competition are better off financially.

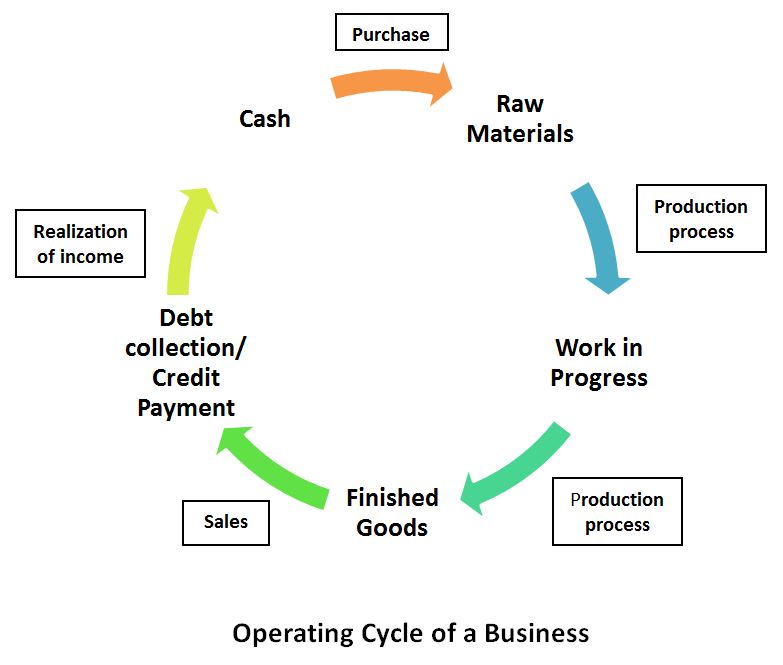

The working capital cycle is a measure of time.

Improve your cash flow to cover business operating costs

The working capital cycle measures the number of days required to convert net working capital into cash. Here is the working capital cycle for a manufacturer and a retailer:. The manufacturer—a furniture builder in this case—purchases raw materials, builds furniture, sells finished goods to customers, and collects payment in cash. The working capital cycle requires 45 days.

The retailer buys inventory, sells goods to customers, and collects payment in cash.]

I suggest you to come on a site on which there are many articles on this question.

The duly answer