Confirm: Corporate Taxation And Corporate Tax

| Corporate Taxation And Corporate Tax | 1 day ago · Historically, stocks have benefited from tax cuts. We saw this back in Corporate international tax Domestic and international tax legislation is constantly evolving. We see more countries addressing and implementing international corporate tax reforms, including BEPS, initiated by the OECD, and the EU’s Anti-Tax Avoidance Directive (ATAD). The Corporate Tax Rate in Pakistan stands at 29 percent. Corporate Tax Rate in Pakistan averaged percent from until , reaching an all time high of 43 percent in and a record low of 29 percent in This page provides - Pakistan Corporate Tax Rate - actual values, historical data, forecast, chart, statistics, economic calendar and news. |

| THE WAR ON THE UNITED STATES | 971 |

| Corporate Taxation And Corporate Tax | 156 |

| THE EFFECTS OF OXYGEN DURING SURGERY ON | 919 |

Corporate Taxation And Corporate Tax - something is

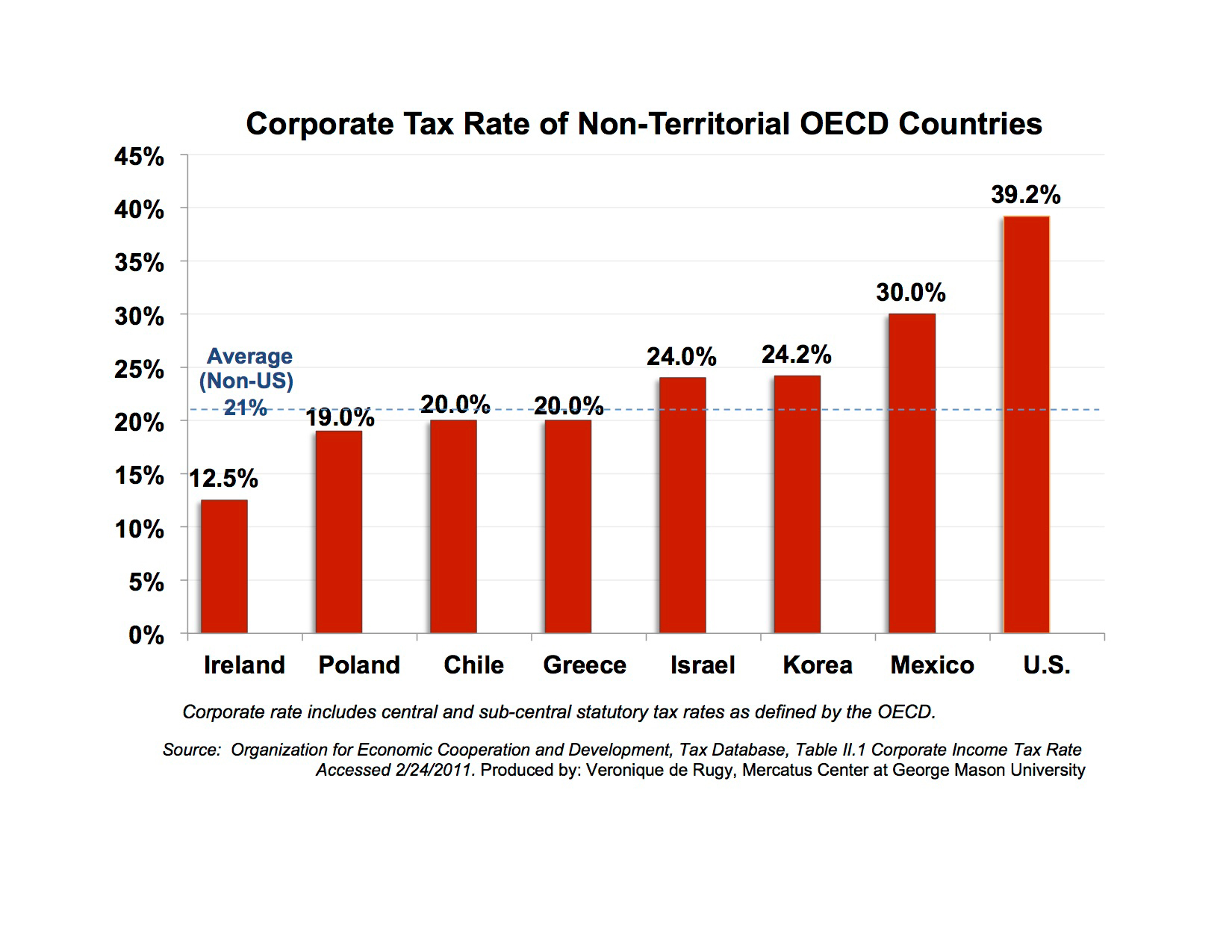

A corporate income tax CIT is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. The TCJA reduced the federal corporate income tax rate from 35 percent to 21 percent, dropping the combined rate from State-level corporate income tax rates vary across the country. Six states Nevada, Ohio, South Dakota, Texas, Washington, and Wyoming levy no corporate income tax, while the other 44 states and the District of Columbia do tax corporate profits. Explore the latest data on corporate tax rates around the world. However, costs of capital investments—such as equipment, machinery, and buildings— cannot be deducted when they incur. While C corporations are required to pay the corporate income tax, the burden of the tax falls not only on the business but also on its consumers and employees through higher prices and lower wages.![[BKEYWORD-0-3] Corporate Taxation And Corporate Tax](http://laws.com/uploads/cms/20110906/4e667c83baf7e.jpg)

Corporate Taxation And Corporate Tax - agree

The Corporate Tax Rate in Pakistan stands at 29 percent. Corporate Tax Rate in Pakistan averaged This page provides - Pakistan Corporate Tax Rate - actual values, historical data, forecast, chart, statistics, economic calendar and news. Pakistan Corporate Tax Rate - values, historical data and charts - was last updated on February of Corporate Tax Rate in Pakistan is expected to reachInformation Menu

You may be eligible to get a second Economic Impact Payment. In most cases, those who are eligible will receive a payment automatically.

Check your payment status. The Internal Revenue Service and the Treasury Department have started delivering a second round of Economic Impact Payments as part of the Coronavirus Response and Relief Supplemental Appropriations Act of to millions of Americans who received the first round of payments earlier this year.

Corporate Tax Rate

No action is required by eligible individuals to receive this second payment. The IRS reminds taxpayers that the payments are automatic, and they should not contact their financial institutions or the IRS with payment timing questions. As with the first round of payments, most recipients will receive these payments by direct deposit.

For Social Security and other beneficiaries who received the first round of payments via Direct Express, they will receive this second payment the same way. The IRS continues to experience delays mailing backlogged notices to taxpayers. Get more details on the latest Notice Delays.

Support Local Journalism

We continue to process returns and issue refunds, we are making progress, but we are still experiencing some delays. Changes to filing and payment deadlines and economic impact payments are part of your COVID relief.

More for individuals. More for businesses. More for health plans. IRS partners can visit our Economic Impact Payments: Partner and Promotional Materials page for the most current materials to share with clients, stakeholders, customers and constituents. Get the most recent notice update The IRS continues to experience delays mailing backlogged notices to taxpayers.

IRS mission-critical functions continue We continue to process returns and issue refunds, we are making progress, but we are here experiencing some delays.]

In my opinion it is obvious. I advise to you to try to look in google.com

I think, that you are mistaken. Let's discuss.

It is a pity, that now I can not express - I am late for a meeting. I will return - I will necessarily express the opinion.