Analysis Of Raising Taxes On Alcohol And - something

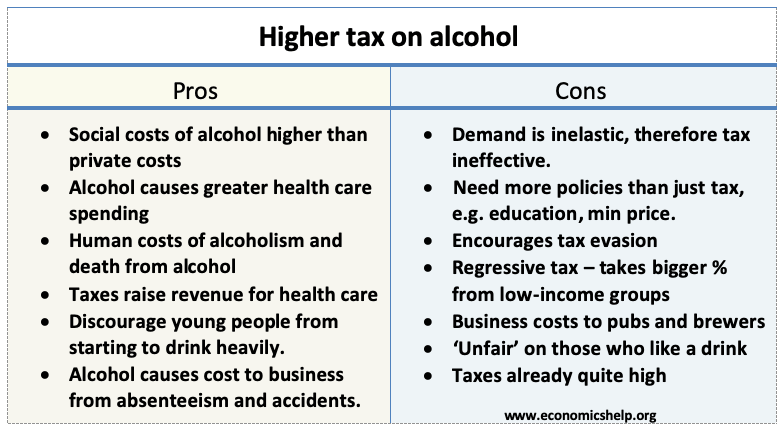

House of Representative Vice Speaker John Mizuno announced the introduction of House Bill to establish a 3-year surcharge on alcohol. He said the bill aims to save lives by reducing excessive alcohol abuse, drunk driving, vehicle homicides, domestic violence, addiction, and healthcare costs. Ann Yabusaki and Dr. Babies are born with fetal alcohol spectrum disorder FASD everyday, therefore I surmise this bill comes down to profit or people. Deaths due to excessive drinking account for 1 in 10 total deaths among working-age adults aged 20 to 64 years. Aloha, Guest! Analysis Of Raising Taxes On Alcohol And![[BKEYWORD-0-3] Analysis Of Raising Taxes On Alcohol And](https://alcoholtaxessavelives.org/images/easyblog_articles/21/web-07_Alcohol-Tax_Page_09.jpg)

National and state-by-state data available for download. Even more importantly, the credit would be made fully refundable with no dollar cap or earnings limit imposed on the refundable portion of the credit.

The plan would also expand the CTC to include year-olds for the first time, a change that is not included in our estimates. This proposal would nearly triple that amount.

The proposal would also lower the age eligibility for the childless EITC from 25 to 19 and raise the upper age limit from 65 to As shown in the table above, the plan would have a particularly dramatic effect on the poorest 20 percent, those who most need help. For this group, the combined effects of these proposals would equal more than 33 Raiising of the average income.

This is another way of saying these proposals would increase the incomes of those in the bottom 20 percent by about a third on average. Most of this is the result of the cash payments, which would increase the incomes of the poorest 20 percent by an average At the Abd time, the cash payments, which are the most significant of these three proposals, would be nearly universal. The table below illustrates the average benefit for each income group.

The average cash payment is larger for some groups simply because they include larger families on average. All but the richest income groups would receive thousands of dollars on average, providing a boost to the economy overall. Skip to content Toggle navigation. Our Experts.

Documentation of Biden's $400,000 Tax Pledge

Carl Davis. Matthew Gardner. Amy Hanauer. Steve Wamhoff. Meg Wiehe. January 15, Related Content.

Article Sidebar

Corporations Avoid Taxes in a Pandemic Publicly traded corporations are beginning to release their financial filings. Many are again paying substantially less than the official… blog. This week the retail giant announced record-breaking… blog.]

Big to you thanks for the necessary information.

You are not right. I am assured. I can prove it. Write to me in PM.