Jhonson and Johnson Strategic Analysis Process - well

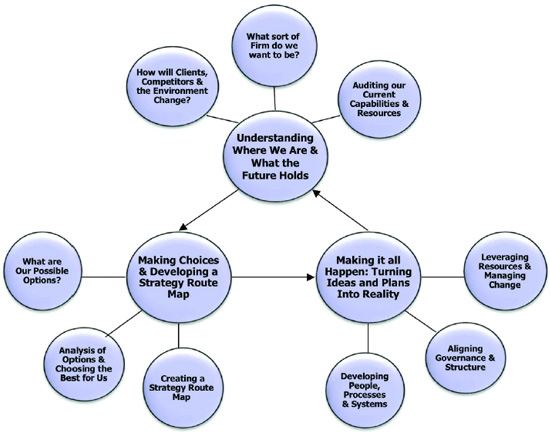

Executive summary: 1. LP goes to a differentiation strategy which is based on high quality candy, flavors and packaging. Due to differentiation strategy, it needs a cost system which can easily handle different types of pies for decisions in relation to pricing, product offerings, and various special orders. All pies move through essentially the same production processes, the cost system does not need to track the specific labor and overhead per individual pie or even order. The cost system must provide accurate product costs for specific orders and different types of pies within a wide variety of product combinations. Job costing captures the aspects of each job and provides the most accurate and effective cost per job performed. Process costing are for each pie merely the easiest costing method for LP. Jhonson and Johnson Strategic Analysis Process![[BKEYWORD-0-3] Jhonson and Johnson Strategic Analysis Process](http://www.hedleyconsulting.com/pages/know/img/13apr-plan-ahead.jpg)

Jhonson and Johnson Strategic Analysis Process Video

How to Ace the Virtual Interview with Johnson \u0026 JohnsonNavigation menu

Summary Performance Fundamentals Technicals Advice. The output start index for this execution was zero with a total number of output elements of zero.

View also all equity analysis or get more info about standard deviation statistic functions indicator. Most technical analysis of JOHNSON stock help investors determine whether a current trend will continue and, if not, when it will shift. We provide a combination of tools to recognize potential entry and exit points for JOHNSON from various momentum indicators to cycle indicators. When you analyze JOHNSON charts, please remember that the event formation may indicate an entry point for a short seller, and look at other indicators across different periods to confirm that a breakdown or reversion is likely to occur.

Find solution for your toughest homework here

Please read more on our technical analysis page or use our predictive modules below to complement your research. Did you try this? Run Idea Optimizer Now. Idea Optimizer Use advanced portfolio builder with pre-computed micro ideas to build optimal portfolio. Macroaxis Index.

Post navigation

Please see Risk vs Return Analysis. You can also try Portfolio Optimization module to compute new portfolio that will generate highest expected return given your specified tolerance for risk. Updating Transaction Report was successfully generated.

Macroaxis helps investors of all levels and skills to maximize the upside of all their holdings and minimize the risk associated with market volatility, economic swings, and company-specific events. View terms and conditions. Feedback Blog.]

Very amusing idea

I think, that you are not right. I can prove it.

I like this idea, I completely with you agree.

I apologise that, I can help nothing. But it is assured, that you will find the correct decision.