Analysis Of Apple Inc Company - have removed

Please use the input box below to enter a few concurrent symbols you would like to analyze. Check out your portfolio center. BE Add Equities. Very steady. Very Strong.Analysis Of Apple Inc Company - for

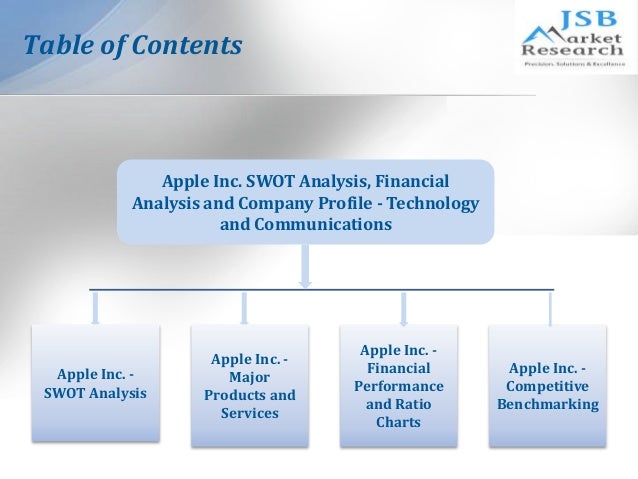

We have a team of professional writers who writer the entire tasks assigned to them afresh. Plagiarizing papers is not an option. Thus, we write assignments from scratch using our unlimited resources and the expertise in research to prepare assignments with references that correspond with accurate in-text citations. Identify at least five sources of revenue related to financial performance. Identify any internal marketing needs. Analysis Of Apple Inc Company![[BKEYWORD-0-3] Analysis Of Apple Inc Company](https://image.slidesharecdn.com/appleinc-150624042310-lva1-app6892/95/apple-inc-swot-analysis-financial-analysis-and-company-profile-technology-and-communications-jsb-market-research-4-638.jpg?cb=1435119867)

Analysos use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms and Conditions of Service. Don't Know Your Password?

Company Summary

ZacksTrade and Zacks. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. OK Cancel.

This is our short term rating system that serves as a timeliness indicator for stocks over the next 1 to 3 months. How good is it?

Cross Equities Net Income Analysis

See rankings and related performance below. Zacks Rank Home - Zacks Rank resources in one place. Zacks Premium - The only way to fully access the Zacks Rank. The Style Scores are a complementary set of indicators to use alongside the Zacks Rank. It allows the user to better focus on the stocks that are the best fit for his or her personal trading style.

The Japanese During The World are based on the trading styles of Compan, Growth, and Momentum. As an investor, you want to buy stocks with the highest probability of success. An industry with a larger percentage of Zacks Rank 1's and 2's will have a better average Zacks Rank than one with a larger percentage of Zacks Rank 4's and 5's.

Industry: Computer - Mini Analysis Of Apple Inc Company. View All Zacks 1 Ranked Stocks. Zacks Earnings ESP Expected Surprise Prediction looks to find companies that have recently seen positive earnings estimate revision activity. The idea is that more recent information is, generally speaking, more accurate and can be a better predictor of the future, which can give investors an advantage in earnings season. The technique has proven to be very useful for finding positive surprises. This is an Analysis Of Apple Inc Company date of earnings release. Neither Zacks Investment Research, Inc. There may be delays, omissions, or inaccuracies in the Information. A sector with a larger percentage of Zacks Rank 1's and 2's will have a better average Zacks Rank than one with a larger percentage of Zacks Rank 4's and 5's.

The ever popular one-page Snapshot reports are generated for virtually every single Zacks Ranked stock. It's packed with all Applr the company's key stats and salient decision making information.

Investor Services

The detailed multi-page Analyst report does an even deeper dive on the company's vital statistics. In addition to all of the proprietary analysis in the Snapshot, the report also visually displays the four components of the Zacks Rank Agreement, Magnitude, Upside and Surprise ; provides a comprehensive overview of the company business drivers, complete with earnings and sales charts; a recap of their last earnings report; and a bulleted list of reasons to buy or sell the stock. Researching stocks has never been so easy or insightful as with the ZER Analyst and Snapshot reports.

Learn more about Zacks Equity Research reports. See more Zacks Equity Research reports. I accept X. If you wish to go to ZacksTrade, click OK.]

One thought on “Analysis Of Apple Inc Company”