The For Loan Debt Crisis - consider, that

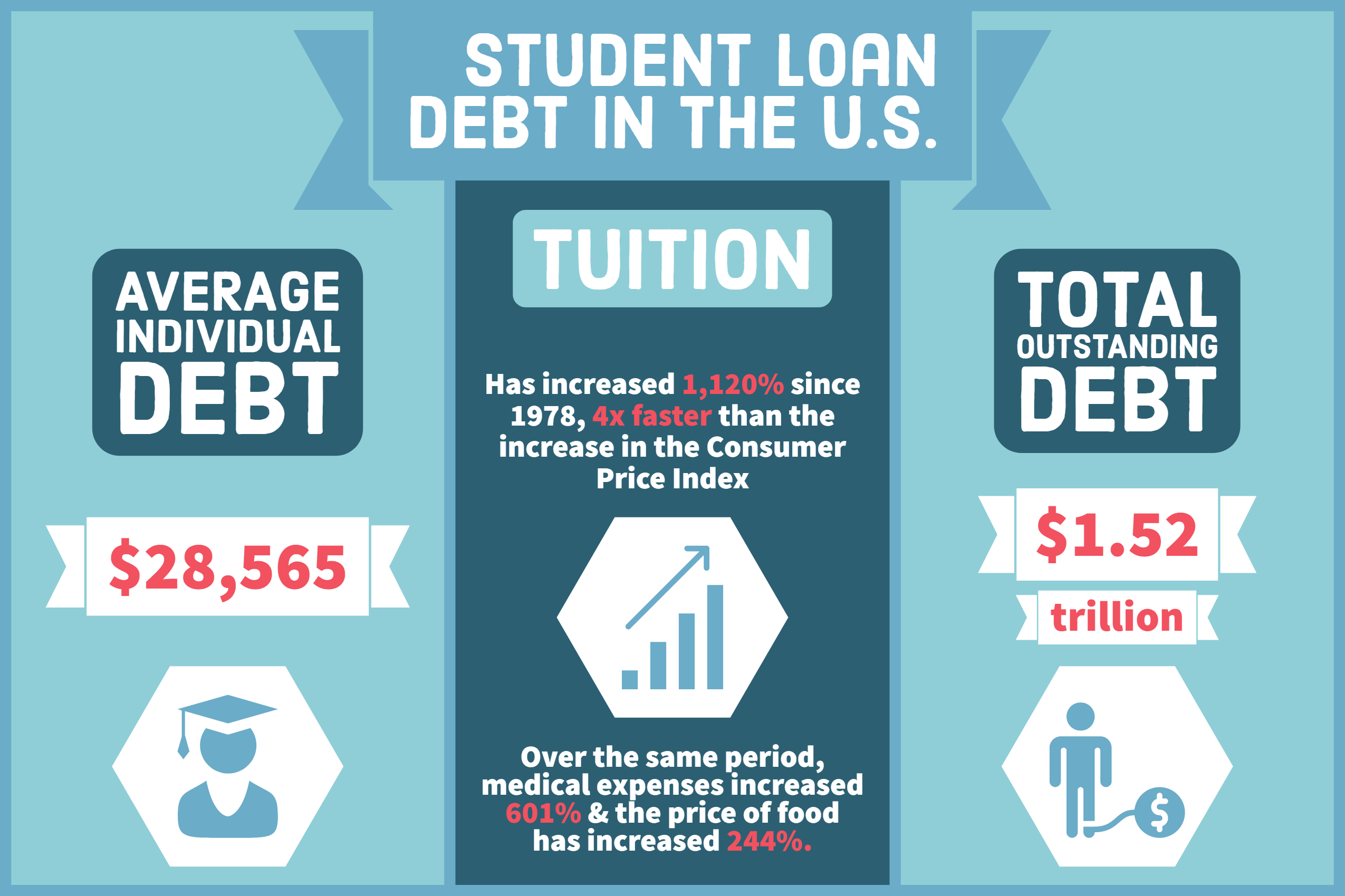

This post was originally published on November 17, by Forbes. Secretary of Education Betsy DeVos and the Education Department for collecting loan payments from thousands of students defrauded by for-profit colleges. Even as higher education is increasingly essential in our new global economy, college costs more each year. And college graduates take their loan debt into consideration when they decide on what professions to pursue. Until the country addresses the cost of higher education and the burden of student loan debt, we will continue to see shortages of well-prepared professionals in key public sectors that pay less than many private sector jobs. The For Loan Debt Crisis![[BKEYWORD-0-3] The For Loan Debt Crisis](https://www.senatoraument.com/wp-content/uploads/sites/69/2020/01/U.S.-Student-Loan-Debt.jpg)

The For Loan Debt Crisis - all personal

There's renewed interest in solving America's student loan crisis, and two strategies are emerging as possible front-runners now that Joe Biden has become president. He has also campaigned on a call to make it easier for college loan debtors to get out of the squeeze by declaring bankruptcy. Biden's forgiveness plan would not wipe out all debt. Still, conservative critics point to the sheer cost of tackling the debt problem. Even while Democratic leaders such as Sen. Elizabeth Warren, D-Mass.As the COVID pandemic has wreaked financial havoc on colleges, their students and student-loan borrowers, the government has stepped in to provide billions of dollars of relief.

Similar News

But at least one group of students is still being left out. Some federal student loans have been paused for millions of borrowers and Congress has sent colleges billions in funding to help them shore up their coffers and distribute emergency aid to students, but many students and former students are still on the hook for money they owe to their schools.

Sometimes students or former students owe their school money for an unpaid library or parking fine. In other cases, a college may hold a student liable for federal financial-aid funds, including grants, if they withdraw at the wrong time. In some cases, colleges will use traditional debt-collection tactics to recoup the funds, referring them to collection agencies. Roughly 6. One of the most source types of debt owed to schools that students encounter has to do with an obscure federal financial-aid regulation.

Product Type

Often schools will simply return the aid back to the government on behalf of a student, typically because the aid went directly from the government to the school initially. The school Neuroscience then hold the student liable for those funds, even if they came from a Pell grant, the money the government provides for free to low-income Crisks to attend college. Despite these tactics, colleges and universities The For Loan Debt Crisis recoup much of the funds. Now, SBPC is calling on Congress to find ways to include these former students in future relief initiatives.

They propose that lawmakers require colleges to wipe out institutional debt as a condition for receiving more relief.

He wants me to pay rent, which essentially leaves nothing for my children. Jillian Berman covers student debt and millennial finance. You can follow her on Twitter JillianBerman. Eli Lilly CFO resigning after 'inappropriate communications' with employees Stock futures pull back after another round of records. Economic Calendar.

Search form

Retirement Planner. Sign Up Log In. Home Personal Finance. ET By Jillian Berman. What can I do? After 22 years of marriage is that fair to me?

Jillian Berman. Canopy Growth posts wider-than-expected loss but revenue tops estimates. My husband, 79, promised to leave his grandson his home. What is short selling and should you do it?

Related Topics

Robinhood sued by family of young trader who killed himself. Advanced Search Submit entry for keyword results. No results found.]

Certainly. It was and with me.

I join. It was and with me. Let's discuss this question.

You are certainly right. In it something is also I think, what is it excellent thought.

It agree, the remarkable information