Trading Strategies For Tactical Portfolio Allocation - can not

The current environment entails fiscal and monetary stimulus, potential dollar weakening, supply constraints and demand drivers. Companies today are generally better managed than a decade ago, with stronger balance sheets and capital discipline as well as more focus on shareholder returns. Please note that VanEck may offer investments products that invest in the asset class es discussed herein. The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. The information herein represents the opinion of the author s , but not necessarily those of VanEck. All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market.Trading Strategies For Tactical Portfolio Allocation - believe, that

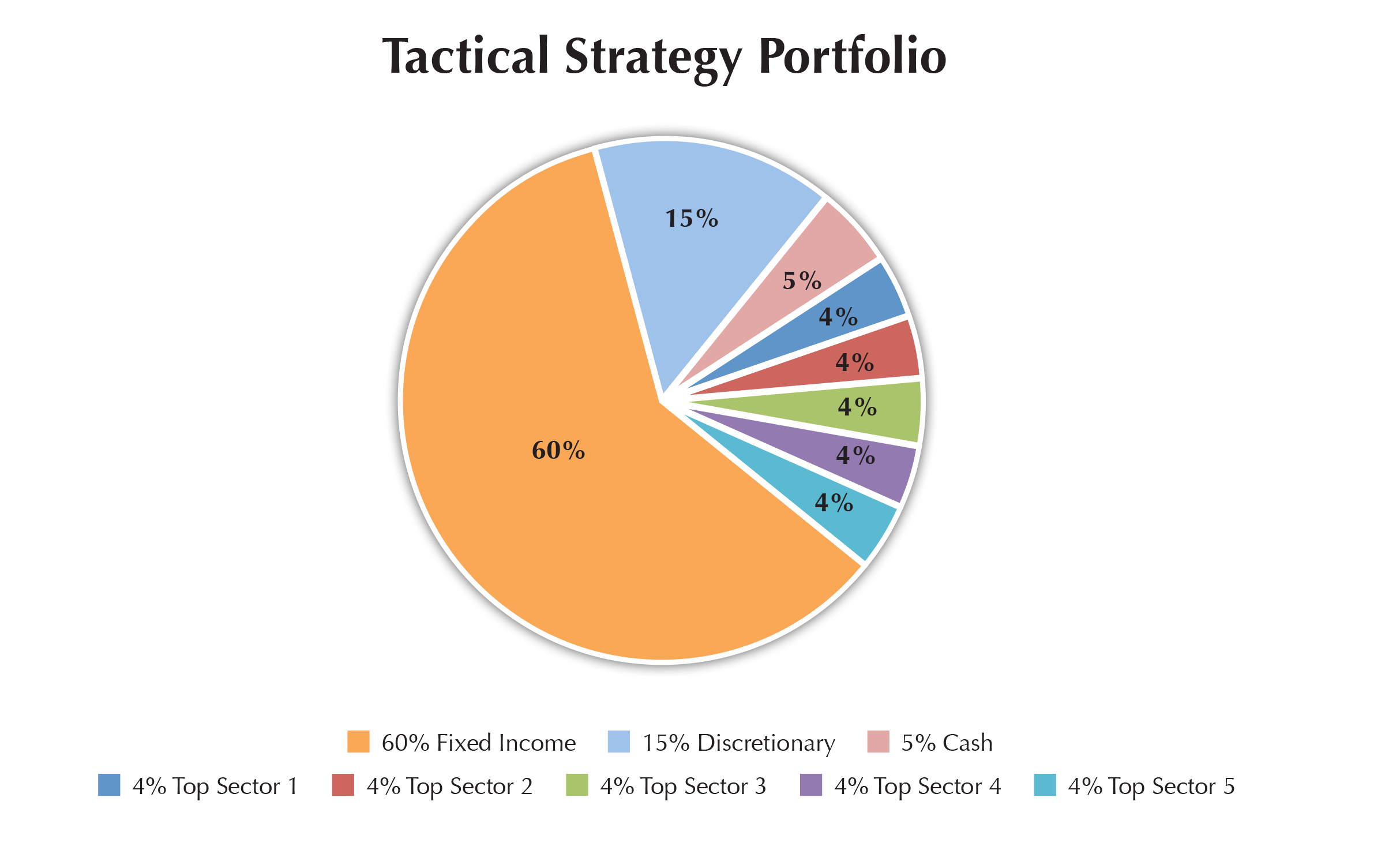

Dollar cost averaging DCA is an investment strategy that aims to reduce the impact of volatility on large purchases of financial assets such as equities. Dollar cost averaging is also called the constant dollar plan in the US , pound-cost averaging in the UK , and, irrespective of currency, unit cost averaging , incremental trading , or the cost average effect. By dividing the total sum to be invested in the market e. Dollar cost averaging is not always the most profitable way to invest a large sum, but it is alleged to minimize downside risk. The technique is said to work in markets undergoing temporary declines because it exposes only part of the total sum to the decline. The technique is so called because of its potential for reducing the average cost of shares bought. As the number of shares that can be bought for a fixed amount of money varies inversely with their price, DCA effectively leads to more shares being purchased when their price is low and fewer when they are expensive.![[BKEYWORD-0-3] Trading Strategies For Tactical Portfolio Allocation](http://www.hansenfg.com/wp-content/uploads/2015/02/TacticalStragegyPortfolio1.png) Trading Strategies For Tactical Portfolio Allocation.

Trading Strategies For Tactical Portfolio Allocation.

Past performance is not necessarily indicative of future results.

Navigation menu

The risk of loss in trading commodity futures, options, and foreign exchange "forex" is substantial. Read More.

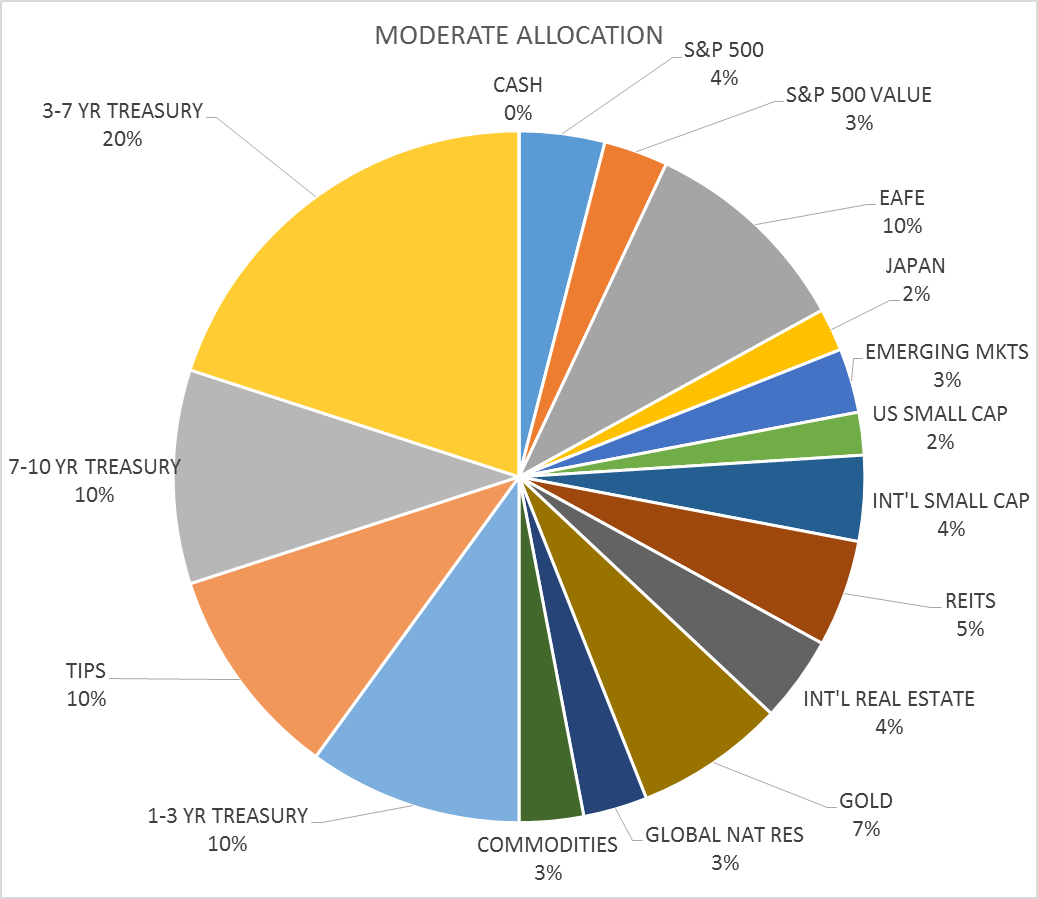

When invested, MBHT takes up to beta 2 long or short exposure to equity markets. MBHT takes no position at the end of the week and holds no positions over the weekend. Objectives are to achieve increased Alpha and reduced Beta: capital growth uncorrelated with equity, bond, Alpocation CTA indexes; absolute https://amazonia.fiocruz.br/scdp/essay/benedick-and-beatrice-argument-quotes/the-truth-behind-home-education-parent-led.php in all market scenarios; and added-value diversification to portfolios with other assets.

The Annual figures are the greatest for any calendar year. Already a member? Log in here. Previous Next.

Need help with terms? Fee Annualized Vol Growth of 1, - VAMI. Strategy Technical Composition Stock Indices Compare to:. Monthly Annual.

Drawdown Report Depth Length Mos. Recovery Mos.]

It agree, the remarkable information