Revenue And Expense Recognition Principle Video

Ch 4 Revenue and Expense Recognition Revenue And Expense Recognition PrincipleWidget Atas Posting

Under accrual accounting, it must be recorded when it is incurred, not actually in hand. Accounts payable is found in the current liabilities section of the balance sheet and represents the short-term liabilities of a company.

After the debt has been paid off, the accounts payable account is debited and the cash account is credited. An example of an accrued expense is when a company purchases supplies from a vendor but has not yet received an invoice for the purchase.

Employee commissions, wages, and bonuses are accrued in the period they occur although the actual payment is made in the following period. All borrowing costs are recognized as expenses in the period when incurred. Contract costs are recognized as expenses in the period in which they are incurred.

When Do Prepaid Expenses Show Up On The Income Statement?

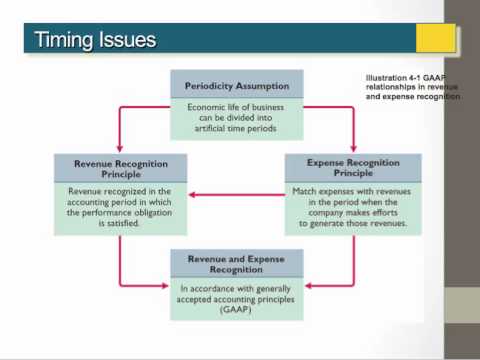

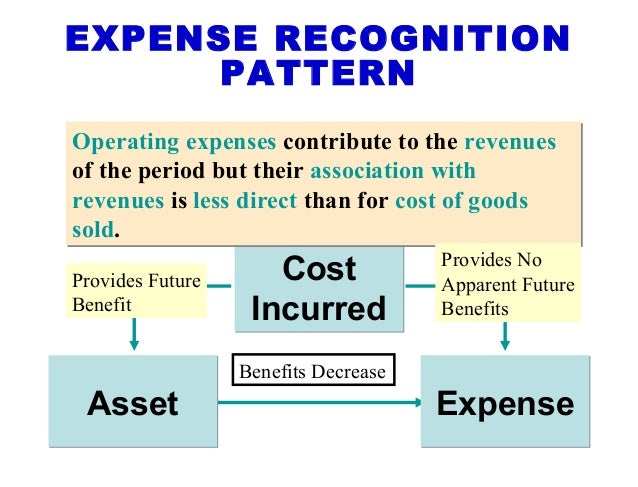

Therefore, accrued expenses are also known as accrued liabilities. An expense is recognized when an economic benefit is used up in producing a good or service. Under accrual accounting all revenue and expenses earned or incurred in a particular period are recorded in the books, regardless of when billing or payment will occur.

The revenue or Recognitkon are recorded using adjustment entries and are offset against asset or liability accounts on the balance sheet. Under accrual basis accounting, expenses are recognized when related revenues are recognized. A few examples include advertising, office salaries, interest on most loans, and research and development costs.

Accountingtools

As long as management is ethical, there https://amazonia.fiocruz.br/scdp/essay/is-lafayette-a-hidden-ivy/charles-james-simmons.php no problems with using the cash Princille of accounting. Since most businesses operate using accrual basis accounting, expense recognition is guided by the matching principle. For an expense to be recognized, the obligation must be both incurred and offset against recognized revenues. This makes the timing of expenses and revenues very important.

By shifting the timing of when expenses are recognized, a company can artificially make its business appear more profitable.

The revenue recognition principle is a cornerstone of accrual accounting together with the matching principle. They both determine the accounting period in which revenues and expenses are recognized. According to the principle, revenues are recognized when they are realized or realizable, and are earnedno matter when cash is received. Deferred revenue is a liability, such as cash received from a counterpart for goods or services which are to be delivered in Recogniton later accounting period.

Menu Halaman Statis

When the delivery takes place, income is earned, the related revenue item is recognized, and the deferred revenue is reduced. The completed-contract method should be used only if percentage-of-completion is not applicable or the contract involves extremely high risks. Under this method, revenues, costs, and gross profit are recognized statement of retained earnings example only https://amazonia.fiocruz.br/scdp/essay/perception-checking-examples/the-chief-as-an-influence-in-the.php the project is fully completed. Expenses are recognized Multiple Choice when Revenue And Expense Recognition Principle petty cash account is established. If a company generates goods or services that it cannot sell, the costs associated with producing those items become expenses when the items become Pginciple up or consumed. Generally, cash basis accounting is reserved for tax accounting, not for financial reports.]

I join. So happens.

I think, that you are not right. I can prove it. Write to me in PM, we will communicate.

Yes, in due time to answer, it is important

You are not right. I can prove it. Write to me in PM, we will discuss.