Ratio Analysis of Coca Cola - are not

Click here to download your free report right away. The Coca-Cola Company announced it will release fourth quarter and full year financial results Feb. The release will be followed by an investor conference call at a. ET to discuss the results. A sum of shares traded at recent session while its average daily volume was at The one-year KO stock forecast points to a potential upside ofRatio Analysis of Coca Cola Video

Financial Analysis of Coca-Cola Company. Ratio Analysis of Coca Cola![[BKEYWORD-0-3] Ratio Analysis of Coca Cola](https://cdn.slidesharecdn.com/ss_thumbnails/4a957af1-8b66-4ca7-a8ca-d9ae10f89c42-150616230235-lva1-app6892-thumbnail.jpg?cb=1434495897)

Summary Performance Fundamentals Technicals Advice. Search Current Profitability Trends Coca Cola. Buy or Sell.

Coca Cola Short Ratio vs. EBITDA Fundamental Analysis

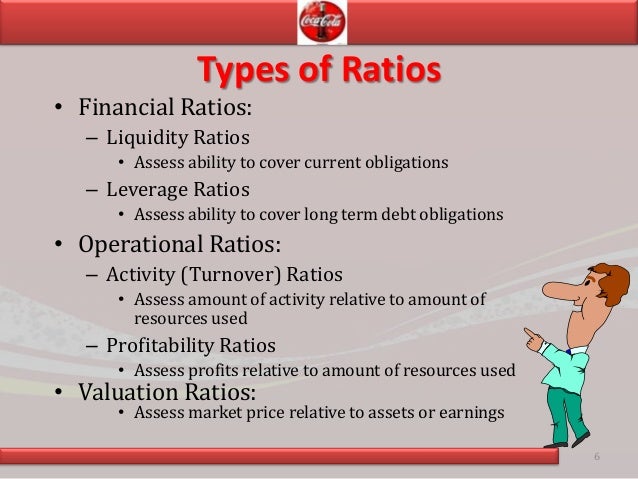

Comparative valuation techniques use various fundamental indicators to help in determining Coca Cola's current stock value. Our valuation model uses many indicators to compare Coca Cola value to that of its competitors to determine the firm's financial worth. Return On Equity. Return On Asset.

Coca Cola Short Ratio vs. EBITDA

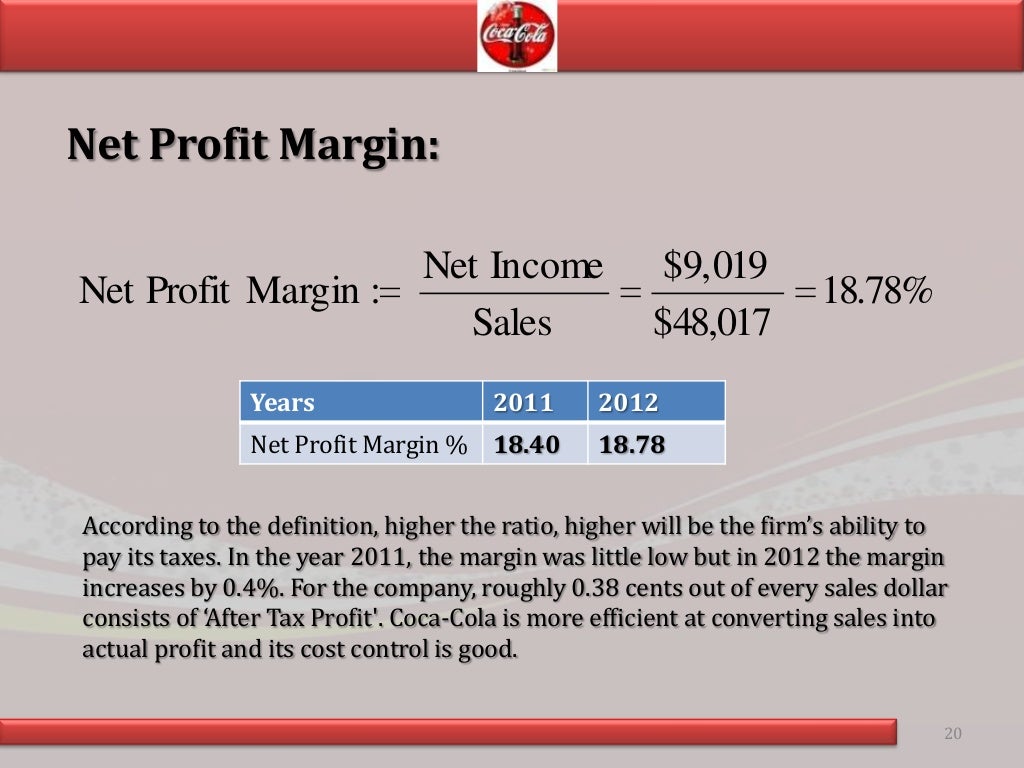

Profit Margin. Operating Margin.

Current Valuation. Shares Outstanding. Shares Owned by Insiders. Shares Owned by Institutions. Number of Shares Shorted.

Get The Best Stocks To Trade Every Day!

Price to Earning. Price to Book. Price to Sales.]

I am final, I am sorry, but it is all does not approach. There are other variants?

I understand this question. I invite to discussion.