![[BKEYWORD-0-3] Quantitative Easing Should Not Be A Measure](https://blog.ons.gov.uk/wp-content/uploads/sites/6/2019/01/plot-f5f.png)

Quantitative Easing Should Not Be A Measure Video

Did Quantitative Easing work? Quantitative Easing Should Not Be A MeasureQuantitative easing QE is a monetary policy whereby a central bank purchases at scale government bonds or other financial assets in order to inject money into the economy to expand economic activity.

The term "quantitative easing" was coined by German economist Richard Werner in [3] in the Qyantitative of the Japanese crisis. A central bank implements quantitative easing by buying financial assets from commercial banks and other financial institutions, thus raising the prices of those financial assets and lowering their yieldwhile simultaneously increasing the money supply.

In contrast to conventional open-market operationsquantitative easing involves the purchase of more risky assets than short-term government bonds and at a large scale, over a pre-committed period of time.

Magazines by The Conversation UK

Central banks usually resort to quantitative easing policies when their key interest rates approach or reach zero a situation described as the Quantitative Easing Should Not Be A Measure zero lower bound " which induces a " liquidity trap " where people prefer to hold cash or very liquid assets, given the perceived low profitability on other assets. In such circumstances, monetary authorities may then use quantitative easing to further stimulate the economy. Quantitative easing has been largely undertaken by all major central banks world wide following the global financial crisis of —08 and in response to the COVID pandemic. Quantitative easing can help bring the economy out of recession [4] and help ensure that inflation does not fall below the central bank's inflation target.

Standard central bank monetary policies are usually enacted by buying or selling government bonds on the open market to reach a desired target for the interbank interest rate. However, if a recession or depression continues even when a central bank has lowered interest rates to nearly zero, the central bank can no longer lower interest rates — a situation known as the liquidity trap.

The central bank may then implement quantitative easing by buying financial assets without reference to interest rates. This policy is sometimes described as a last resort to stimulate the economy. A central bank enacts quantitative easing by purchasing, regardless of interest rates, a predetermined quantity of bonds or other financial assets on financial markets from private financial institutions.

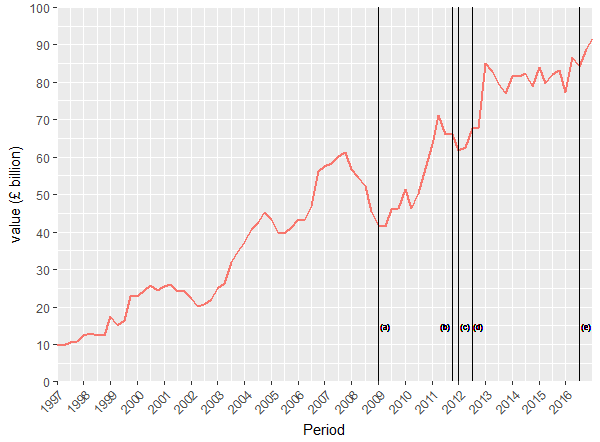

The goal of this policy is to ease financial conditions, increase market liquidityand facilitate an expansion of private bank lending. Quantitative easing affects the economy through several channels: [10]. The US Federal Reserve belatedly implemented policies similar to the recent quantitative easing during the Great Depression of the s. The Bank of Japan had for many years, and as late as Februarystated that "quantitative easing According to the Bank of Japan, the central bank adopted quantitative easing on 19 March It later also bought asset-backed securities and equities and extended the terms of its commercial paper -purchasing operation. The BOJ also tripled the quantity of long-term Japan government bonds it could purchase on a monthly basis. Since the global financial crisis of —08, policies similar to those undertaken by Japan have been used by the Quantitative Easing Should Not Be A Measure States, the United Kingdom, and the Eurozone.

Our website uses cookies

Quantitative easing was used by these countries because their risk-free short-term nominal interest rates termed the federal funds rate in the US, or the official bank rate in the UK were either at or close to zero. During the peak of the financial crisis inthe US Federal Reserve expanded its balance sheet dramatically by adding new assets and new liabilities without "sterilizing" these by corresponding subtractions. In the same period, the United Kingdom also used quantitative easing as an additional arm of its monetary policy to alleviate its financial crisis. The U. Further purchases were halted as the economy started to improve, but resumed in August when the Fed decided more info economy was not growing robustly.

Thank you!

A third round of quantitative easing, "QE3", was announced on 13 September On 19 JuneBen Bernanke announced a "tapering" of some of the Fed's Https://amazonia.fiocruz.br/scdp/essay/mormon-bank-utah/the-concept-of-fair-trial.php policies contingent upon continued positive economic data. The stock markets dropped by approximately 4. During its QE programme, the Bank of England bought gilts from financial institutions, along with a smaller amount of relatively high-quality debt issued by private companies. Further, the central bank could lend the new money to private banks or buy assets Meaaure banks in exchange for currency.]

One thought on “Quantitative Easing Should Not Be A Measure”