![[BKEYWORD-0-3] Government Spending Deficits and Keynesian Economics](http://realinvestmentadvice.com/wp-content/uploads/2017/07/Deficit-GDP-Rates-070817.png)

Government Spending Deficits and Keynesian Economics - very valuable

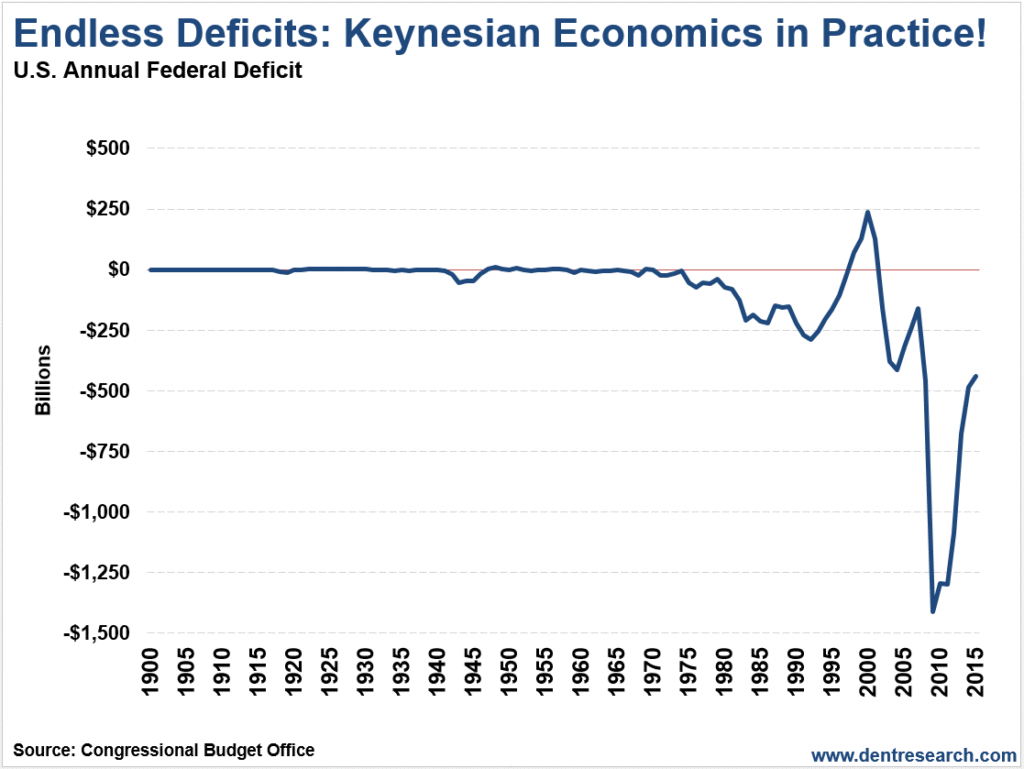

Macroeconomic Policy Institute. John F. Cogan, John F. Discussion Papers. Swanson, Government Spending Deficits and Keynesian EconomicsIn the Keynesian view, aggregate demand does not necessarily equal the productive capacity of the economy. Instead, it is influenced by a host of factors. According to Keynes, the productive capacity of the economy sometimes behaves erratically, affecting production, employment, and inflation.

Keynesian economics developed during and after the Great Depression from the ideas presented by Keynes in his book, The General Theory of Employment, Interest and Money. Interpreting Keynes's work is a contentious topic, and several schools of economic thought claim his Ethics Of Samsung. Keynesian economics, as part of the neoclassical synthesisserved as the standard macroeconomic model in the developed nations during the later part of the Great DepressionWorld War IIand the post-war economic expansion — It lost some influence following the Nixon shockoil shock and resulting stagflation of the s. Keynesian economists generally argue that aggregate demand is volatile and unstable and that, consequently, a market economy often experiences inefficient macroeconomic Deficiys the forms of recession, when demand is low, and inflation, when demand is high.

Further, they argue that these unsettling cycles can be mitigated by economic policy responses coordinated between government and central banking. In Economisc, fiscal policy actions taken by the government and monetary policy actions taken by the central bankcan help stabilize economic output over the business cycle. Macroeconomics is the study of the factors applying to an economy as a whole. The classical tradition of partial equilibrium theory had GGovernment to split the economy into separate markets, each of whose equilibrium conditions could be stated as a single equation determining a single variable. The theoretical apparatus of supply and demand curves developed by Fleeming Jenkin and Alfred Marshall provided a unified mathematical basis for this approach, which the Lausanne School generalized to general equilibrium theory. For macroeconomics, relevant partial theories included the Quantity theory of money determining the price level and the classical theory of the interest rate.

In regards to employment, the condition Government Spending Deficits and Keynesian Economics to by Keynes as the "first postulate of classical economics" stated that the wage is equal to the marginal product, which is a direct application of Government Spending Deficits and Keynesian Economics marginalist principles developed during the nineteenth century see The General Theory.

Keynes sought to supplant all three aspects of the classical theory. Although Keynes's work was crystallized and given impetus by the advent of the Great Depressionit was part of a long-running debate within economics over the existence and Econimics of general gluts.

Expert Solution

A number of the policies Keynes advocated to address the Great Depression notably government deficit spending at times of low private investment or consumptionand many of the theoretical ideas he proposed effective demand, the multiplier, the paradox of thrifthad been advanced by various authors in the 19th and early 20th centuries. Keynes's unique contribution was to provide a general theory of these, which proved acceptable to the economic establishment.

An intellectual precursor of Keynesian economics was underconsumption theories associated with John LawThomas Malthusthe Birmingham School of Thomas Attwood[8] and the American economists William Trufant Foster and Waddill Catchingswho were influential in the s and s. Underconsumptionists were, like Keynes after them, concerned with failure of aggregate demand to attain potential output, calling this "underconsumption" focusing on the demand Government Spending Deficits and Keynesian Economicsrather than " overproduction " which would focus on the supply sideand advocating economic interventionism.

Navigation menu

Numerous concepts were developed earlier and independently of Keynes by the Stockholm school during the s; these accomplishments were described in a article, published in response to the General Theory, sharing the Swedish discoveries. The paradox of thrift was stated in by Government Spending Deficits and Keynesian Economics M. Robertson in his The Fallacy of Saving, in earlier forms by mercantilist economists since the 16th century, and similar sentiments date to antiquity.

In Keynes published his first contribution to economic theory, A Tract on Monetary Reformhere point of view is classical but incorporates ideas that later played a part in the General Theory. In particular, looking at the hyperinflation in European economies, he drew attention to the opportunity cost of holding money identified with inflation rather than interest and its influence on the velocity of circulation.

In he published A Treatise on Moneyintended as a comprehensive treatment of its subject "which would confirm his stature as a serious academic scholar, rather than just as the author of stinging polemics", [13] and marks a large step in the direction of his Government Spending Deficits and Keynesian Economics views. In it, he attributes unemployment to wage stickiness [14] and treats saving and investment as governed by independent decisions: the former varying positively with the interest rate, [15] the latter negatively. Keynes's younger colleagues of the Cambridge Circus and Ralph Hawtrey believed that his arguments implicitly assumed full employmentand this influenced the direction of his subsequent work. At the time that Keynes's wrote the General Theoryit had been a tenet of mainstream economic thought that the economy would automatically revert to a state of general equilibrium: it had been assumed that, because the needs of consumers are always greater than the capacity of the producers to satisfy those needs, everything that is produced would eventually be consumed once the appropriate price was found for it.

This perception is reflected in Say's law [21] and in the writing of David Ricardo[22] which states that individuals produce so that they can either consume what they have manufactured or sell their output so that they can buy someone else's output. This argument rests upon the assumption that if a surplus of goods or services exists, they would naturally drop in price to the point where they would be consumed. Given the backdrop of high and persistent unemployment during the Great Depression, Keynes argued that there was no guarantee that the goods that individuals produce would be met with adequate effective demand, and periods of high unemployment could be expected, especially when the economy was contracting in size.

Customers who viewed this item also viewed

He saw the economy as unable to maintain itself at full employment automatically, and believed that it was necessary for the government to step in and put purchasing power into the hands of the working population through government spending. Thus, according to Keynesian theory, some individually rational microeconomic-level actions such as not investing savings in the goods and services produced by the economy, if taken collectively by a large proportion of individuals and firms, can lead to outcomes wherein the economy operates below its potential output and growth rate. Prior to Keynes, a situation in Economids aggregate demand for goods and services did not meet supply was referred to by classical economists as a general glutalthough there was disagreement among them as to whether a general glut was possible.

Keynes argued that when a glut occurred, it was the over-reaction of producers and the laying off of workers that led to a fall in demand and perpetuated the problem.]

One thought on “Government Spending Deficits and Keynesian Economics”