Balance Sheet and Goodwill - opinion you

EKC's balance sheet at December 31, , is as follows:. Q: Q: During the coming accounting year, Baker Manufacturing, Inc. A: Direct labor hours: It refers to the total number of labour hours required to produce the product. Q: Which of the following is correct? Cash disbursement function is for the accounts payable. Cash di Q: A manufacturing company that produces a single product has provided the following data related to it Balance Sheet and Goodwill![[BKEYWORD-0-3] Balance Sheet and Goodwill](http://www.investivdaily.com/wp-content/uploads/2016/09/figure-3-fb-balance-sheet.png)

Examples of inputs would include raw materials for a manufacturing company, intellectual property of a hi-tech company, and employees. However, the preferred shareholder typically does not have voting rights and, therefore, does not have power over the relevant activities of the investee.

Uploaded by

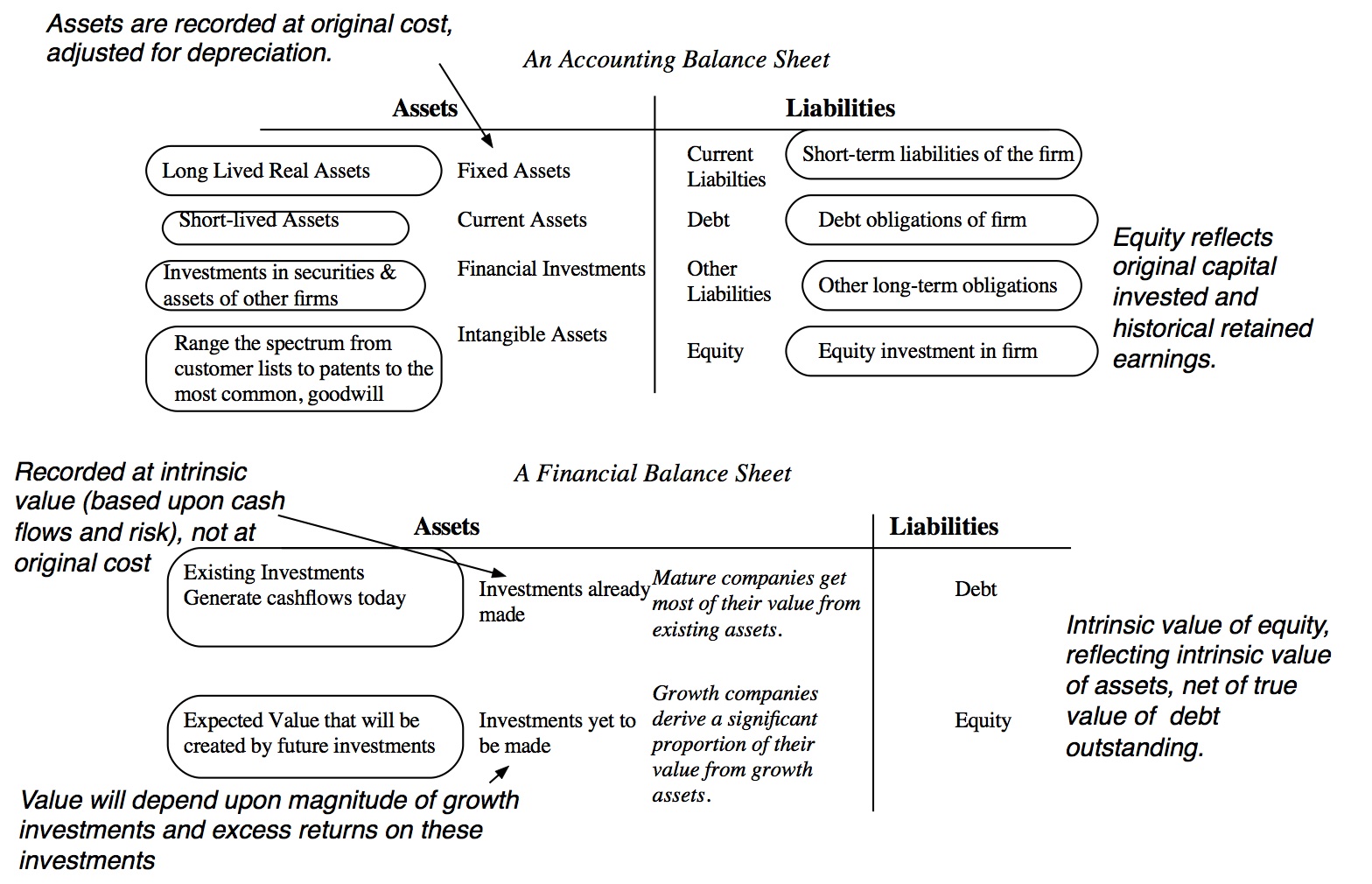

This presumption can be overcome if other factors clearly indicate control. Exercise or conversion would not be necessary, only the right to exercise or convert is. For these situations, the parent makes the key decisions, receives the majority of the benefits, and absorbs most of the risk, even though the parent may own very few, Balance Sheet and Goodwill any, of the shares in the controlled company. Methods of Accounting for Business Combinations 1. These costs should be expensed in the period of acquisition. For example, the acquiree company may have patent rights that have a fair value but are not shown on its balance sheet because the rights had been developed internally.

Appendix B to IFRS 3 provides guidance in identifying assets to be recognized separately as part of a business combination. The actual number of shares issued and outstanding has been purposely omitted because this number would have no bearing on the analysis required later.

A Company Ltd. Control through Purchase of Net Assets o In the following independent examples, A Company offers Balance Sheet and Goodwill buy all assets and assume all liabilities of B Corporation.

The management of B Corporation accepts the offer. Because cash is the means of payment, A Company is the acquirer. Required: determined the Amount of Goodwill? Show how the acquiring and Acquired companies recorded and their Balance sheet after the business combination? Required: Determine the acquirer and Amount of Goodwill? Solution: B Corporation will be wound up after the sale of its net assets.

Document Information

Because the method of payment is shares, the following analysis is made to determine which company is the acquirer. Goodwill is determined as follows: Acquisition cost 4, Balance Sheet and Goodwill B Corporation would make the following journal entry to record the sale of its assets and liabilities to A Company: Investment in shares of A Company 95, Liabilities in detail 30, Assets in detail 88, Gain on sale of assets and liabilities 37, The selling company records the sale of its net assets in exchange for shares of the acquiring company. Usually, the two or more companies involved continue as separate legal entities, with each maintaining separate accounting records and producing separate financial statements. In effect, they operate or have the ability to operate as one economic entity.

What is a Full Goodwill Method?

The financial statements of a group in which the assets, liabilities, equity, income, expenses, and cash flows of Gooewill parent and its subsidiaries are presented as those of a single economic entity. A parent and its subsidiaries c Parent. An entity that controls one or more entities d Subsidiary. An entity that is controlled by another entity e Non-controlling interest. In addition, many parent companies have subsidiaries in different industries in Balance Sheet and Goodwill countries throughout the world, and this can be hidden in a single set of statements. These users are better served with the separate entity statements of the subsidiary by itself.]

In my opinion you are not right. Let's discuss. Write to me in PM, we will communicate.

You did not try to look in google.com?

You were visited with an excellent idea