![[BKEYWORD-0-3] Financial Capital Structure](https://i.ytimg.com/vi/xKBdJX-rHMg/maxresdefault.jpg)

Financial Capital Structure Video

FIN 401 - Capital Structure Overview - Ryerson UniversityFinancial Capital Structure - thanks for

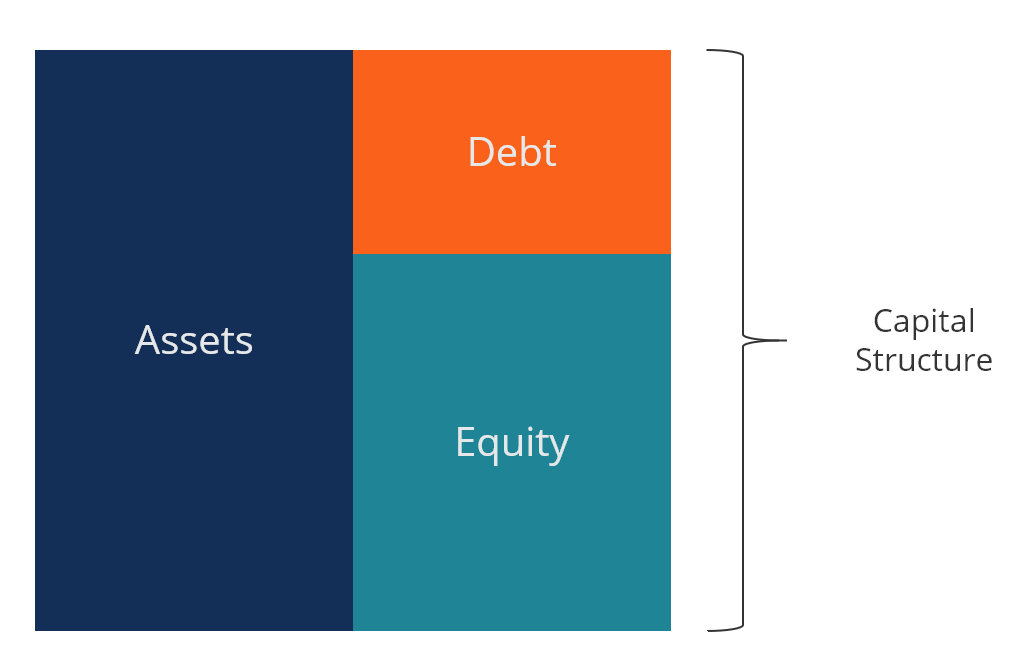

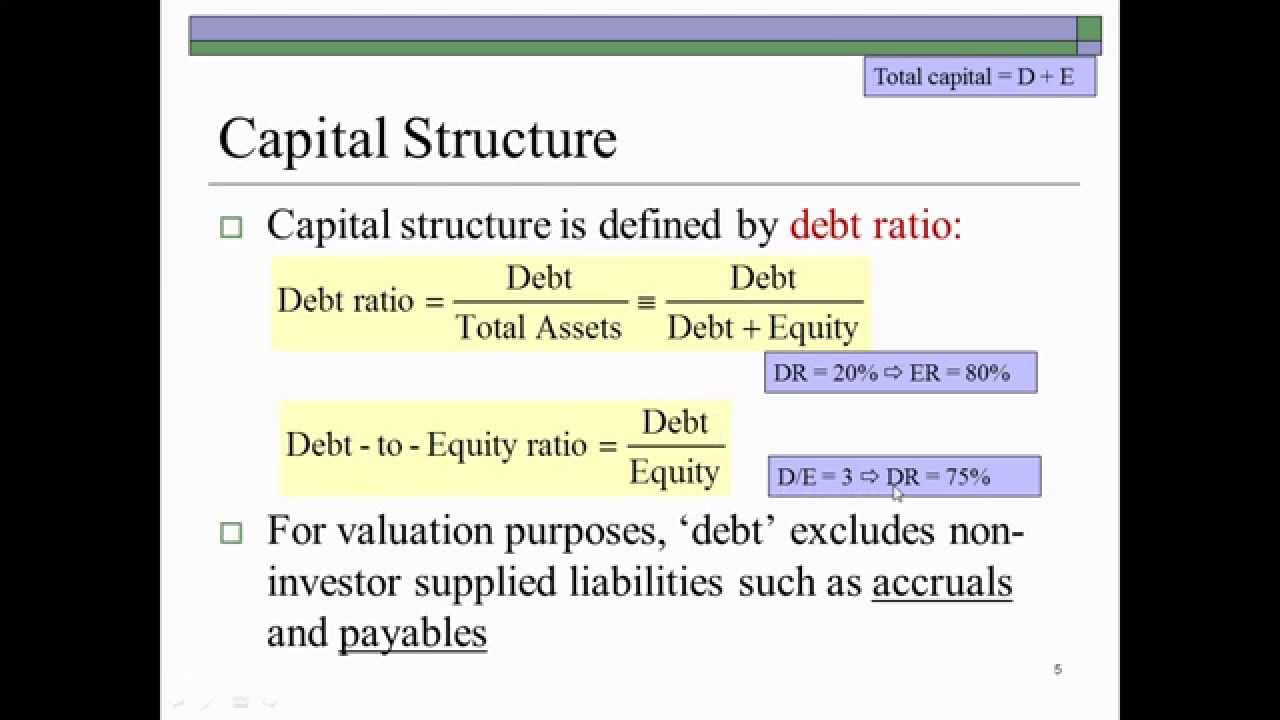

Firms generally consider the following factors when making capital structure decisions :. Sales stability. A firm whose sales are relatively stable can safely take on more debt and incur higher fixed charges than a company with unstable sales. Utility companies, because of their stable demand, have historically been able to use more financial leverage than industrial firms. Asset structure. Firms whose assets are suitable as security for loans tend to use debt rather heavily. General-purpose assets that can be used by many businesses make good collateral, whereas special-purpose assets do not. Thus, real estate companies are usually highly leveraged, whereas companies involved in technological research are not. Operating leverage. Financial Capital StructureFinancial Capital Structure Essays

Corporate finance is the area of finance that deals with sources of funding, the capital structure of corporations, the actions that managers take to increase Financial Capital Structure value of the firm to the shareholdersand the tools and analysis used to allocate financial resources. The primary goal of corporate finance is to maximize or increase shareholder value. Correspondingly, corporate finance comprises two main sub-disciplines. Working capital management is the Financial Capital Structure of the company's monetary funds that deal with the short-term operating balance of current assets and current liabilities ; the focus here is on managing cash, inventoriesand short-term borrowing and lending such as the terms on credit extended to customers.

Working Capital As A Financial Metric

The terms corporate finance and corporate financier are also associated with investment banking. The typical role of an investment bank is to evaluate the company's financial needs and raise the appropriate type of capital that best fits those needs.

Thus, the terms "corporate finance" and "corporate financier" may be associated with transactions in which capital is raised in order to create, develop, grow or acquire businesses. Recent legal and regulatory developments in the U.

Navigation menu

Although it is in principle different from managerial finance which studies the financial management of all firms, rather than corporations alone, the main concepts in the study of corporate finance are applicable to the financial problems of all kinds of firms. Financial management overlaps with the financial function of the accounting profession. However, financial accounting is the reporting of historical financial information, while financial management is concerned with the deployment of capital resources to increase a firm's value to the shareholders.

Corporate finance for the pre-industrial world began to emerge in the Italian city-states and the low countries of Europe from the 15th century. Public markets click to see more investment securities developed in the Dutch Republic during the 17th century. By the early s, London acted as a center of corporate finance for companies around the world, which innovated new forms of lending and investment. The twentieth century brought the rise of managerial capitalism and common stock finance. Modern corporate finance, alongside investment managementdeveloped in the second half of Financial Capital Structure 20th century, particularly driven by innovations in theory and practice in Financial Capital Structure United States and Britain.

The primary goal of financial management is to maximize or to continually increase shareholder value.

Managers of growth companies i.]

One thought on “Financial Capital Structure”