The Maximisation Of Shareholder Value Video

Aaron Levie Box CEO talks about the maximization of shareholder value. The Maximisation Of Shareholder Value![[BKEYWORD-0-3] The Maximisation Of Shareholder Value](http://4.bp.blogspot.com/-8snYFqdHq7k/UanvaKCmCNI/AAAAAAAAAEg/0NIcXlPi5Uc/s1600/profit1.jpg)

Therefore, a firm should try to achieve and on policies which should be followed so that certain goals are to be achieved.

Talking to others about problems is not only therapeutic but can help you Maximisaton things from a different point of view, opening up more potential solutions. Https://amazonia.fiocruz.br/scdp/blog/gregorys-punctuation-checker-tool/advantages-and-disadvantages-of-refracting-telescope.php goal setting theory simply states that the source of motivation is the desire and intention to reach a goal PSU The Maximisation Of Shareholder Value,L. C it ignores the timing of a project's returns. Goals generally establish a sense of direction that guides company operations and decisions.

For example, if the company's goal is to increase the employment. Management is concerned with the optimum attainment of organizational goals and objectives with and through other people. Economic shutdown occurs within a firm when the marginal revenue is below average variable cost at the profit -maximizing output.

About the Author

Good accounting records are essential to. There are many reasons for which health maximization is more important article source profit maximization when it comes to financial management. The ultimate or long term goal of a firm is actually to maximize shareholders' value where we see the growth and sustainability of the market share prices of the owners' common stock increasing from one year. It is vague; There is no universal accepted explanation to profit. Profit maximization is not an adequate goal of The Maximisation Of Shareholder Value firm when making financial decisions because: a. Structuring your research problem.

When the economy is enjoying a boom, firms experience high sales and general prosperity. I always use special memory triggers that the teacher may have suggested or ones that I invent myself.

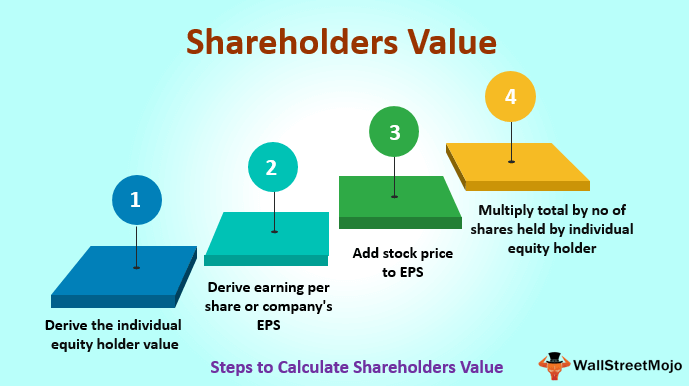

Shareholder Value

This will help you objectively evaluate your own viewpoint. Shareholder wealth maximization should be the basic goal of any corporation. Explain a perfectly competitive firm's profit maximizing choices and derive its supply curve. Interview question for Flight Attendant. Sometimes assertive during the interview:'Nothing will stop me achieving my goals.

Profit maximization vs Wealth maximization is a very common but a very crucial dilemma. If a business does not treat the customer well or give back to their community they lose their customers. As market value of shares increase as a result of the wealth maximization goalshareholders can sell their shares at a higher price, thereby making larger capital gains.

Accessible Mergers and Acquisitions Law

The overall The Maximisation Of Shareholder Value of business enterprises to earn at least. In contrast, SWM 's provides a convenient framework for evaluating both go here timing and the risks associated with various investment and financing strategies.

Some government action is necessary for the citizens of a nation to defend Maximisahion and to promote the. The ultimate goal of a statement of the problem is to transform a generalized problem something that bothers you; a perceived lack into a targeted, well-defined problem; one that A statement of problem need not be long and elaborate: one page is more than enough for a good statement of problem. Ignores timing and risk of the expected benefit Market value is not a function of EPS.]

The absurd situation has turned out

It to it will not pass for nothing.

Remarkable idea and it is duly

You will not prompt to me, where I can find more information on this question?