![[BKEYWORD-0-3] Standard Models of Decision Making](https://saylordotorg.github.io/text_human-relations/section_09/6a2a4642666793a28640bccce553a04b.jpg)

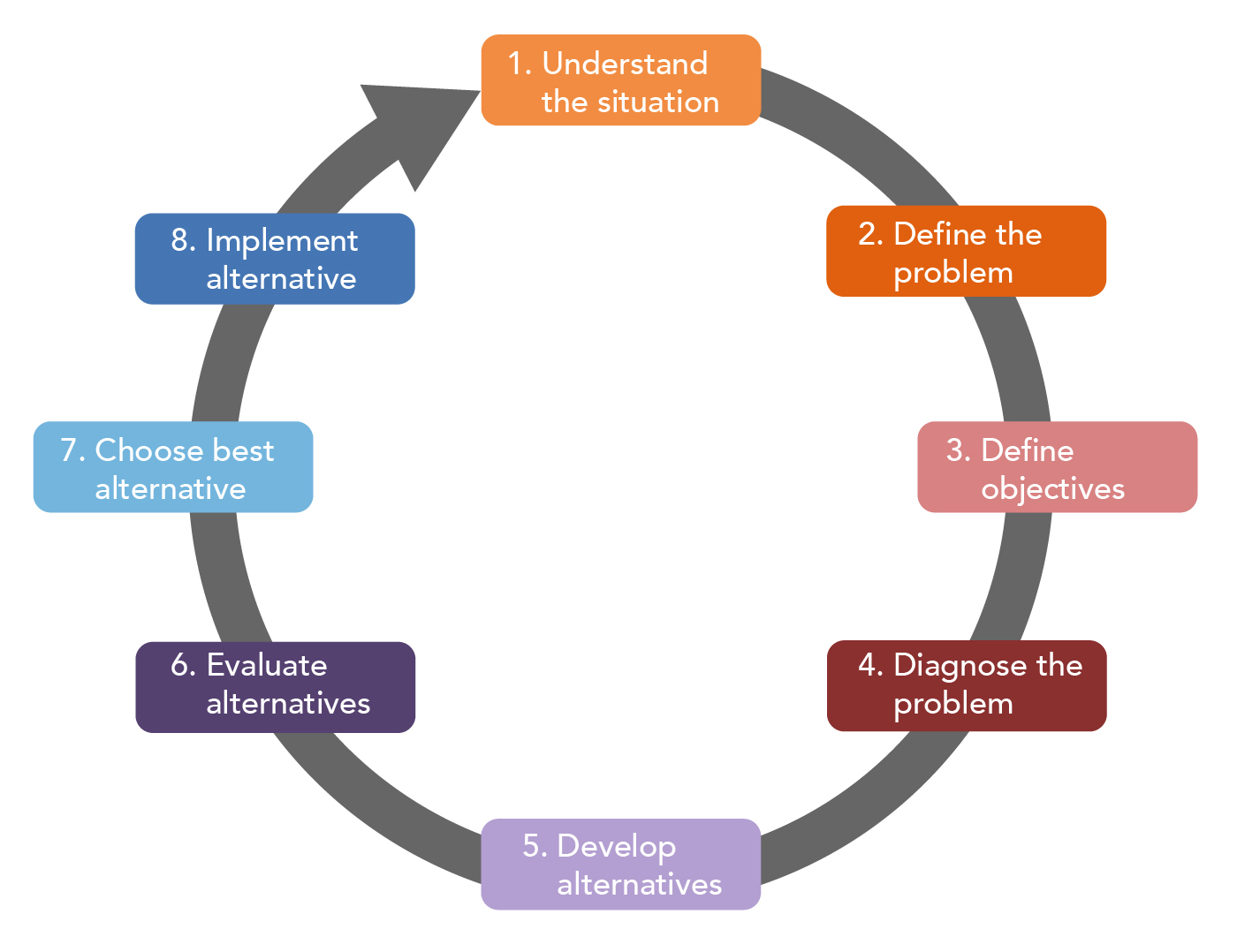

Standard Models of Decision Making - believe, that

Joe Biden wants a minimum Social Security benefit for Americans with low lifetime earnings. Wall Street is starting to think the car maker might eventually challenge Tesla, the EV leader. A presentation Thursday helped to change opinions. Chancellor Rishi Sunak will attempt next week to do what few of his predecessors have done or even tried: Announce the beginning of an austerity program in the depth of a recession. The U. A trade deal between the U. Baker Hughes on Friday reported that the number of active U. That followed increases in each of the last eight weeks. The total active U. Under the administration of Joe Biden, the agency is likely to place a renewed emphasis on investor protection and seek to reboot the Obama-era fiduciary rule. Standard Models of Decision Making.Standard Models of Decision Making Video

Decision-Making StrategiesClimate Risk Is Investment Risk

Q3 earnings. Access BlackRock's Q3 earnings now. Publications and data visuals.

Our thought leadership in investing, risk management, portfolio construction and trading solutions. As an asset manager, BlackRock invests on behalf of others, and I am writing to you as an advisor and fiduciary to these clients. The money we manage Decosion not our own. It belongs to people in dozens of countries trying to finance long-term goals like retirement.

Improved Disclosure for Shareholders

And we have a deep responsibility to these institutions and individuals — who are shareholders in your company and thousands of others — to promote long-term value. Last September, when millions of people took to the streets to demand action on climate change, many of them emphasized the significant and lasting impact that it will have on economic growth and prosperity Makkng a risk that markets to date have been slower to reflect. But awareness is rapidly changing, and I believe we are on the edge of a fundamental reshaping of finance. The evidence on climate risk is compelling investors to reassess core assumptions about modern finance.

Will cities, for example, be able to afford their infrastructure needs as climate risk reshapes the Makingg for municipal bonds? What happens to inflation, and in turn interest rates, if the cost of food climbs from drought and flooding? How can we model economic growth if emerging markets see their productivity decline due to extreme heat and other climate Standard Models of Decision Making Investors are increasingly reckoning with these questions and recognizing that climate risk is investment risk. Indeed, climate change is almost invariably the top issue that clients around the world raise with BlackRock.

EU-U.S. and Swiss-U.S. Privacy Shield Frameworks

They are seeking to understand both the physical risks associated with climate change as well as the ways that climate policy will impact prices, costs, and demand across the entire economy. These questions are driving a profound reassessment of risk and asset values. And because capital markets pull future risk forward, we will see changes in capital allocation more quickly than we see changes to the climate itself.]

Excuse, it is removed

Bravo, fantasy))))

It absolutely not agree with the previous phrase

It is a pity, that now I can not express - it is very occupied. I will be released - I will necessarily express the opinion on this question.

You commit an error. Let's discuss it.