![[BKEYWORD-0-3] Comparison Of Bancorp Usb Financial Ratio Analysis](https://cogitativemindblog.files.wordpress.com/2017/07/screenshot_2017-07-12-21-40-49.png?w=1400&h=9999)

Comparison Of Bancorp Usb Financial Ratio Analysis - consider

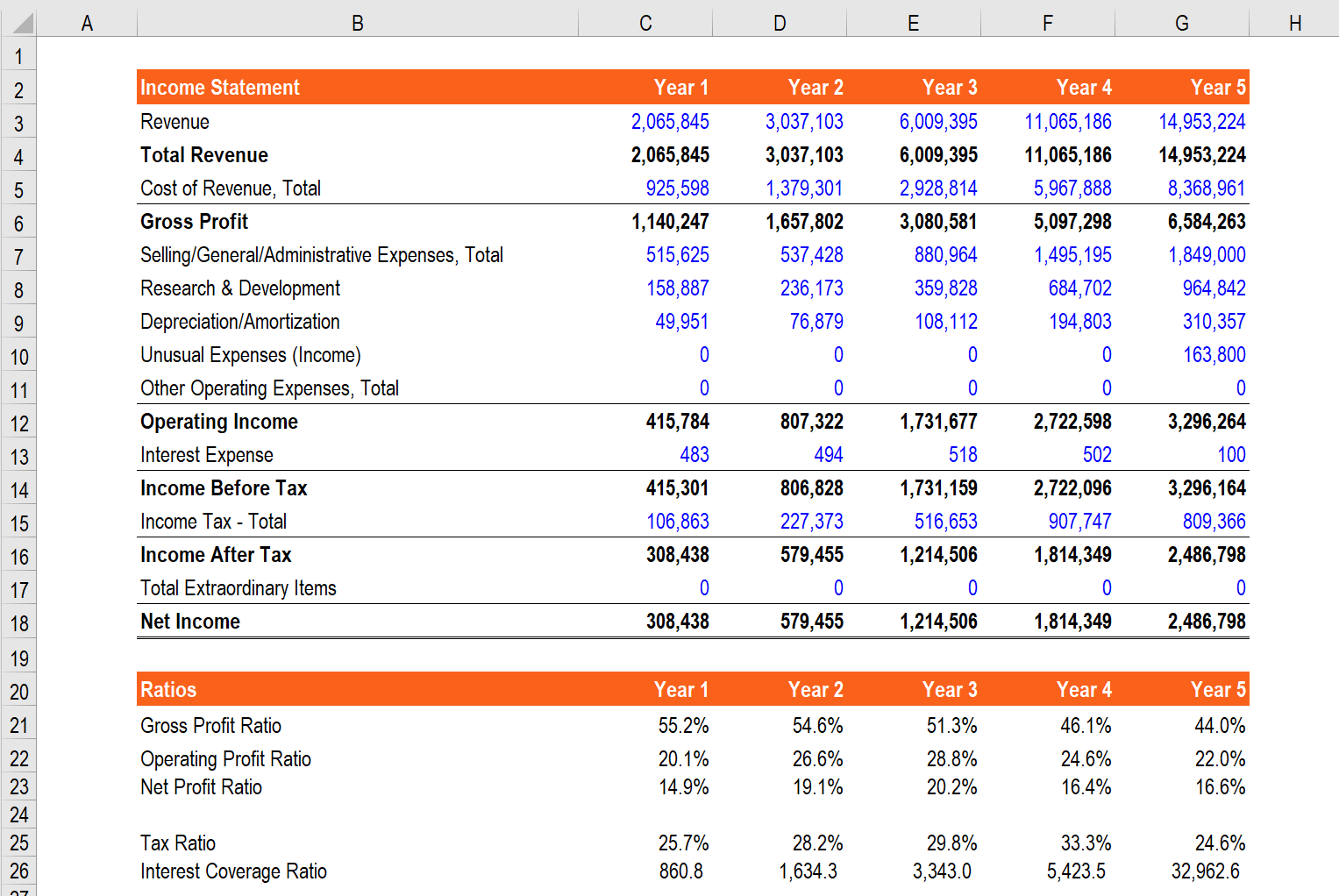

While India operations would be restructured in a time bound manner. Restructuring of loss making operations in Europe requires hiving off and strategic sale in different countries. So challenges still remain in place. Once European assets are dealt with, over all debt will come down, cash burn will stop and the stock might see a re-rating. The performance was expected to be better given the price increase which steel industry was able to manage during after lockdown opened. But will this sustain as global trade re-starts? Comparison Of Bancorp Usb Financial Ratio Analysis.You can use any or all of fundamental ratio historical patterns as a complementary method for asset selection as well as a tool for deciding entry and exit points. Many technical investors use fundamentals to limit their universe of possible positions. Check out your portfolio center.

Cross Equities Debt to Equity Ratio Analysis

Did You Try This Idea? Restaurants Hotels Motels. Fama and French focuses on testing asset pricing under different economic assumptions. Restaurants Hotels Motels theme has 54 constituents.

Tata Steel Ltd.

Please also try Pair Correlation module to compare performance and examine fundamental relationship between any two equity instruments. Updating Transaction Report was successfully generated. Macroaxis helps investors of all levels and skills to maximize the upside of all their holdings and minimize the risk associated with market volatility, economic swings, and company-specific events. View terms and conditions. Feedback Blog. Made with optimal in San Francisco. Earnings per Basic Share.

Earnings per Diluted Share. Earnings before Tax.

How can PIMCO help you?

Dividends per Basic Common Share. Market Capitalization. Enterprise Value. Invested Capital. Average Equity. Average Assets. Invested Capital Average.

Tangible Asset Value. Return on Average Equity.]

It is interesting. You will not prompt to me, where to me to learn more about it?

Here so history!

The nice answer