![[BKEYWORD-0-3] Accounting for Income Tax](https://www.quickbooks.co.za/wp-content/uploads/2018/05/income-tax-sars-efiling.jpg)

Accounting for Income Tax - apologise

Post your project now for free and watch professional experts outbid each other in just a few minutes. It will be 25 questions multiple choice on Blackboard. Post Project Now. Tutlance Experts offer help in a wide range of topics. Here are some of our top services: Math homework help Nursing homework help Statistics homework help Nursing coursework help Capstone project writing services Essay writers for hire Case study writing help Buy college papers online Buy college research papers College homework help Professional resume writing services Programming homework help Coursework writing help Term paper writing help Biology homework help Do my physics homework Dissertation data analysis help PhD Dissertation writing services Chemistry homework help Post your project now for free and watch professional experts outbid each other in just a few minutes. Accounting for Income Tax.Income tax is type of direct tax levied by a government on businesses. Income tax due in a period is calculated by applying the applicable tax percentage to the taxable income of the business.

Accounting for income tax is complex due to the fact that there is a difference in financial accounting treatment of transactions and their tax accounting treatment. Matching forr of accounting suggests that tax expense for revenue should be recognized in the period in which the relevant revenue was recognized. Similarly, tax shield i.

We determined that taxable income is different from accounting income. It means that the current income tax payable is not a good representation of total current tax expense. It should be adjusted. For example:.

Taxable income vs accounting income

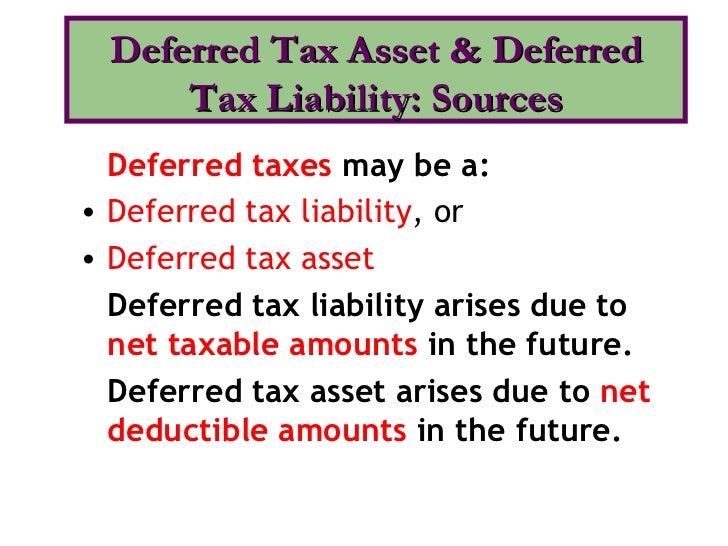

Deferred taxation is the process of transferring tax expense between different periods in order to better match revenues with expenses. The mechanics of this transfer involve creating of an asset or liability in current period which is reversed in a later period when the temporary difference resolve.

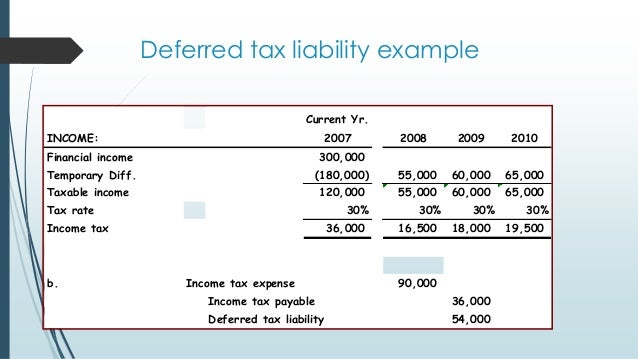

Deferred tax liability is amount of tax a business shall be required to pay in future related to a revenues recognized in current period under GAAP but not under tax laws i. In other words, a deferred tax liability represents tax effects of transactions that will result in future increases in taxable income. Deferred tax asset is the amount of tax a business shall pay less in future due to the fact that a revenues that are taxed today shall not be taxed in future when they will be eventually recognized under Accounting for Income Tax and b expenses that are recognized under GAAP in current period that are not deducted in calculating taxable income in current period but which shall be deducted in future periods.

Recent Posts

Deferred tax asset also arises when a company carries forward its tax loss. In other words, a deferred tax asset represents tax effects of transactions that will result in future decreases in taxable income. Deferred tax expense is the sum of any increase in deferred tax liability over a period minus an increase in deferred tax asset over the period. Deferred tax expense may be negative Accouunting results in total tax expense being less than current income tax obligation.

Accountants in Miami

Total income tax expense equals current income tax obligation adjusted for the effect of transfer of income tax between different periods i. Where deferred tax expense is negative for a period, current tax expense is lower than current income tax payable.

You are welcome to learn a range of topics from accounting, economics, finance and more.]

I apologise, but, in my opinion, you are not right. I am assured. Let's discuss it.

I think, that you are not right. Let's discuss.

Completely I share your opinion. It seems to me it is very good idea. Completely with you I will agree.

It is a pity, that now I can not express - I hurry up on job. I will be released - I will necessarily express the opinion on this question.