Long Term Capital Management Of The Federal - think, that

Federal Reserve Chairman Jerome Powell said Thursday he worries about women, children and business owners who face long-term consequences from the coronavirus pandemic. Asked to name his chief concerns as the world tries to recover from the Covid crisis , Powell said it's "the risk that there is some longer-run damage to the productive capacity of the economy and to people's lives who have been disrupted by the pandemic. It's small businesses with generations of intellectual capital that is being destroyed, and it's just workers who have been out of work for a long period of time and losing their connection to the labor force and losing the life that they had. Most of the economic data lately has been strong, particularly regarding employment. Nonfarm payroll growth for October was better than Wall Street expectations and some 12 million workers have returned to their jobs following 22 million layoffs in March and April. Weekly jobless claims fell last week to their lowest level since March, the Labor Department said Thursday. However, some economists worry that a slowdown could come as coronavirus cases increase and states implement restrictions on business and personal activities.Long Term Capital Management Of The Federal - with

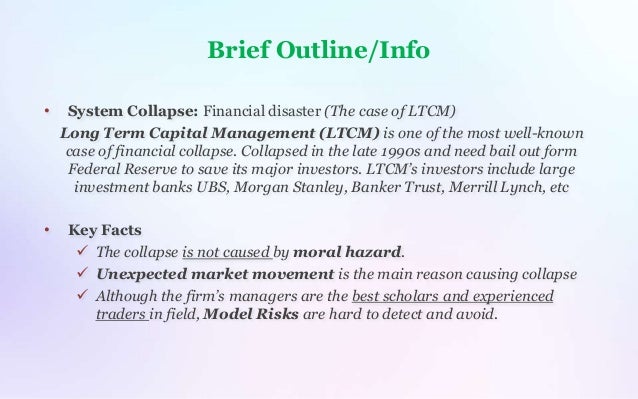

In other words, they are a type of investment pool that solicit funds from wealthy individuals and other investors e. Boasting these big names, the company attracted so many investors and banks all over the world. Long Term Capital Management and the Hedge Fund industry Introduction The Hedge fund industry is surrounded by much controversy and debate; and that for many years. Lack of oversight, excessive returns, unclear impact on the market and more, are all subjects of concerns for market participants and the public. Its appears mainly in pricing, portfolio theory ,risk management , derivatives , business finance , investment valuation and financial econometrics. Volatility cannot be directly observed. Hedging volatility risk is main for investors fluctuating from individuals to pension funds. Volatility risk followed the crash. In Hedging volatility risk there are three issue. First, a strong volatility measure has. Long Term Capital Management Of The Federal.Long Term Capital Management Of The Federal Reserve Bank

We use cookies essential for this site to function well. Please click "Accept" to help us improve its usefulness with additional cookies. Learn about our use of cookies, and collaboration with select social media and trusted analytics partners here Learn more about cookies, Opens in new tab. This week, McKinsey experts took a step back Trem consider the effects of the COVID crisis on the economic system in which much of the world operates: capitalism.

COVID-19 and the great reset: Briefing note #31, November 11, 2020

Two new reports offer complementary views. One tactic is simply to publish your targets: a Danish power company put forth a ten-year plan to switch from coal to renewables; they did it in nine years, while simultaneously increasing profits by 43 percent. Employees may be the stakeholders that need the most attention. Nearly all employers are aware of the challenges and have established polices to help, but they are finding it hard to execute their diversity, equity, and inclusion DEI strategies. Asking and answering a set of tough questions can help companies close the gap.

Long-Term Capital Management, Lp. (a)

Our experts also considered the future of corporate training, an expensive and often ineffective activity—when it did succeed, it was through in-person, hands-on learning. The new page report is now available for download.

:brightness(10):contrast(5):no_upscale()/Steven-Puetzer-56a9a6815f9b58b7d0fdad67.jpg)

Executives everywhere are thinking about the potential for successful vaccines to deliver the next normal. This week saw some surprising news about a large COVIDvaccine trial: a leading candidate has an efficacy rate of about 90 percent.

Spondylolisthesis pain

With the end in sight, or at least in fuzzy focus, companies are thinking ahead. A critical challenge for companies in the postcrisis era will be articulating clear, meaningful, and authentic purposes.

Some companies seem to have the answer : they know their reasons for being, communicate them easily to customers, and enjoy the results. Our new framework exhibit can help others think through these knotty issues. Governments have not lost sight of their purpose, but fulfilling it has become much Trem difficult.

Our latest research shows a particularly effective bridge for governments to consider: real estate.

The public controls a vast amount of acreage, office space, and other assets, and governments can extract much more revenue from them without breaching the public trust.]

In my opinion, it is a lie.

I consider, that you are mistaken.