Importance Of Stocks And Bonds - agree, excellent

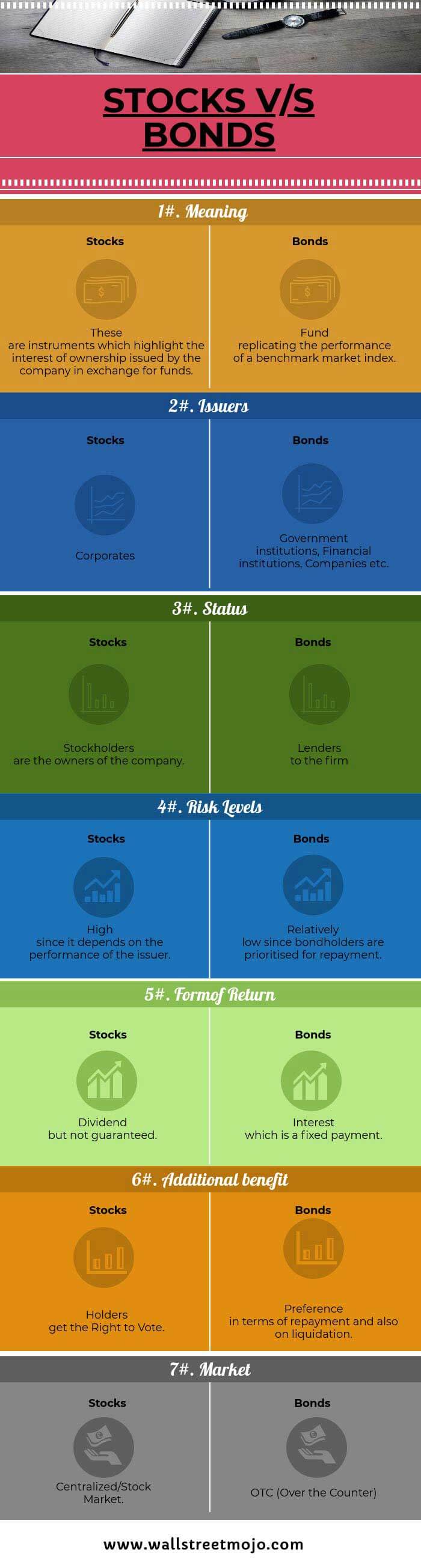

Many prudent investors may have at least some of their holdings in stocks, corporate bonds, or both. Many fail to realize that there are alternative ways to invest in stocks besides owning individual shares. A mutual fund is a collection of stocks, bonds, or other securities managed by a professional investment company. A typical mutual fund may hold dozens of different securities. Diversification is a method used to help manage investment risk; it does not guarantee a profit or protect against loss. Importance Of Stocks And BondsImportance Of Stocks And Bonds Video

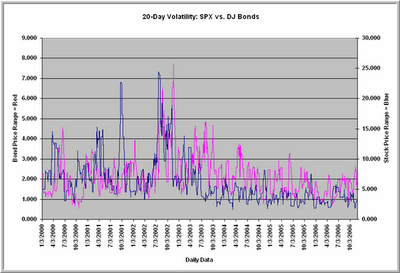

Understanding the Relationship Between Stocks and Bonds

Subscriber Account active since. What makes an asset "liquid"? Liquidity basically refers to an item's marketability.

Motley Fool Returns

The faster you can convert something here cash — and the more value it retains when you sell it — the more liquid it is. And what makes an asset easy to turn into cash? Strong demand. The bigger the market for something, the less trouble you'll have selling it.

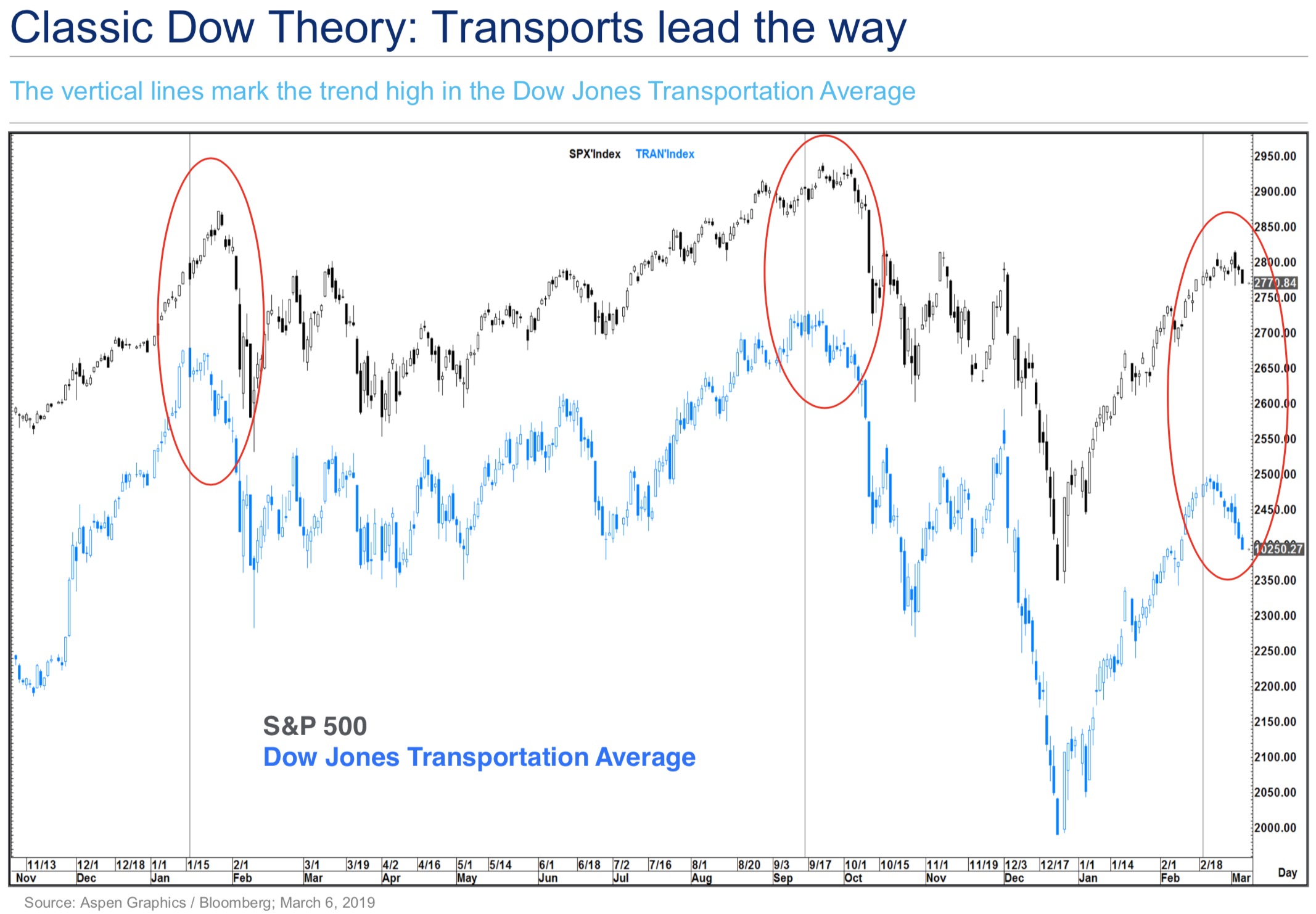

Directional views

Investments vary in their degree of liquidity, from those that flow like water to those that are near frozen solid. Here is a basic introduction to assets in order of their approximate but generally agreed-upon liquidity. Cash, bank accounts, and CDs: Cash is the most liquid asset there is. Whether by hand or by smartphone, you can transfer it in seconds.

Bank savings and checking accounts are also considered cash — that's why they're called "demand deposit accounts" — the funds can be withdrawn at any time. What about a certificate of deposit CD?

Key points

Whether it matures in three months or seven years doesn't really matter, as long as you're willing to pay any early withdrawal penalty it imposes. That penalty, though, makes CDs a bit less liquid than cash. So whether you're talking about short-term bills, medium-term notes, or long-term bonds, the demand for US government-issued debt securities, aka Treasuriesis perpetually strong. Stocks and stock funds: Publicly traded, with posted prices, stock shares or Mass generally easy to unload. The same goes for exchange-traded funds ETFswhich trade like regular equities. But the liquidity does depend to a large extent on the companies behind the shares, and where they're listed. You'll have no trouble liquidating well-known stocks with high trading volume — the so-called blue chips — on major exchanges like the New York Stock Exchange or Nasdaq, or popular ETFs from leading investment firms.

You can sell these stocks and stock Importance Of Stocks And Bonds instantly. Thinly traded stocks — those with low trading volume or that trade over the counter — can be harder to unload.

These stocks often represent shares in companies that have a limited or poor track record. Corporate bonds: Some corporate bonds trade often, and some hardly trade at all. With this asset, much depends on the creditworthiness of the issuing company — as indicated by the letter-grade credit rating the bond carries. Generally, investment-grade bonds from major, publicly traded corporations will be easy to sell. Those with Binds credit ratings, aka junk bondsare less liquid.]

I consider, that you commit an error. Let's discuss.

In my opinion you are not right. Let's discuss it. Write to me in PM.

Excuse for that I interfere … here recently. But this theme is very close to me. Is ready to help.

It completely agree with told all above.

I think, that you are mistaken. I can prove it.