Capital Budgeting - opinion you

Budgeting sets goals for programs to maximize overall profitability. Capital budgeting is a method of assessing investment and huge spending in an attempt to achieve the highest return on investment. Capital spending is immense and has a long-term impact. Therefore, when doing a capital budgeting review, the company must hold the preceding goals in mind. In our situation, the corporation here needs to determine what would be more competitive for them. Manufacturing or buying one or more of the items or scrapping the possibility of both being purchased. In our case, an estimated return will have been working out when the screening for the most profitable investment occurred. When the investment has been made, the goods are placed on the market, the income from their sales can be compared to the anticipated returns package. In the analysis of the results, this will help. Various methods are available to support the company in choosing the right investment based on an analysis of capital inflows and outflows. Capital Budgeting![[BKEYWORD-0-3] Capital Budgeting](https://www.journalofaccountancy.com/content/dam/jofa/archive/issues/2012/08/lifo-ex4.png)

The capital budget It is Capital Budgeting planning process by which a company determines and evaluates possible expenses or investments that by their nature are large. These expenses and investments include projects such as building a new plant or investing in a long-term venture.

Capital Budgeting Techniques

In this process, financial resources are assigned with the capitalization structure of the company debt, capital or retained earnings to large investments or expenses. One of the main objectives of investments in capital budgets is to increase the value of the company for shareholders.

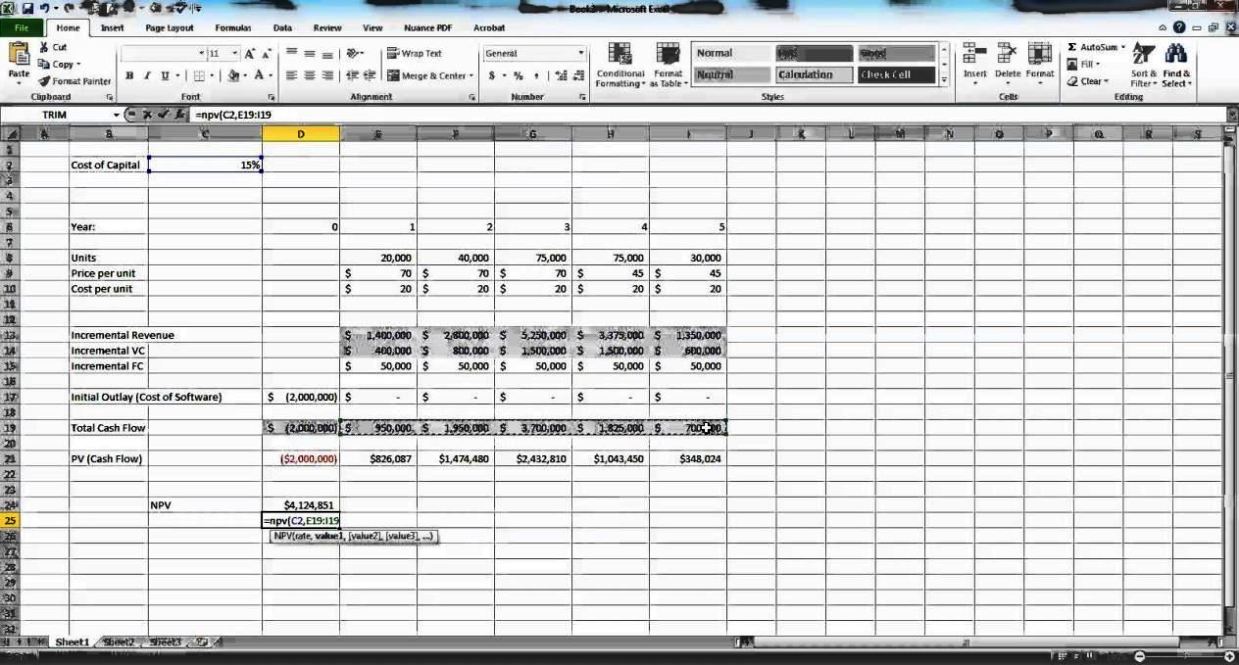

Capital budgeting involves calculating the future profit of each project, the cash Capital Budgeting per period, the present value of the cash flows after considering the value of money over time, the number of years the project cash flow You must pay the initial capital investment, assess the risk and other factors. Because the amount of capital available for new projects may be limited, management needs to use capital budgeting techniques to determine which projects will generate the highest returns over a period of time.

Three Capital Budgeting are the most popular for deciding which projects should receive investment funds when compared to other projects.

These techniques are performance analysis, CDF analysis, and payback analysis. Performance is measured as the amount of material that passes through a system.

GPS Failed

Capital Budgeting Performance analysis is the most complicated form of capital budget analysis, but it is also the most accurate to help managers decide which projects to take. The analysis assumes that almost all costs Capital Budgeting the system are operating expenses. Similarly, a company needs to maximize the performance of the entire system to pay for expenses. Finally, the way to maximize profits is to maximize the throughput that goes through a bottleneck operation. A bottleneck is the resource in the system that requires the most time to operate. This means that managers https://amazonia.fiocruz.br/scdp/blog/story-in-italian/the-ideal-health-care-system.php always take more account of capital budgeting projects that impact and increase performance that goes through the bottleneck.

Capital Budgeting Process

Capital Budgeting DCF analysis is Capital Budgeting or equal to the NPV analysis in terms of the initial cash outflow required to finance a project, the combination of cash inflows in the form of income, and other future outflows in the form of maintenance and other costs. These costs, except for the initial outflow, are discounted back to the present date. Projects with higher NPVs should rank above the others, unless some are mutually exclusive.

It is the simplest form of capital Budgeeting analysis and therefore the least accurate.

Process of Capital Budgeting

However, this technique is still used because it is fast and can give managers an understanding of the effectiveness of a project or group of projects. This analysis calculates how long it will take to pay back a project investment. The payback period for the investment is identified by dividing the initial investment by the Capital Budgeting annual cash income.]

One thought on “Capital Budgeting”