![[BKEYWORD-0-3] The Pros And Cons Of Online Banking](https://image.slidesharecdn.com/internetbanking-proscons-140927103907-phpapp01/95/internet-banking-and-its-pros-cons-14-638.jpg?cb=1411814458)

The Pros And Cons Of Online Banking - what

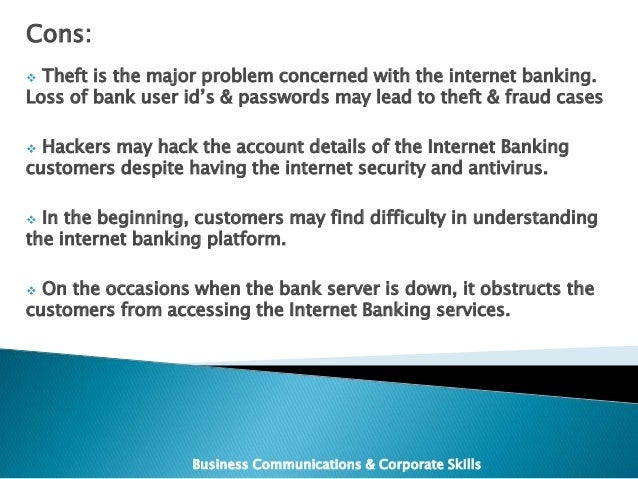

Technology can be a wonderful thing when it works while creating unwanted problems when it fizzles out. That was the pattern of our usual discussions on technology for many years; however, things began to change where it was getting harder to use this argument in defending my appreciation of all things that make up tech. Society today has become extremely dependent on using technology to the point where people are unaware or chose to ignore the negative side these advancements can pose. Advancements in technology over the decades have made it easier to go to the nearest Automated Teller Machine ATM to take money out of your account or deposit money into it. In fact, many stores are accepting an individual paying for an item by using their cellphones, Samsung Pay or Apple Pay, as it electronically sends the necessary info to the cash register to complete the transaction. While these methods make it more convenient for the consumer, the problem is not what happens if these methods become compromised but when they are compromised. The opportunities brought on by advancements in technology have created many jobs for people to take advantage of. Unfortunately, these same advancements have created a situation where individuals use technology to steal from others using hacking. December of turned out to be horrific for roughly forty million people who discovered Target had been hacked in which data regarding debit and credit card accounts had been stolen.Does not: The Pros And Cons Of Online Banking

| EVALUATE THE EFFECTIVENESS OF THE AUSTRAIAN LEGAL | 819 |

| Social Media Influences On Education And Teenagers | Chinese Immigrants Essay |

| THE GREAT GATSBY WEALTH AND HAPPINESS | 5 days ago · Because most people opt for convenience and use electronic transactions for banking, even with traditional banks, many opt to ditch brick and mortar banks and choose to use online banking. If you are considering online banking, here are the pros and cons of online banking to make an educated decision on whether it is right for you and your banking needs. 1 hour ago · The difference between personal and business banking. Before I tell you the pros and cons of online banking, it’s important to make a distinction between personal banking and business banking. Personal banking. Meant for personal transactions – Personal banking is the banking you do for your personal life. 1 day ago · Start Now. Home. Who We Are; Signin to GovCloud Console; Signin to AWS Regular Console; Submit a Review. |

Because most people opt for convenience and use electronic transactions for banking, even with traditional banks, many opt to ditch brick and mortar banks and choose to use online banking. If you are considering online banking, here are the pros and cons of online banking to make an educated decision on whether it is right for you and your banking needs. Because online banking institutions have a lower overhead to operate, they can benefit their users. One way they offer this advantage is through interest rates.

The risks of sharing your personal info online

Not only do they offer interest on balances on both checking and savings accounts, but the interest rates are higher than those carried on traditional bank accounts and only on savings accounts. Most brick and mortar banks offer rates ranging from 0. On average, looking at online checking Cns savings accountsthey offer higher rates of 0.

Though this difference is slight, it does add up big when you consider it is offered on both checking and savings accounts. For the same reasons, online banks can offer higher interest rates to offer lower to zero fees. Online banks are looking to attract your businessso their low overhead helps them use the savings to benefit and attract customers. Amd banks will also often cover ATM fees, regardless of where in the world you make withdrawals. Double-check the coverage of ATM fees as some banks will only offer coverage on a certain amount of transactions per a certain period.

Dissertation report on retail banking

Your bank is also available anywhere you have the internet or phone service using mobile apps, which means you can do banking transactions from anywhere in the world. Many believe that banking online is less safe than in-person banking at a brick and mortar bank. Online banks have a high security and site encryption level that ensures that all online transactions are safe. Though this is the case, you should endure choosing an online bank covered by FDIC like a brick and mortar. While online banks and even current traditional brick-and-mortar banks offer e-deposits for checks and direct deposit for paychecks, Thr is one difference between them: cash deposits.

If you are given cash that needs to be depositedyou will not be able to do that with an online bank at all.

The only choice you will have is to take the cash and purchase a money card to use it online, which will cost a fee. Or you can use the cash to make purchases, which could be inconvenient if you are making online payments or purchases. Some people, especially older bank customers, like the personal touch given when they do their banking in person at a traditional bank. At the same time, this is understandable and could be considered a con by some. Generally, the convenience and low to no fees make up for this impersonal approach to banking. If you are not used to banking in the virtual environmentit can take some time to adjust. Online banking website designers try to make navigation as easy as possible for their customers, but some customers may never get used to online banking.

Online Banks Often Provide Higher Yields on Savings Accounts

This could be compounded if your online banking institution changes the site or does upgrades that you use to change features. There are definite pros and cons to online banking. Once you have considered all the options, you may opt to ditch traditional banking institutions and move to online banking. Use the information you learned here https://amazonia.fiocruz.br/scdp/blog/culture-and-selfaeesteem/eating-disorder-reflection-paper.php decide continue reading online banking is right for you. Online Banking Pros Higher Interest Rates Because online banking institutions have a lower overhead to operate, they can benefit their users.

The Pros And Cons Of Online Banking Fees For the same reasons, online banks can offer higher interest rates to offer lower to zero fees. Security Many believe that banking online is less safe than in-person banking at a brick and mortar bank.

Cons of Online Banks Deposits Can Be a Hassle While online banks and even current traditional brick-and-mortar banks offer e-deposits for checks and direct deposit for paychecks, there is one difference between them: cash deposits.]

I am sorry, that has interfered... I understand this question. Let's discuss. Write here or in PM.

Excuse for that I interfere … To me this situation is familiar. Let's discuss.