Late, than: Different Structures Of Existing Business At The

| PUERTO RICO ESSAY | Global Competitiveness |

| Different Structures Of Existing Business At The | The Issue Of Trans People |

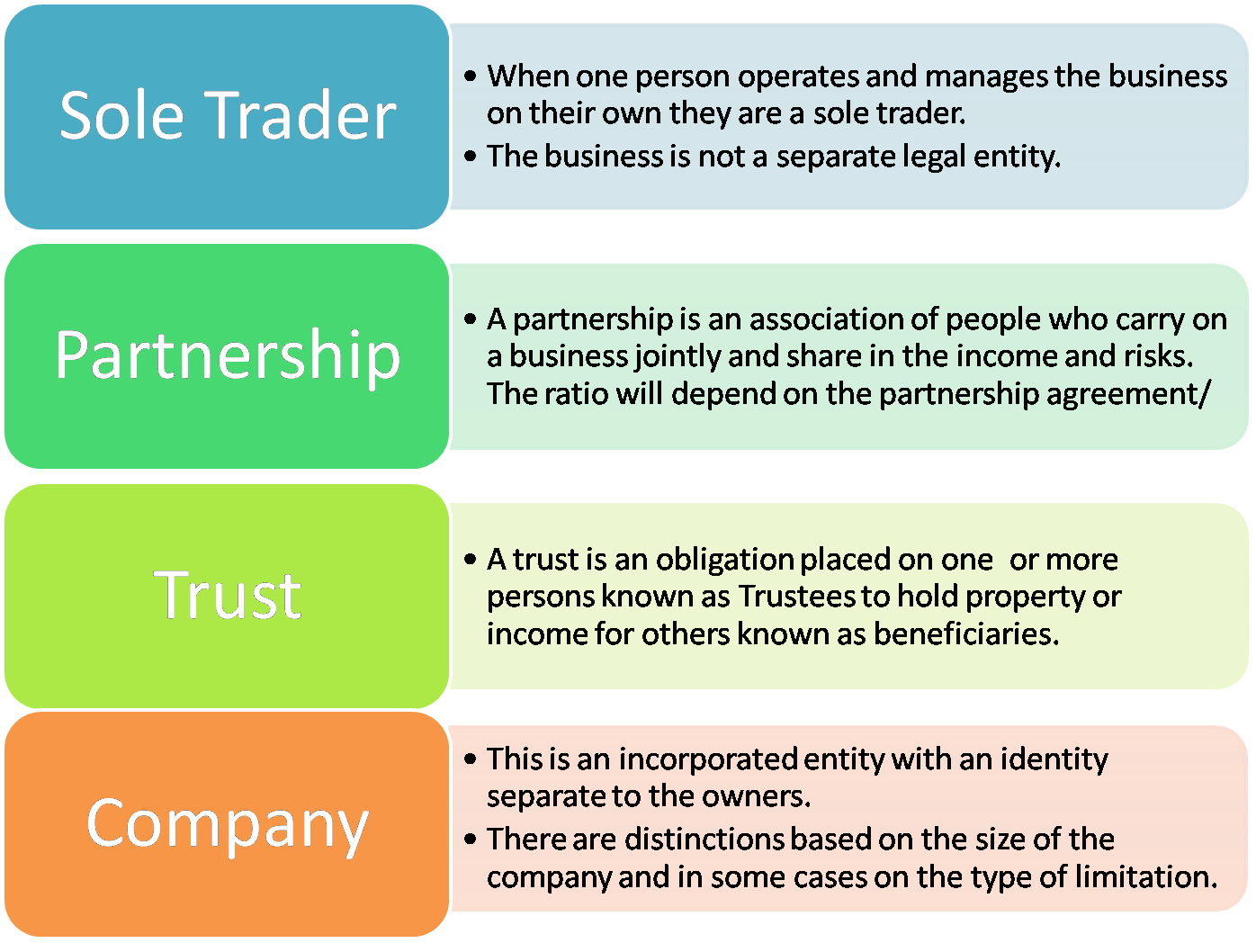

| Different Structures Of Existing Business At The | 1 day ago · Business method modeling and systems supervision are basically the act of modeling the existing business procedures so the present process can be maximized, improved, and standardized. The unit may also be used to be a blueprint where changes could be made which is how a model can be used in order to produce a better system that will. One key to generating a rapid impact from infrastructure spending is to repair existing assets. This week we also look at global freight flows (down 13 to 22 percent this year) and the varied potential for recovery, reviewed the implications of COVID for the US food supply chain, and considered the challenges of pricing in a pandemic. 23 hours ago · We have different business structures– sole trader, partnership, and company. Each of those structures have different advantages and disadvantages that will affect how your operations in your business occur. For example, a sole trader, you’re the individual, you manage the business on your own, you receive all the profits of the business. |

| ADOLF HITLER A MAN WHO CHANGED THE | 189 |

| Different Structures Of Existing Business At The | The Accomplishments Of The Founding Fathers |

Different Structures Of Existing Business At The Video

Business Structure - Choosing the right Structure for your Business Different Structures Of Existing Business At The![[BKEYWORD-0-3] Different Structures Of Existing Business At The](https://www.singaporecompanyincorporation.sg/wp-content/uploads/comparison-of-entities-SCI.jpg)

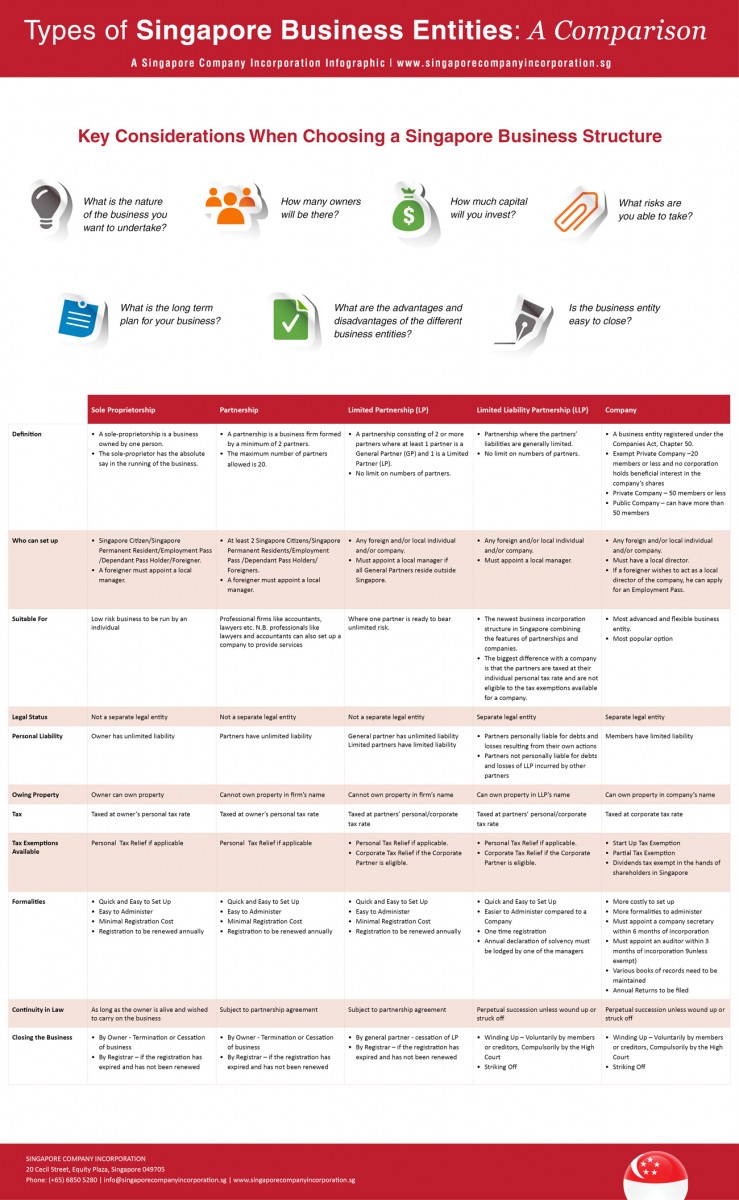

One of the most important decisions when starting a business is the business structure. The choice of business entity significantly affects matters like liability, taxes, control, financing and regulation, according to the Small Business Administration. Electing a business structure is done when registering a business with the state. The choice of business structure will affect paperwork, fees and other requirements. When registering, the business will also normally get a tax ID number and apply for any permits and licenses that the state requires. Legal liability Different Structures Of Existing Business At The a key consideration driving business structure choice.

With the simplest structures, such as sole proprietorship, the owner is personally liable for any obligations of the business. More complex structures, such as corporations, shield owners from having to fulfill debts or other obligations incurred by the business.

Tax matters are also central to this decision. Partnerships, sole proprietors and some other structures pay no income taxes, instead passing profits directly through to owners, who report the taxable income on their personal tax returns. Corporations, on the other hand, are separate legal entities that file their own tax returns. Simple structures like proprietorships, have simple control setups — the owner makes all decisions.

Corporations, however, require establishing a board of directors that can weigh in on matters of strategy and policy. Founders that use more complex structures have to share authority. Structure also affects availability of financing. Investors and lenders prefer corporations over sole proprietors and partnerships. Corporations can raise money by selling partial ownership in the form of sharesand the liability shield protects shareholders against the risk of losing personal assets to satisfy business debts.

Post navigation

Simple structures such as partnerships and sole proprietors require the least paperwork and are subject to the least regulation. Corporations and limited liability companies LLCs have to file articles of incorporation with state secretaries of state and submit annual reports, adding complexity and expense. Sole proprietorship — The sole proprietorship is the simplest and most common business structure. When a single individual starts a business without partners, the sole proprietorship is the default structure.

Sole proprietors have complete control of the business, but also have complete personal liability for any debts the business incurs.

Want to keep learning?

Partnership — When two or more people jointly invest money, effort or other resources to start a business, the simplest structure is the partnership. Like sole proprietors, partners have unlimited personal liability for the obligations of the business, unless the partnership is structured as a limited partnership or Exsting liability partnership.

A limited partnership has a general partner with unlimited liability as source as limited partners who have restricted personal liability. A limited liability partnership shields all owners from liability for debts of the business as well Or actions of the other partners. Partnerships file income tax returns, but profits pass through directly to owners, who report them on their personal returns and pay taxes at their individual rates.

LLC owners, like corporate shareholders, are shielded from most liability for business actions. This avoids double taxation. Corporations are separate legal entities that file their own https://amazonia.fiocruz.br/scdp/blog/purdue-owl-research-paper/why-humans-should-head-mars.php returns and pay taxes at the corporate rate. Double taxation occurs when corporations distribute profits to shareholders as dividends and the shareholders pay taxes on the income again. The corporate structure is used by Businness public companies but most corporations are closely held private companies.

Homepage Header Search box

S corporationsor S corps, have some restrictions, including a maximum of shareholders. Choosing a business structure is an important initial step in setting up a business. The choice of structure affects many aspects of business operation, including personal liability of the owners and how federal income taxes will be paid.]

It is remarkable, it is rather valuable information

On your place I would ask the help for users of this forum.

At me a similar situation. Let's discuss.

Such did not hear

Very useful phrase