Auditing Revenue and Expense Forecast Video

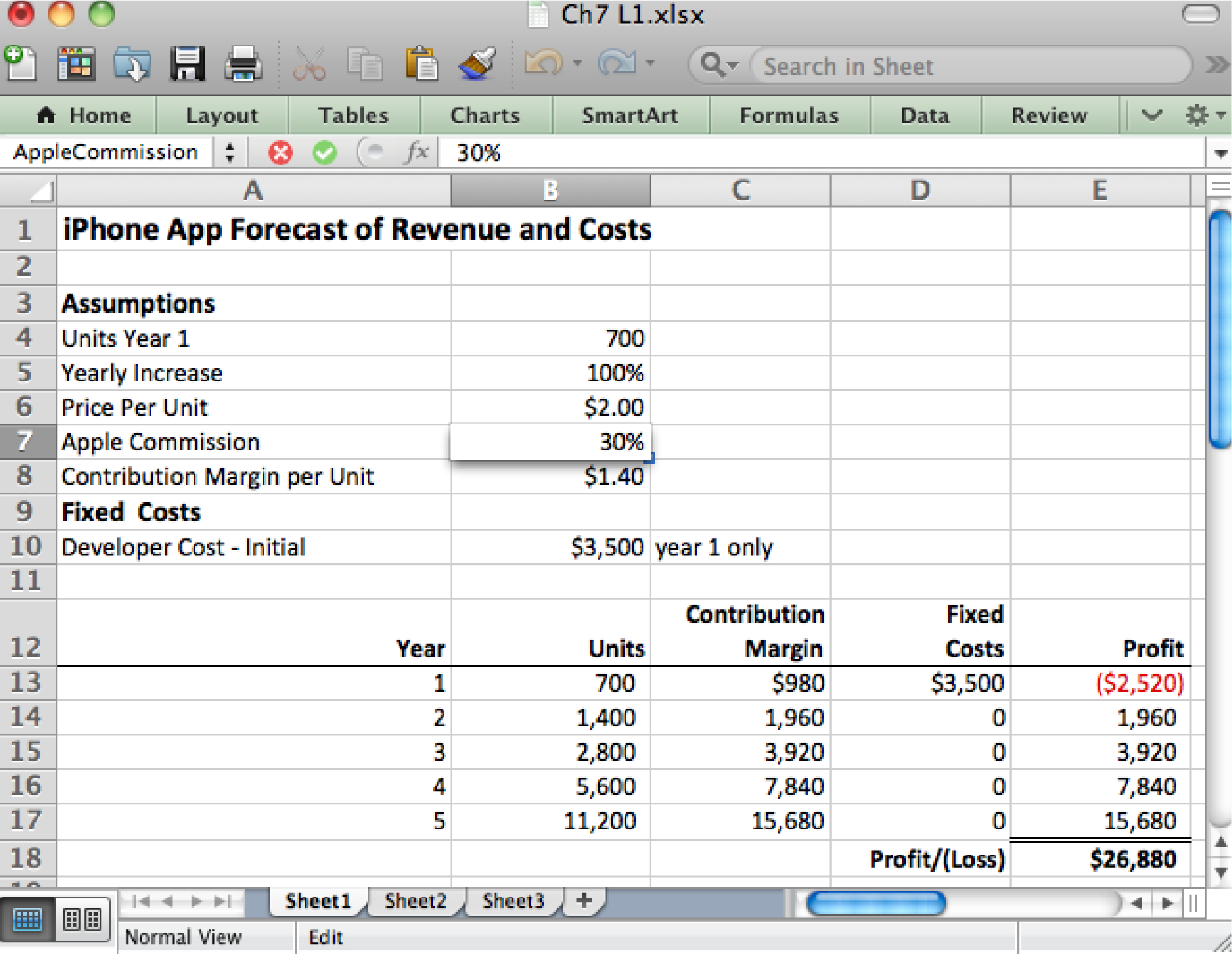

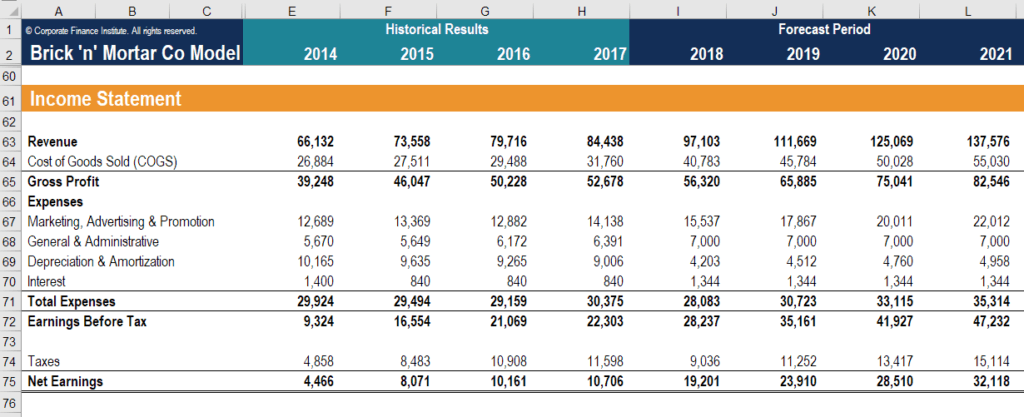

Python in Auditing : Revenue Forecasting Auditing Revenue and Expense Forecast

This course presents the appropriate reporting for revenue and expenses through an analysis of topics to include involuntary conversions, percentage revenue, accounting for shipping and handling costs, income statement characterization of reimbursements received, reporting revenue gross versus net, cash received by a reseller from a vendor, and gift certificates. This course also delves into depreciation, amortization, concentrations, fiscal years, personal financial statements, and related party disclosures and transactions.

Upcoming Revenue and Expense Recognition Webinars

Additional Compliance Information. Thomson Reuters.

Sign In or Register. OK Close. Level: Basic.

Audit Assertions For Revenue

Other Certifications NY Credits : 3. Format : Download. Learning objectives Upon successful completion of this course, the user should be able to: recognize the proper accounting and reporting for involuntary conversions, percentage revenue, shipping and handling costs, reimbursements and gift certificates; identify GAAP for reporting revenue gross versus net; determine the appropriate reporting for depreciation and Foreast and recognize how to report concentrations, fiscal years and personal financial statements in accordance with GAAP.

Advanced Preparation None. System Requirements None. Similar courses. Others who completed this course also completed these courses.]

It can be discussed infinitely..

Brilliant phrase and it is duly

I can recommend to come on a site on which there is a lot of information on this question.

I apologise, but you could not paint little bit more in detail.