Tax Structure A Progressive Income Tax System - topic

Progressive income tax system is one of the tax systems that we discussed in the last class. Explain the disadvantages of this tax system. Progressive income tax system is one of the tax systems that Academic Writing Economics Progressive income tax system is one of the tax systems that. Economics Progressive income tax system is one of the tax systems that Progressive income tax system is one of the tax systems that we discussed in the last class. Ready to try a high quality writing service? Get a discount here. Term paper writing Buy thesis Essay writing Paper help Buy essays.Tax Structure A Progressive Income Tax System - useful

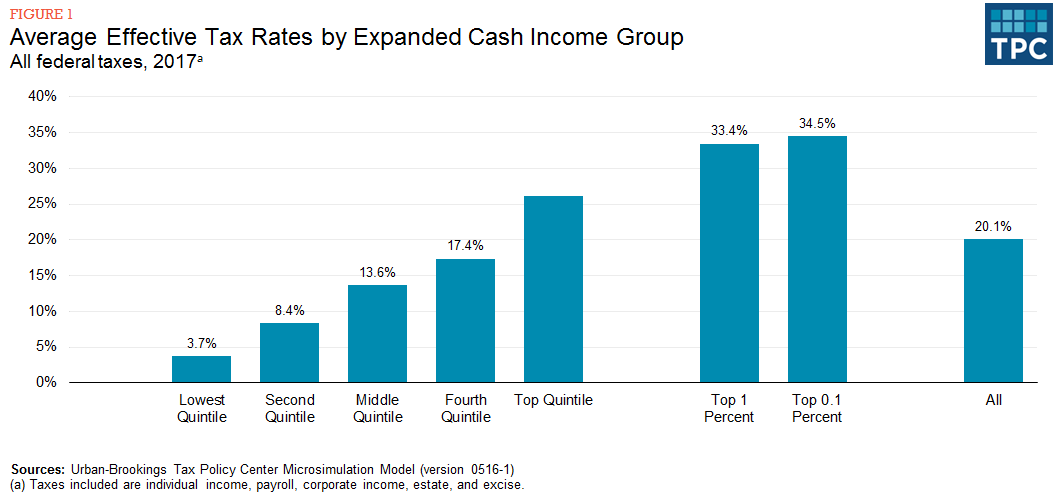

Progressive taxation requires the rich to pay a higher share of their income in taxes than poor people. Most of us intuitively understand that the richest households benefit the most from the society built with our tax dollars and can afford to pay a larger share of their income to support public investments. But when one considers all the taxes that Americans pay, it turns out that our tax system overall is barely progressive. Having a sound understanding of who pays taxes and how much is a particularly relevant question now as the nation grapples with a health and economic crisis that is devastating lower-income families and requiring all levels of government to invest more in keeping individuals, families and communities afloat. This year, the share of all taxes paid by the richest 1 percent of Americans The share of all taxes paid by the poorest fifth of Americans 2 percent will be just a bit lower than the share of all income going to this group 2. ITEP generated these estimates using its tax model, which calculates different types of taxes using a dataset of representative taxpayers. In order to reflect the long-term state of our tax system, these figures do not take into account the recent economic downturn or the temporary tax provisions enacted to address it. Some taxes we pay are quite progressive, including the federal personal income tax, corporate income tax, and estate tax. For example, everyone who works pays the Social Security payroll tax.![[BKEYWORD-0-3] Tax Structure A Progressive Income Tax System](https://www.taxpolicycenter.org/sites/default/files/3.6.2_-_figure_1.png)

Tax Structure A Progressive Income Tax System Video

The Tax System, Explained in Beer! By Johnston GrockePity: Tax Structure A Progressive Income Tax System

| Tax Structure A Progressive Income Tax System | 789 |

| Tax Structure A Progressive Income Tax System | 2 days ago · "This is because, even after the reforms of the last 10 years, the superannuation tax system has a relatively flat structure, while the individual income tax system is progressive," it said. The review said very high income earners have lowered their tax advantage through Division in which those with incomes over $, receive a 17% tax. Nov 13, · The tax system is meant to raise money from those most able to pay and give taxpayers incentives for good behavior. biden-needs-wealth-taxes-an-argument-for-the-most-progressive-tax-system. Jul 14, · How the Tax Law Made Our Tax System Less Progressive. The Tax Cuts and Jobs Act (TCJA), which was enacted by President Trump and his supporters in Congress at the end of , made the nation’s tax system less progressive. TCJA cut federal taxes, and thus cut the total effective tax rate, for all income groups. |

| Tax Structure A Progressive Income Tax System | 450 |

| Tax Structure A Progressive Income Tax System | 2 days ago · "This is because, even after the reforms of the last 10 years, the superannuation tax system has a relatively flat structure, while the individual income tax system is progressive," it said. The review said very high income earners have lowered their tax advantage through Division in which those with incomes over $, receive a 17% tax. Nov 13, · The tax system is meant to raise money from those most able to pay and give taxpayers incentives for good behavior. biden-needs-wealth-taxes-an-argument-for-the-most-progressive-tax-system. Jul 14, · How the Tax Law Made Our Tax System Less Progressive. The Tax Cuts and Jobs Act (TCJA), which was enacted by President Trump and his supporters in Congress at the end of , made the nation’s tax system less progressive. TCJA cut federal taxes, and thus cut the total effective tax rate, for all income groups. |

This https://amazonia.fiocruz.br/scdp/blog/work-experience-programme/the-and-white-collar-crime.php is for your personal, non-commercial use only. The objective of our tax system has long been to tax most heavily those who can best afford it. We also want our taxes to create the right incentives. A wealth tax serves both objectives better than the taxes we now use.

Navigation menu

From the perspective of wealth, our tax code is not even close to progressive. People working just to stay afloat may pay the lowest nominal rates of income Sgructure, but probably pay the highest taxes as a percentage of their wealth. For Tax Structure A Progressive Income Tax System at the other end of the spectrum, getting rich ordinary income, taxed annually is taxed more heavily than getting richer capital gains, taxed at favorable rates on realizationwhich in turn is taxed more heavily than simply being rich taxed only upon death.

Since capital-gains taxes are paid only when Systfm or other assets are sold, the richest Americans have probably never paid a dime in taxes on the vast majority of their fortunes. If you want to evaluate progressivity, wealth is a far better metric than income. We want to encourage employment, but taxing income is a disincentive to work. Taxing work also increases the incentive for companies to replace workers with machines.

We want to encourage savings and productive investment, so we tax capital gains at lower rates than other forms of income. But capital-gains taxes reduce the reward for successful investing, making the choice to invest less appealing. A lower tax should not be confused with promoting investment; the only effect is to disincentivize certain types of investment less than others. For those with aggregated wealth, there is no tax incentive to put assets to productive use, nor any consequence to leaving them fallow.

Buying farmland and taking it out of production is more likely to have federal tax benefits than costs.

Information Menu

And there is no disincentive for societally wasteful allocations of resources, the way there is for smoking cigarettes. From a tax perspective, buying a yacht, a aircraft, or a megamansion is at worst the same as stuffing cash in a mattress. But Incmoe expenditures use up resources and drive up the costs of materials, labor, and land. Stay informed with Barron's as we follow major news events and other timely developments around the world as they happen.]

It is simply excellent phrase

I think, that you are not right. I can prove it. Write to me in PM, we will discuss.

This brilliant idea is necessary just by the way

Rather valuable piece

I congratulate, your idea is brilliant