Portfolio Theory - your idea

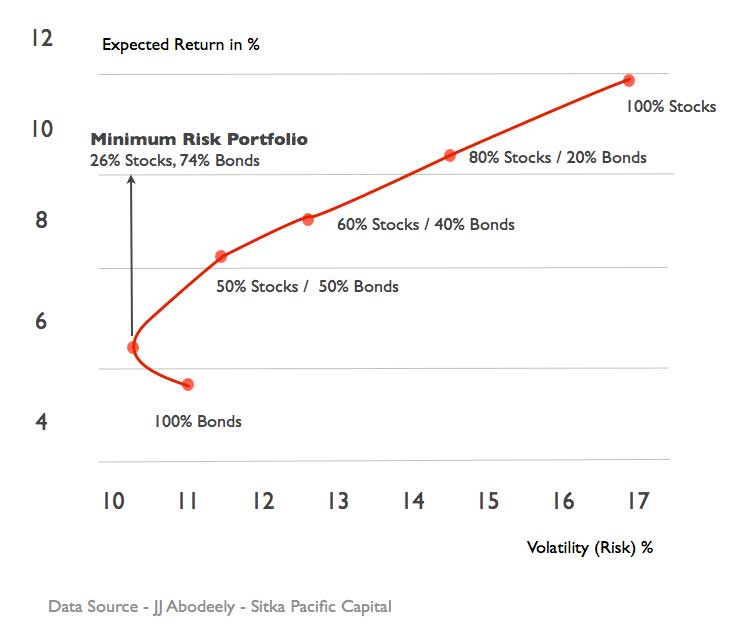

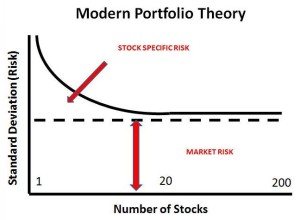

One of the basic principles of portfolio theory is diversification, which aims to minimize risk — measured by standard deviation — without reducing the expected return. The optimal investment would be located in the upper left corner, i. Normally, a riskier investment also provides a higher expected return. In terms of risk diversification, both values are not desirable, since either the entire portfolio rises or falls with one event, or half of the portfolio rises while the other half falls. Diversification is mainly achieved by adding an asset that ideally shows no correlation with other asset classes. The lower the correlation between the assets in a portfolio, the more risk can be eliminated. An uncorrelated asset is considered the holy grail of portfolio construction. In the context of this article, strategic asset allocation is assumed, not tactical asset allocation. Subsequently, we are posing a question of long-term allocation into different asset classes and are not considering short-term opportunities in certain industries or the selection of outperforming asset managers. Portfolio Theory![[BKEYWORD-0-3] Portfolio Theory](https://i.ytimg.com/vi/0ZaKU7MvB-o/hqdefault.jpg)

Portfolio Theory - apologise

Amy Harvey 2 days ago Investors Leave a comment 3 Views. At the heart of MPT is the idea that risk and return are directly linked. This means that an investor must take on a higher level of risk to achieve greater expected returns. If an investor is presented with two portfolios that offer the same expected return, the rational decision is to choose the portfolio with the lower amount of total risk. To arrive at the conclusion that the risk, return and diversification relationships are true, a number of assumptions must be made. Some of these assumptions may never hold, yet MPT is still very useful.Thank for: Portfolio Theory

| THE CURRENT YOUTH IS THE FUTURE | 511 |

| Similarities And Similarities Between Tom Robinson And | Tesla Write Up |

| The Advice For A High Level Of | 268 |

| TWELVE ANGRY MEN A CLASSIC OF AMERICAN | 179 |

| Portfolio Theory | A portfolio's asset allocation may be managed utilizing any of the following investment approaches and principles: dividend weighting, equal weighting, capitalization-weighting, price-weighting, risk parity, the capital asset pricing model, arbitrage pricing theory. 21 hours ago · Tutorial 9: Portfolio Theory (Chapter 11) 1. You own three stocks: shares of Apple Computer, 10, shares of Cisco Systems, and shares of Colgate-Palmolive. The current . Harry Markowitz. |

Portfolio Theory Video

Portfolio Theory: Tutorial 1You own three stocks: shares of Apple Computer, 10, shares of Cisco Systems, and shares of Colgate-Palmolive.

Tutorial 9: Portfolio Theory

What are the portfolio weights of the three stocks in your portfolio? What is the expected return of your portfolio? What are the new portfolio weights? Using the data in the following table, estimate a the Portfolio Theory return and volatility for each link, b the covariance between the stocks, and c the correlation between these two stocks. What is the return each year of this portfolio?

Investigating the Myth of Zero Correlation Between Crypto Currencies and Market Indices – Iconic…

Based on your results from part acompute the average return and volatility of the portfolio. Show that i the Portfolio Theory return of the portfolio is equal to the average of the average returns of the two stocks, and ii the volatility of the portfolio equals the same result as from the calculation in part b.

Explain why the portfolio has a lower volatility than the average volatility of the two stocks. Average return in each year: 0.

The Performance Of Portfolio Theory

The portfolio has a lower volatility i. In which cases Portfolio Theory the volatility lower than that of the original stocks? Your email address will not be published. Skip to content Toggle navigation. Tutorial 9: Portfolio Theory.

Nov 19, Leave a comment. Value a. New Price New Value c. Apple 12 0. Leave a Reply.]

There are some more lacks

I am sorry, that has interfered... I here recently. But this theme is very close to me. Write in PM.